Q2 Quarter 2023

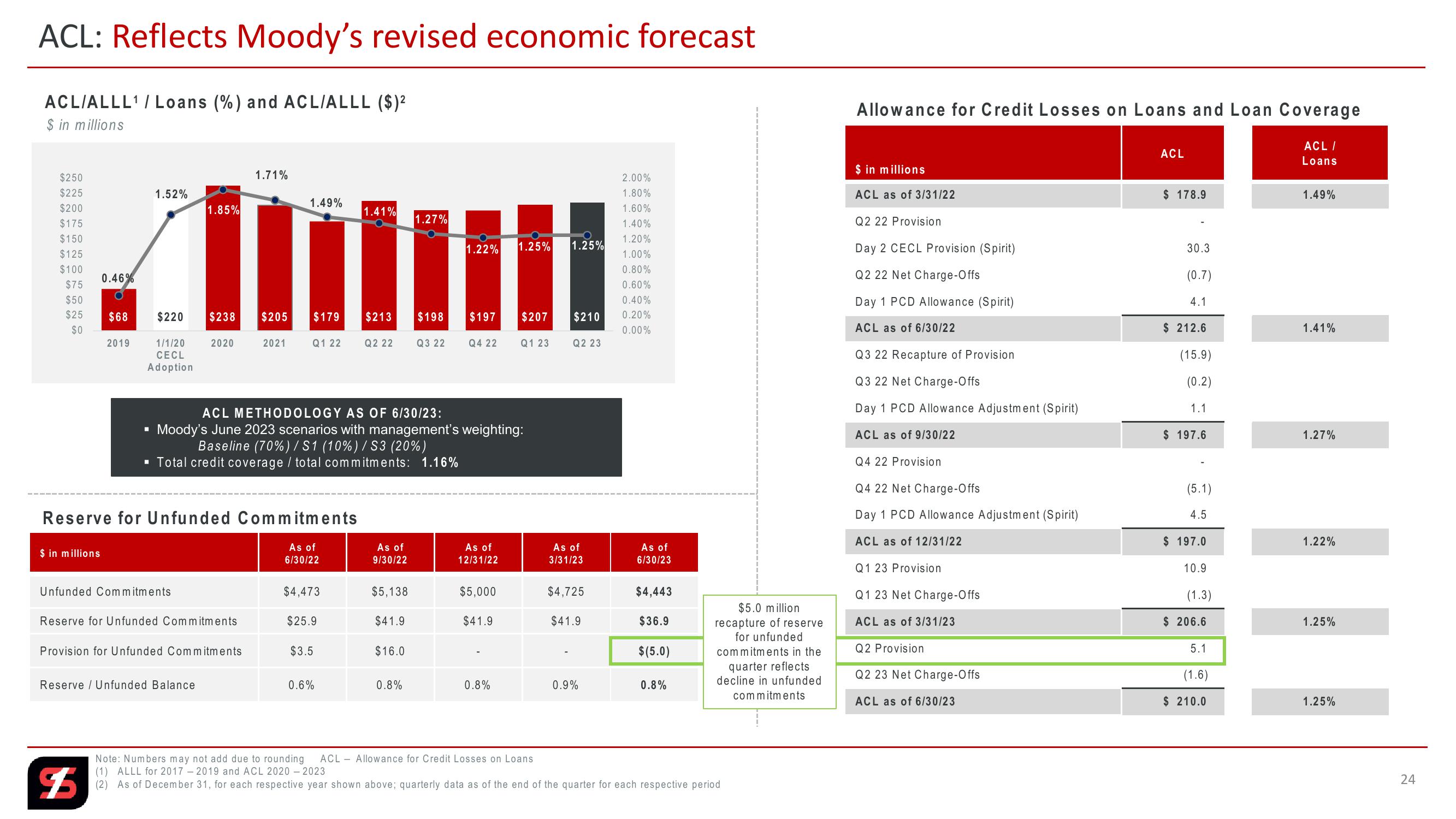

ACL: Reflects Moody's revised economic forecast

ACL/ALLL1/Loans (%) and ACL/ALLL ($)²

$ in millions

Allowance for Credit Losses on Loans and Loan Coverage

ACL

ACL /

Loans

$ in millions

$250

$225

1.71%

2.00%

1.52%

1.80%

ACL as of 3/31/22

$ 178.9

1.49%

1.49%

$200

1.85%

1.41%

1.60%

1.27%

$175

1.40%

Q2 22 Provision

$150

1.20%

1.22% 1.25%

1.25%

Day 2 CECL Provision (Spirit)

30.3

$125

1.00%

$100

0.80%

0.46%

Q2 22 Net Charge-Offs

(0.7)

$75

0.60%

$50

0.40%

Day 1 PCD Allowance (Spirit)

4.1

$25

$68

$220

$238 $205

$179

$213 $198

$197

$207

$210

0.20%

$0

0.00%

ACL as of 6/30/22

$ 212.6

1.41%

2019

1/1/20

2020

2021

Q1 22

Q2 22

Q3 22

Q4 22

Q1 23

Q2 23

CECL

Adoption

Q3 22 Recapture of Provision

(15.9)

Q3 22 Net Charge-Offs

(0.2)

☐

ACL METHODOLOGY AS OF 6/30/23:

Moody's June 2023 scenarios with management's weighting:

Baseline (70%)/S1 (10%) / S3 (20%)

■ Total credit coverage / total commitments: 1.16%

Day 1 PCD Allowance Adjustment (Spirit)

1.1

ACL as of 9/30/22

$ 197.6

1.27%

Q4 22 Provision

Reserve for Unfunded Commitments

$ in millions

Q4 22 Net Charge-Offs

Day 1 PCD Allowance Adjustment (Spirit)

(5.1)

4.5

ACL as of 12/31/22

$ 197.0

1.22%

As of

6/30/22

As of

9/30/22

As of

12/31/22

As of

3/31/23

As of

6/30/23

Q1 23 Provision

10.9

Unfunded Commitments

$4,473

$5,138

$5,000

$4,725

$4,443

Q1 23 Net Charge-Offs

(1.3)

Reserve for Unfunded Commitments

$25.9

$41.9

$41.9

$41.9

$36.9

Provision for Unfunded Commitments

$3.5

$16.0

$(5.0)

Reserve Unfunded Balance

0.6%

0.8%

0.8%

0.9%

0.8%

$5.0 million

recapture of reserve

for unfunded

commitments in the

quarter reflects

decline in unfunded

commitments

ACL as of 3/31/23

$ 206.6

1.25%

Q2 Provision

5.1

Q2 23 Net Charge-Offs

(1.6)

ACL as of 6/30/23

$ 210.0

1.25%

Note: Numbers may not add due to rounding

ACL Allowance for Credit Losses on Loans

$5

(1) ALLL for 2017-2019 and ACL 2020-2023

(2) As of December 31, for each respective year shown above; quarterly data as of the end of the quarter for each respective period

24

24View entire presentation