T-Mobile Investor Day Presentation Deck

T-Mobile US, Inc.

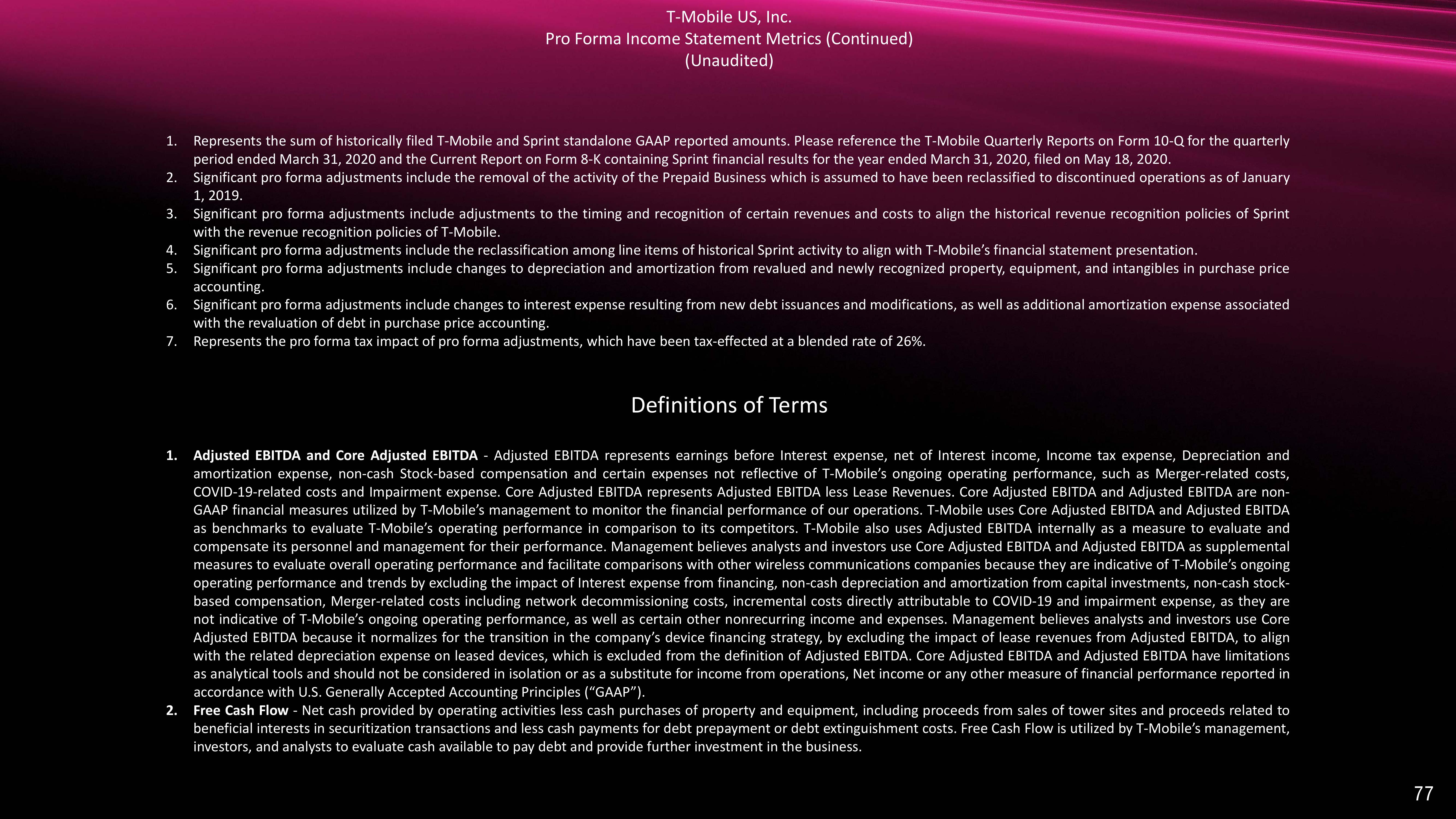

Pro Forma Income Statement Metrics (Continued)

(Unaudited)

1. Represents the sum of historically filed T-Mobile and Sprint standalone GAAP reported amounts. Please reference the T-Mobile Quarterly Reports on Form 10-Q for the quarterly

period ended March 31, 2020 and the Current Report on Form 8-K containing Sprint financial results for the year ended March 31, 2020, filed on May 18, 2020.

2.

Significant pro forma adjustments include the removal of the activity of the Prepaid Business which is assumed to have been reclassified to discontinued operations as of January

1, 2019.

3.

4.

5.

6.

7.

Significant pro forma adjustments include adjustments to the timing and recognition of certain revenues and costs to align the historical revenue recognition policies of Sprint

with the revenue recognition policies of T-Mobile.

Significant pro forma adjustments include the reclassification among line items of historical Sprint activity to align with T-Mobile's financial statement presentation.

Significant pro forma adjustments include changes to depreciation and amortization from revalued and newly recognized property, equipment, and intangibles in purchase price

accounting.

Significant pro forma adjustments include changes to interest expense resulting from new debt issuances and modifications, as well as additional amortization expense associated

with the revaluation of debt in purchase price accounting.

Represents the pro forma tax impact of pro forma adjustments, which have been tax-effected at a blended rate of 26%.

Definitions of Terms

1. Adjusted EBITDA and Core Adjusted EBITDA - Adjusted EBITDA represents earnings before Interest expense, net of Interest income, Income tax expense, Depreciation and

amortization expense, non-cash Stock-based compensation and certain expenses not reflective of T-Mobile's ongoing operating performance, such as Merger-related costs,

COVID-19-related costs and Impairment expense. Core Adjusted EBITDA represents Adjusted EBITDA less Lease Revenues. Core Adjusted EBITDA and Adjusted EBITDA are non-

GAAP financial measures utilized by T-Mobile's management to monitor the financial performance of our operations. T-Mobile uses Core Adjusted EBITDA and Adjusted EBITDA

as benchmarks to evaluate T-Mobile's operating performance in comparison to its competitors. T-Mobile also uses Adjusted EBITDA internally as a measure to evaluate and

compensate its personnel and management for their performance. Management believes analysts and investors use Core Adjusted EBITDA and Adjusted EBITDA as supplemental

measures to evaluate overall operating performance and facilitate comparisons with other wireless communications companies because they are indicative of T-Mobile's ongoing

operating performance and trends by excluding the impact of Interest expense from financing, non-cash depreciation and amortization from capital investments, non-cash stock-

based compensation, Merger-related costs including network decommissioning costs, incremental costs directly attributable to COVID-19 and impairment expense, as they are

not indicative of T-Mobile's ongoing operating performance, as well as certain other nonrecurring income and expenses. Management believes analysts and investors use Core

Adjusted EBITDA because it normalizes for the transition in the company's device financing strategy, by excluding the impact of lease revenues from Adjusted EBITDA, to align

with the related depreciation expense on leased devices, which is excluded from the definition of Adjusted EBITDA. Core Adjusted EBITDA and Adjusted EBITDA have limitations

as analytical tools and should not be considered in isolation or as a substitute for income from operations, Net income or any other measure of financial performance reported in

accordance with U.S. Generally Accepted Accounting Principles ("GAAP").

2. Free Cash Flow - Net cash provided by operating activities less cash purchases of property and equipment, including proceeds from sales of tower sites and proceeds related to

beneficial interests in securitization transactions and less cash payments for debt prepayment or debt extinguishment costs. Free Cash Flow is utilized by T-Mobile's management,

investors, and analysts to evaluate cash available to pay debt and provide further investment in the business.

77View entire presentation