Silicon Valley Bank Results Presentation Deck

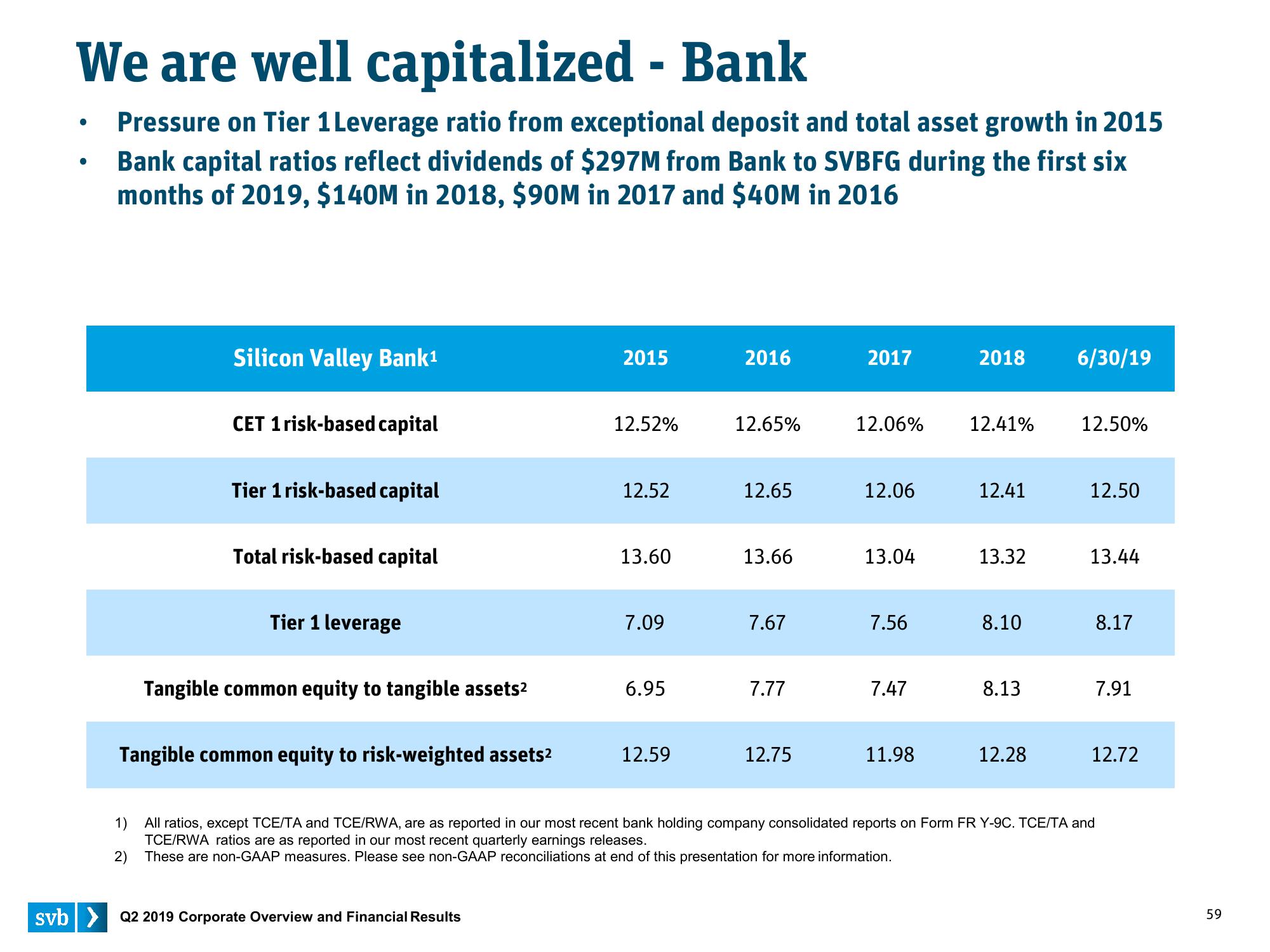

We are well capitalized - Bank

Pressure on Tier 1 Leverage ratio from exceptional deposit and total asset growth in 2015

Bank capital ratios reflect dividends of $297M from Bank to SVBFG during the first six

months of 2019, $140M in 2018, $90M in 2017 and $40M in 2016

●

●

Silicon Valley Bank¹

CET 1 risk-based capital

Tier 1 risk-based capital

Total risk-based capital

Tier 1 leverage

Tangible common equity to tangible assets²

Tangible common equity to risk-weighted assets²

2015

svb> Q2 2019 Corporate Overview and Financial Results

12.52%

12.52

13.60

7.09

6.95

12.59

2016

12.65%

12.65

13.66

7.67

7.77

12.75

2017

12.06%

12.06

13.04

7.56

7.47

11.98

2018 6/30/19

12.41%

12.41

13.32

8.10

8.13

12.28

12.50%

12.50

13.44

1)

All ratios, except TCE/TA and TCE/RWA, are as reported in our most recent bank holding company consolidated reports on Form FR Y-9C. TCE/TA and

TCE/RWA ratios are as reported in our most recent quarterly earnings releases.

2)

These are non-GAAP measures. Please see non-GAAP reconciliations at end of this presentation for more information.

8.17

7.91

12.72

59View entire presentation