Skillsoft SPAC Presentation Deck

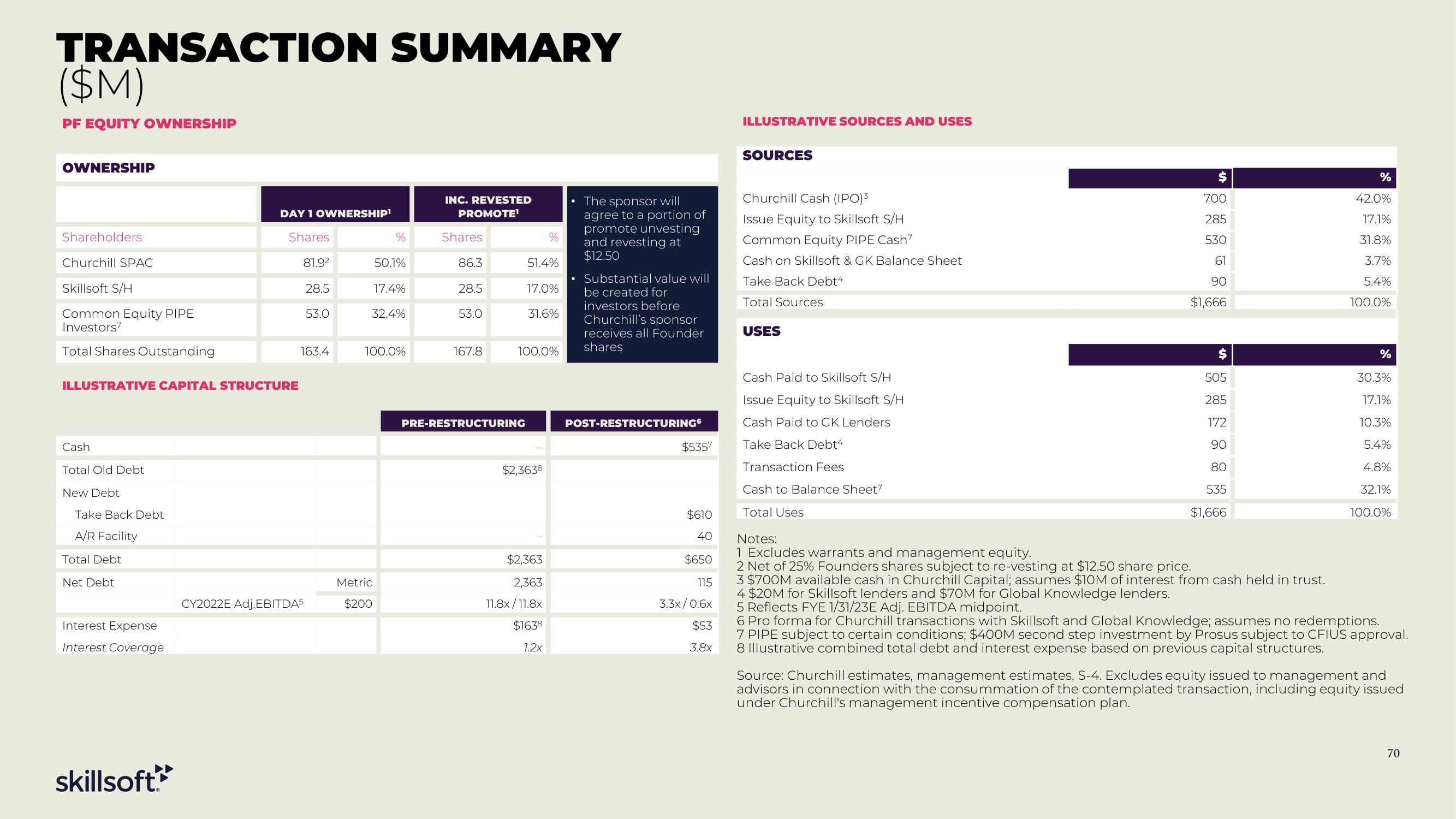

TRANSACTION SUMMARY

($M)

PF EQUITY OWNERSHIP

OWNERSHIP

Shareholders

Churchill SPAC

Skillsoft S/H

Common Equity PIPE

Investors7

Total Shares Outstanding

ILLUSTRATIVE CAPITAL STRUCTURE

Cash

Total Old Debt

New Debt

Take Back Debt

A/R Facility

Total Debt

Net Debt

Interest Expense

Interest Coverage

DAY 1 OWNERSHIP¹

Shares

skillsoft

81.92

28.5

CY2022E Adj.EBITDA5

53.0

163.4

%

50.1%

17.4%

32.4%

100.0%

Metric

$200

INC. REVESTED

PROMOTE¹

Shares

86.3

28.5

53.0

167.8

PRE-RESTRUCTURING

51.4%

17.0%

31.6%

100.0%

%

$2,3638

$2,363

2,363

11.8x/11.8x

$1638

1.2x

The sponsor will

agree to a portion of

promote unvesting

and revesting at

$12.50

Substantial value will

be created for

investors before

Churchill's sponsor

receives all Founder

shares

POST-RESTRUCTURING

$5357

$610

40

$650

115

3.3x/0.6x

$53

3.8x

ILLUSTRATIVE SOURCES AND USES

SOURCES

Churchill Cash (IPO)³

Issue Equity to Skillsoft S/H

Common Equity PIPE Cash"

Cash on Skillsoft & GK Balance Sheet

Take Back Debt4

Total Sources

USES

Cash Paid to Skillsoft S/H

Issue Equity to Skillsoft S/H

Cash Paid to GK Lenders

Take Back Debt4

Transaction Fees

Cash to Balance Sheet7

Total Uses

700

285

530

61

90

$1,666

$

505

285

172

90

80

535

$1,666

%

42.0%

17.1%

31.8%

3.7%

5.4%

100.0%

%

30.3%

17.1%

10.3%

5.4%

4.8%

32.1%

100.0%

Notes:

1 Excludes warrants and management equity.

2 Net of 25% Founders shares subject to re-vesting at $12.50 share price.

3 $700M available cash in Churchill Capital; assumes $10M of interest from cash held in trust.

4 $20M for Skillsoft lenders and $70M for Global Knowledge lenders.

5 Reflects FYE 1/31/23E Adj. EBITDA midpoint.

6 Pro forma for Churchill transactions with Skillsoft and Global Knowledge; assumes no redemptions.

7 PIPE subject to certain conditions; $400M second step investment by Prosus subject to CFIUS approval.

8 Illustrative combined total debt and interest expense based on previous capital structures.

Source: Churchill estimates, management estimates, S-4. Excludes equity issued to management and

advisors in connection with the consummation of the contemplated transaction, including equity issued

under hill's management ince tive compensation plan.

70View entire presentation