Apollo Global Management Investor Day Presentation Deck

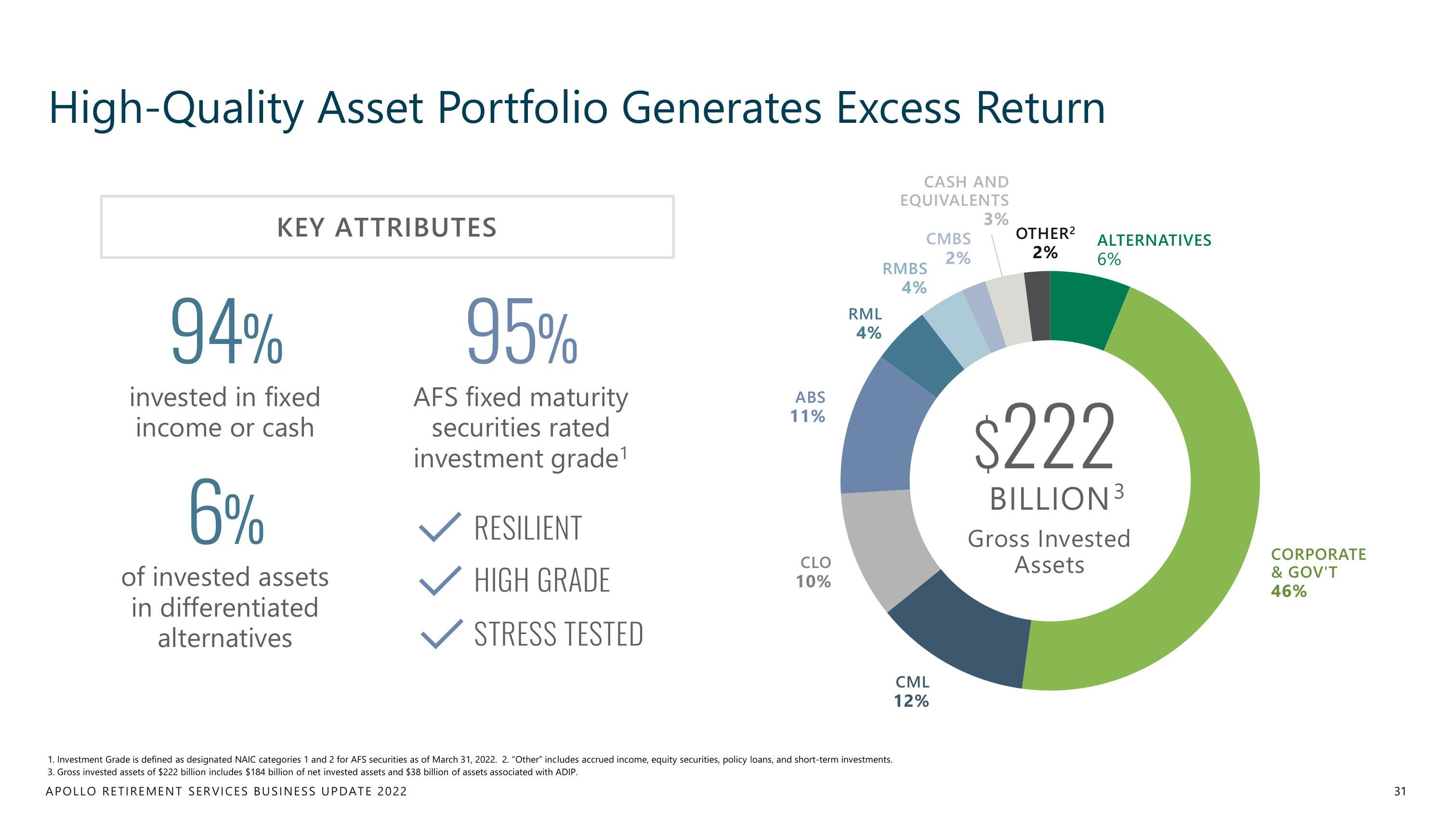

High-Quality Asset Portfolio Generates Excess Return

KEY ATTRIBUTES

94%

invested in fixed

income or cash

6%

of invested assets

in differentiated

alternatives

95%

AFS fixed maturity

securities rated

investment grade¹

RESILIENT

HIGH GRADE

STRESS TESTED

ABS

11%

CLO

10%

RML

4%

CASH AND

EQUIVALENTS

1. Investment Grade is defined as designated NAIC categories 1 and 2 for AFS securities as of March 31, 2022. 2. "Other" includes accrued income, equity securities, policy loans, and short-term investments.

3. Gross invested assets of $222 billion includes $184 billion of net invested assets and $38 billion of assets associated with ADIP.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

CMBS

2%

RMBS

4%

CML

12%

3%

OTHER²

2%

ALTERNATIVES

6%

$222

BILLION ³

Gross Invested

Assets

CORPORATE

& GOV'T

46%

31View entire presentation