HashiCorp Investor Presentation Deck

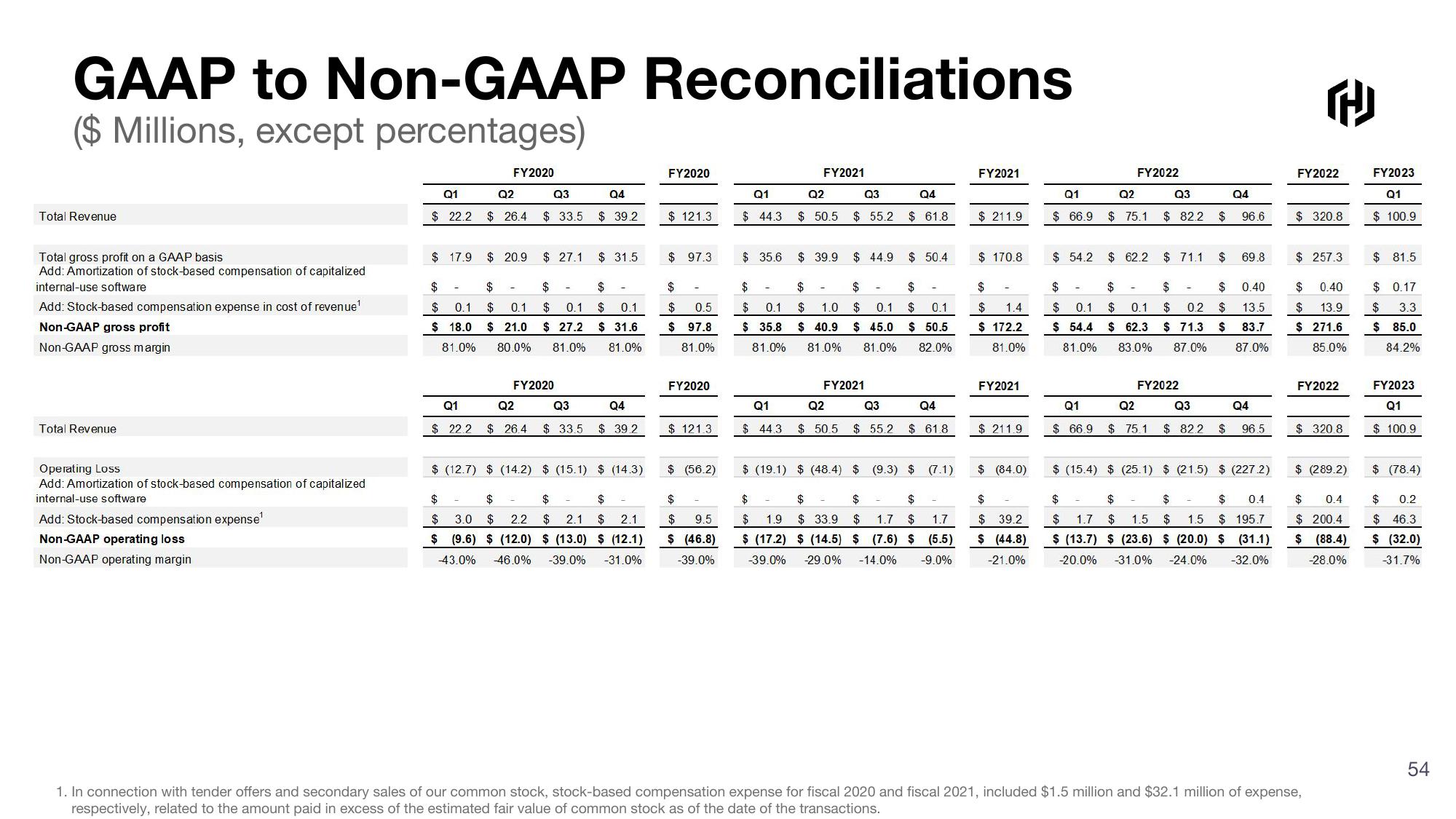

GAAP to Non-GAAP Reconciliations

($ Millions, except percentages)

Total Revenue

Total gross profit on a GAAP basis

Add: Amortization of stock-based compensation of capitalized

internal-use software

Add: Stock-based compensation expense in cost of revenue¹

Non-GAAP gross profit

Non-GAAP gross margin

Total Revenue

Operating Loss

Add: Amortization of stock-based compensation of capitalized

internal-use software

Add: Stock-based compensation expense¹

Non-GAAP operating loss

Non-GAAP operating margin

Q1

$22.2

$17.9

$

$ 0.1

$ 18.0

81.0%

-

Q1

$22.2

FY2020

-

Q2

Q3

Q4

$26.4 $33.5 $39.2

$20.9

$

$ 0.1

$ 21.0

80.0%

-

$27.1

$

$ 0.1

$ 27.2

81.0%

FY2020

Q2

Q3

$26.4 $ 33.5

$31.5

$

$ 0.1

$ 31.6

81.0%

-

Q4

$39.2

$ (12.7) $ (14.2) $ (15.1) $ (14.3)

$

$

$

$

$ 3.0 $ 2.2 $ 2.1 $ 2.1

$ (9.6) $ (12.0) $ (13.0) $ (12.1)

-43.0% -46.0% -39.0% -31.0%

FY2020

$ 121.3

$97.3

$

$ 0.5

$ 97.8

81.0%

-

FY2020

$ 121.3

$ (56.2)

$

$ 9.5

$ (46.8)

-39.0%

Q1

$44.3

$35.6

$

$ 0.1

$35.8

81.0%

-

FY2021

Q2

$ 50.5

-

$39.9

$

$ 1.0

$ 40.9

81.0%

-

Q1

$44.3 $ 50.5

Q2

Q3

Q4

$55.2 $61.8

FY2021

$44.9 $ 50.4

$

$

$ 0.1 $ 0.1

$ 45.0

$ 50.5

81.0% 82.0%

-

Q3

Q4

$55.2 $61.8

$ (19.1) $ (48.4) $ (9.3) $ (7.1)

$

$

$

$

$ 1.9 $33.9 $ 1.7 $ 1.7

$ (17.2) $ (14.5) $ (7.6) $ (5.5)

-39.0% -29.0% -14.0% -9.0%

FY2021

$ 211.9

$170.8

$

$ 1.4

$ 172.2

81.0%

FY2021

$211.9

$ (84.0)

$

$39.2

$ (44.8)

-21.0%

Q1

$66.9

$

$ 0.1

$ 54.4

81.0%

FY2022

$54.2 $62.2 $71.1 $

-

Q2

Q3

$75.1 $82.2 $ 96.6

Q4

FY2022

69.8

$

$

$ 0.40

$ 0.1 $ 0.2 $ 13.5

$ 62.3 $71.3 $ 83.7

83.0% 87.0% 87.0%

Q1

Q2

Q3

Q4

$ 66.9 $75.1 $82.2 $ 96.5

$

$ (15.4) $ (25.1) $ (21.5) $ (227.2)

$

$

$ 0.4

$ 1.7 $ 1.5 $ 1.5 $195.7

$ (13.7) $ (23.6) $ (20.0) $ (31.1)

-20.0% -31.0% -24.0% -32.0%

군

FY2022

$ 320.8

$ 257.3

$ 0.40

$ 13.9

$ 271.6

85.0%

FY2022

$320.8

$ (289.2)

$

0.4

$ 200.4

$ (88.4)

-28.0%

1. In connection with tender offers and secondary sales of our common stock, stock-based compensation expense for fiscal 2020 and fiscal 2021, included $1.5 million and $32.1 million of expense,

respectively, related to the amount paid in excess of the estimated fair value of common stock as of the date of the transactions.

FY2023

Q1

$ 100.9

$ 81.5

$ 0.17

$ 3.3

$ 85.0

84.2%

FY2023

Q1

$100.9

$ (78.4)

$ 0.2

$ 46.3

$ (32.0)

-31.7%

54View entire presentation