ironSource SPAC

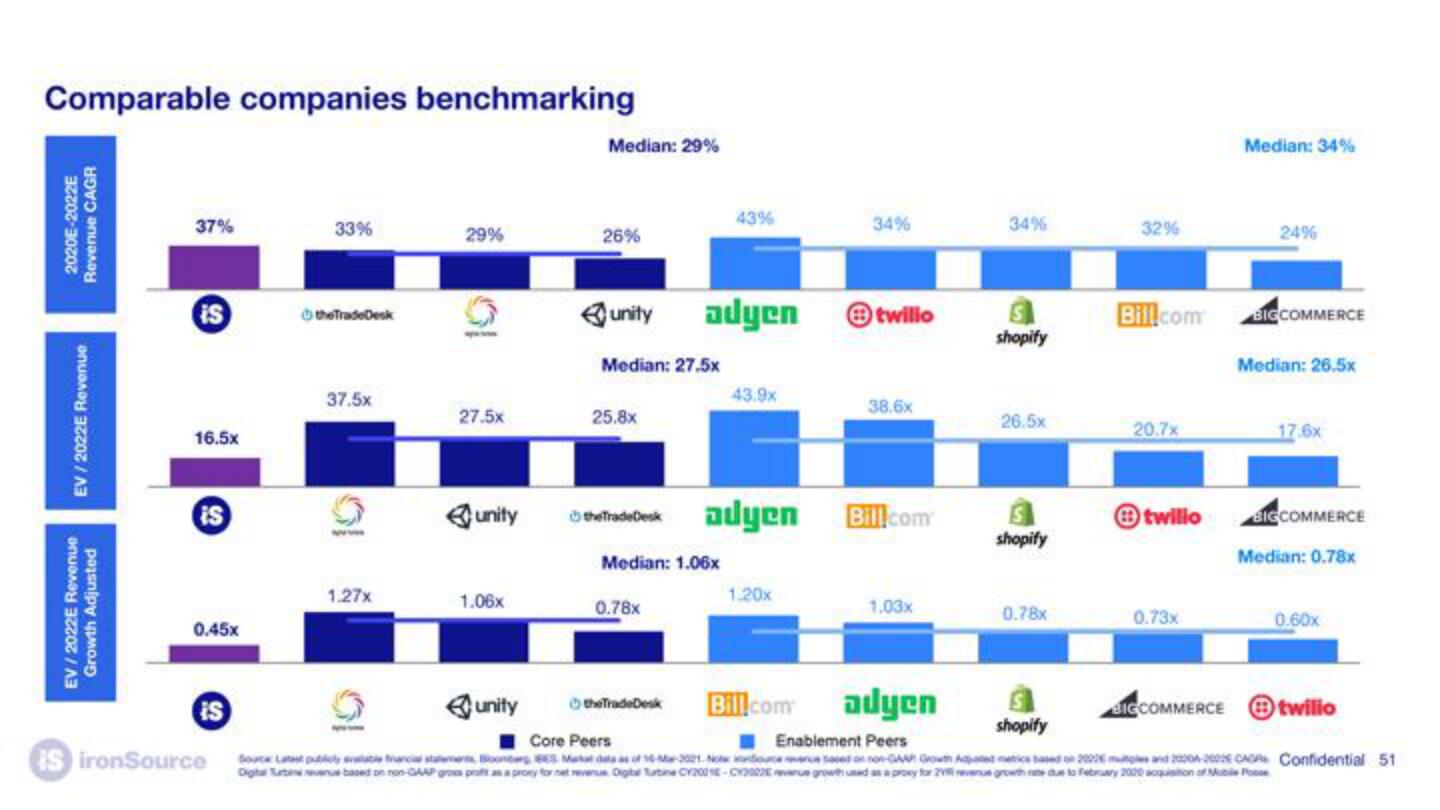

Comparable companies benchmarking

2020E-2022E

Revenue CAGR

EV/2022E Revenue

EV/2022E Revenue

Growth Adjusted

37%

is

16.5x

is

0.45x

is

33%

the TradeDesk

37.5×

1.27x

29%

27.5x

unity

1.06x

unity

Median: 29%

26%

unity

Median: 27.5x

25.8x

43%

0.78x

adyen twilio

43.9x

the TradeDesk adyen

Median: 1.06x

1.20x

34%

the TradeDesk Bill.com

38.6x

Bill.com

1.03x

adyen

34%

shopify

26.5×

shopify

0.78x

32%

Bill.com

20.7x

twilio

0.73x

BIGCOMMERCE

Median: 34%

24%

BIGCOMMERCE

Median: 26.5x

17.6x

BIGCOMMERCE

Median: 0.78x

0.60x

twilio

shopify

Core Peers

Enablement Peers

IS ironSource Lab francial statements 3 Maka data as of 16-Mar-2001. Nec nource vence based on Growth Added matics based in and 2004 Confidential 51

Digha Tutvenue based on non-GAAP gross proft as a proxy for net revenus Digital Turbine CY2001-C2022 venue growth used as a proxy for 2 revenue growth rate due to February 2000 acquisition of Mabile PoseView entire presentation