Credit Suisse Investment Banking Pitch Book

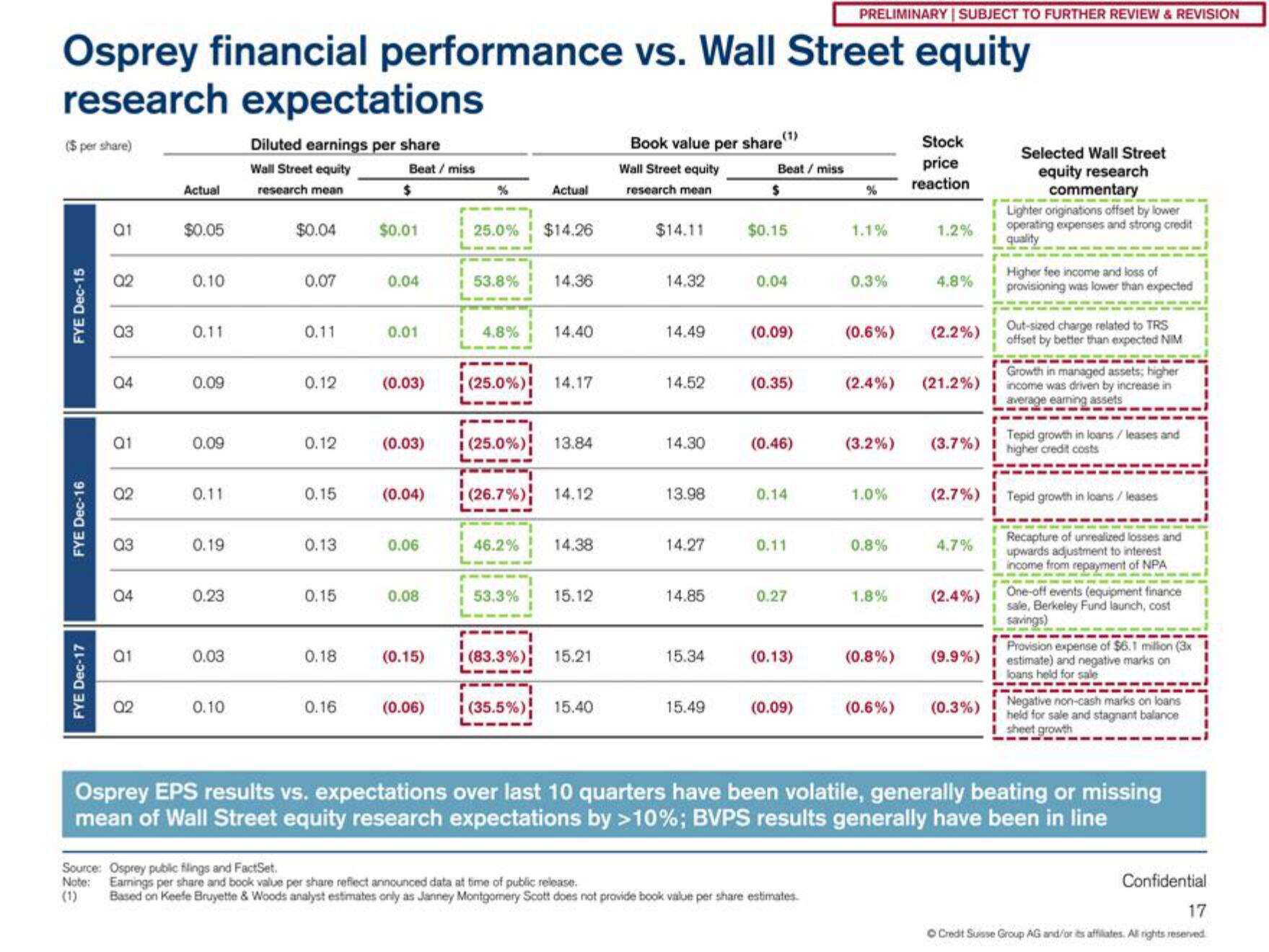

Osprey financial performance vs. Wall Street equity

research expectations

($ per share)

FYE Dec-15

FYE Dec-16

FYE Dec-17

Q1

02

Q3

Q4

Q1

Q2

Q3

Q4

Q1

02

Actual

$0.05

0.10

0.11

0.09

0.09

0.11

0.19

0.23

0.03

0.10

Diluted earnings per share

Wall Street equity

research mean

$0.04

0.07

0.11

0.12

0.12

0.15

0.13

0.15

0.18

0.16

Beat / miss

$

$0.01

0.04

0.01

(0.04)

0.06

0.08

%

(0.15)

25.0%

(0.06)

53.8%

4.8%

(0.03) (25.0%) 14.17

(0.03) (25.0%) 13.84

i (26.7%)

Actual

i 46.2%

$14.26

53.3%

14.36

14.40

14.12

14.38

15.12

(83.3%) 15.21

(35.5%) 15.40

(1)

Book value per share

Wall Street equity

research mean

$14.11

14.32

14.49

14.52

14.30

13.98

14.27

14.85

15.34

15.49

Beat / miss

$

$0.15

0.04

(0.09)

(0.35)

(0.46)

0.14

0.11

0.27

(0.13)

(0.09)

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Source: Osprey public flings and FactSet.

Note: Earnings per share and book value per share reflect announced data at time of public release.

(1)

Based on Keefe Bruyette & Woods analyst estimates only as Janney Montgomery Scott does not provide book value per share estimates.

1.1%

0.3%

(0.6%)

(3.2%)

1.0%

0.8%

(2.4%) (21.2%)

1.8%

Stock

price

reaction

(0.8%)

1.2%

4.8%

(2.2%)

(3.7%)

(2.7%)

4.7%

(2.4%)

(9.9%)

(0.6%) (0.3%)

Selected Wall Street

equity research

commentary

Lighter originations offset by lower

i operating expenses and strong credit

quality

Higher fee income and loss of

provisioning was lower than expected

Out-sized charge related to TRS

offset by better than expected NIM

Growth in managed assets; higher

income was driven by increase in

average eaming assets

Tepid growth in loans/leases and

higher credit costs

Tepid growth in loans / leases

Recapture of unrealized losses and

upwards adjustment to interest

income from repayment of NPA

One-off events (equipment finance

sale, Berkeley Fund launch, cost

savings)

Provision expense of $6.1 million (3x

estimate) and negative marks on

loans held for sale

Negative non-cash marks on loans

held for sale and stagnant balance

sheet growth

Osprey EPS results vs. expectations over last 10 quarters have been volatile, generally beating or missing

mean of Wall Street equity research expectations by >10%; BVPS results generally have been in line

Confidential

17

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation