Orthofix Investor Presentation Deck

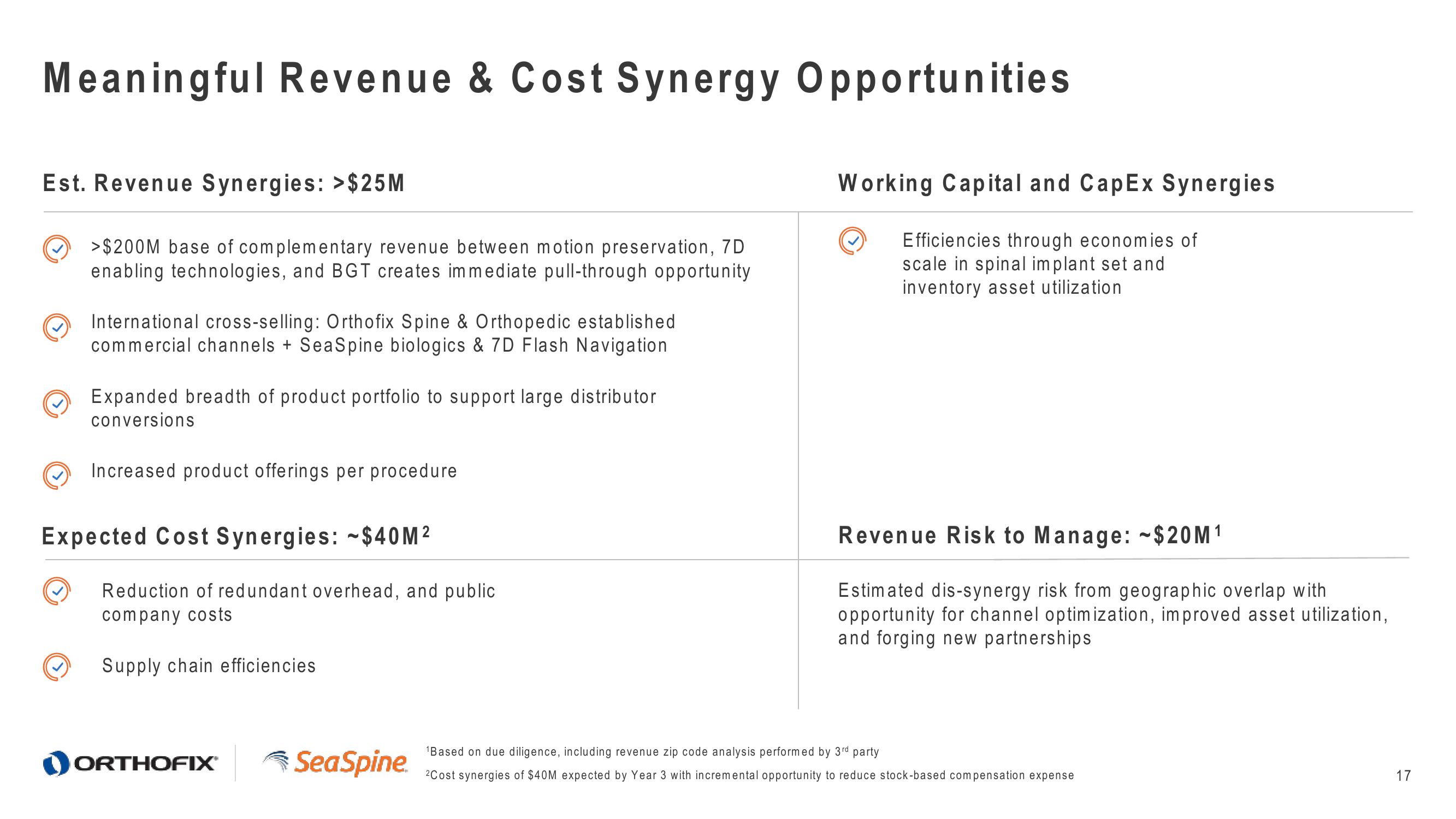

Meaningful Revenue & Cost Synergy Opportunities

Est. Revenue Synergies: >$25M

>$200M base of complementary revenue between motion preservation, 7D

enabling technologies, and BGT creates immediate pull-through opportunity

International cross-selling: Orthofix Spine & Orthopedic established

commercial channels + SeaSpine biologics & 7D Flash Navigation

Expanded breadth of product portfolio to support large distributor

conversions

Increased product offerings per procedure

Expected Cost Synergies: $40M²

Reduction of redundant overhead, and public

company costs

Supply chain efficiencies

ORTHOFIX®™ SeaSpine.

Working Capital and CapEx Synergies

Efficiencies through economies of

scale in spinal implant set and

inventory asset utilization

Revenue Risk to Manage: $20M¹

Estimated dis-synergy risk from geographic overlap with

opportunity for channel optimization, improved asset utilization,

and forging new partnerships

¹Based on due diligence, including revenue zip code analysis performed by 3rd party

2Cost synergies of $40M expected by Year 3 with incremental opportunity to reduce stock-based compensation expense

17View entire presentation