HBT Financial Results Presentation Deck

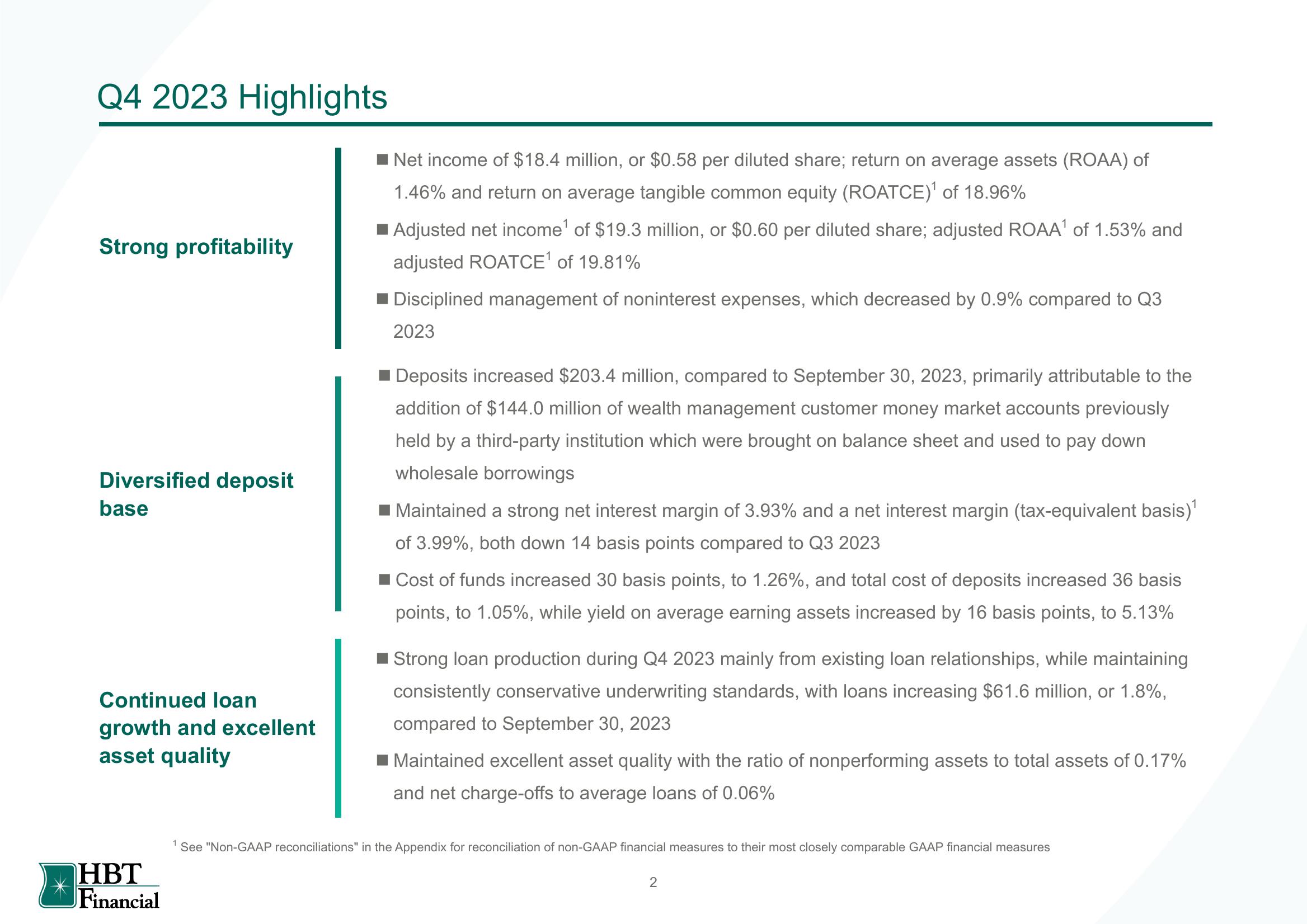

Q4 2023 Highlights

Strong profitability

Diversified deposit

base

Continued loan

growth and excellent

asset quality

HBT

Financial

Net income of $18.4 million, or $0.58 per diluted share; return on average assets (ROAA) of

1.46% and return on average tangible common equity (ROATCE)¹ of 18.96%

Adjusted net income¹ of $19.3 million, or $0.60 per diluted share; adjusted ROAA¹ of 1.53% and

adjusted ROATCE¹ of 19.81%

Disciplined management of noninterest expenses, which decreased by 0.9% compared to Q3

2023

■ Deposits increased $203.4 million, compared to September 30, 2023, primarily attributable to the

addition of $144.0 million of wealth management customer money market accounts previously

held by a third-party institution which were brought on balance sheet and used to pay down

wholesale borrowings

Maintained a strong net interest margin of 3.93% and a net interest margin (tax-equivalent basis)¹

of 3.99%, both down 14 basis points compared to Q3 2023

■Cost of funds increased 30 basis points, to 1.26%, and total cost of deposits increased 36 basis

points, to 1.05%, while yield on average earning assets increased by 16 basis points, to 5.13%

Strong loan production during Q4 2023 mainly from existing loan relationships, while maintaining

consistently conservative underwriting standards, with loans increasing $61.6 million, or 1.8%,

compared to September 30, 2023

Maintained excellent asset quality with the ratio of nonperforming assets to total assets of 0.17%

and net charge-offs to average loans of 0.06%

See "Non-GAAP reconciliations" in the Appendix for reconciliation of non-GAAP financial measures to their most closely comparable GAAP financial measures

2View entire presentation