Avantor Results Presentation Deck

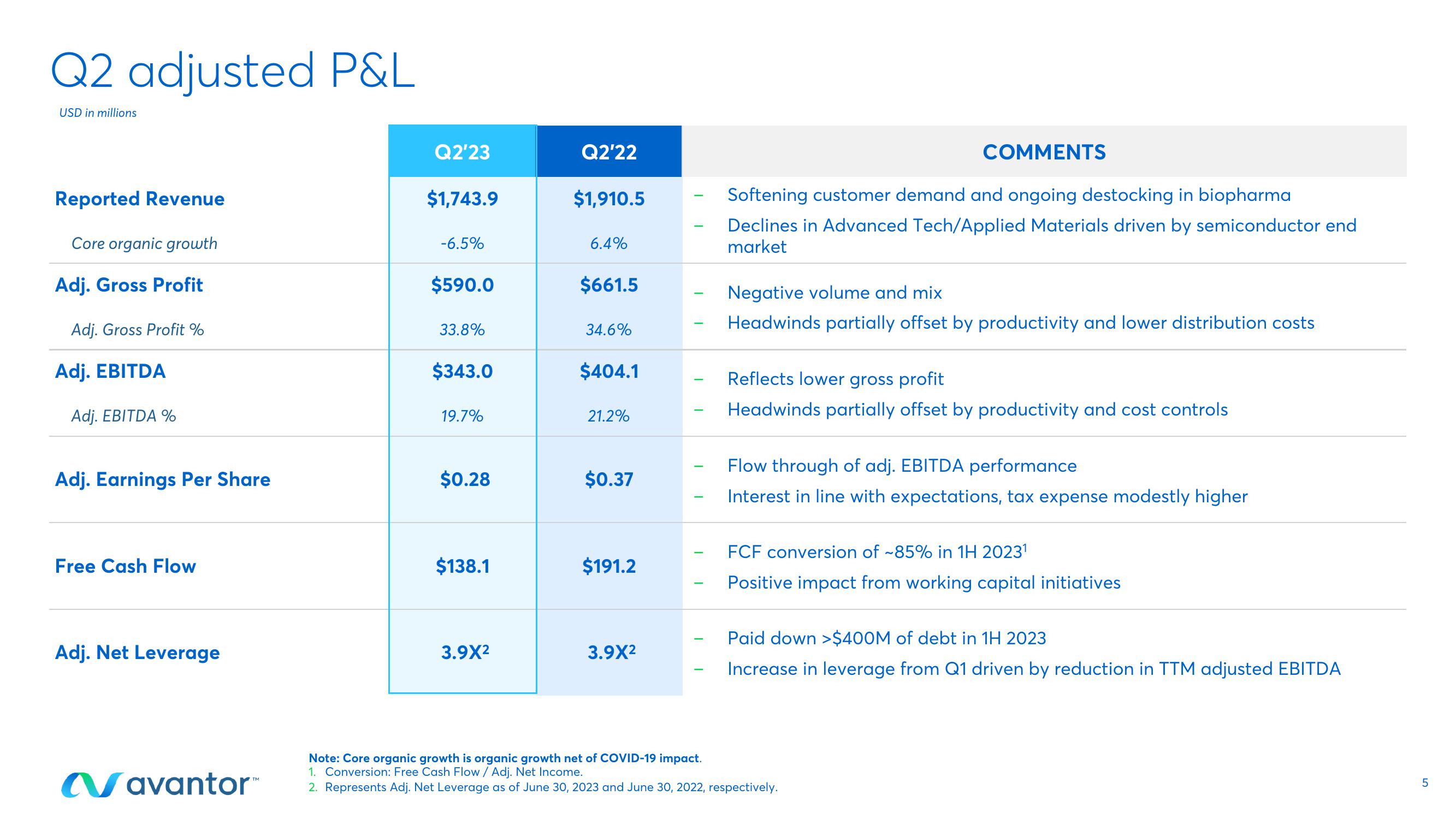

Q2 adjusted P&L

USD in millions

Reported Revenue

Core organic growth

Adj. Gross Profit

Adj. Gross Profit %

Adj. EBITDA

Adj. EBITDA %

Adj. Earnings Per Share

Free Cash Flow

Adj. Net Leverage

avantor™

Q2'23

$1,743.9

-6.5%

$590.0

33.8%

$343.0

19.7%

$0.28

$138.1

3.9X²

Q2'22

$1,910.5

6.4%

$661.5

34.6%

$404.1

21.2%

$0.37

$191.2

3.9X²

COMMENTS

Softening customer demand and ongoing destocking in biopharma

Declines in Advanced Tech/Applied Materials driven by semiconductor end

market

Negative volume and mix

Headwinds partially offset by productivity and lower distribution costs

Reflects lower gross profit

Headwinds partially offset by productivity and cost controls

Flow through of adj. EBITDA performance

Interest in line with expectations, tax expense modestly higher

FCF conversion of ~85% in 1H 2023¹

Positive impact from working capital initiatives

Paid down >$400M of debt in 1H 2023

Increase in leverage from Q1 driven by reduction in TTM adjusted EBITDA

Note: Core organic growth is organic growth net of COVID-19 impact.

1. Conversion: Free Cash Flow / Adj. Net Income.

2. Represents Adj. Net Leverage as of June 30, 2023 and June 30, 2022, respectively.

5

слView entire presentation