Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

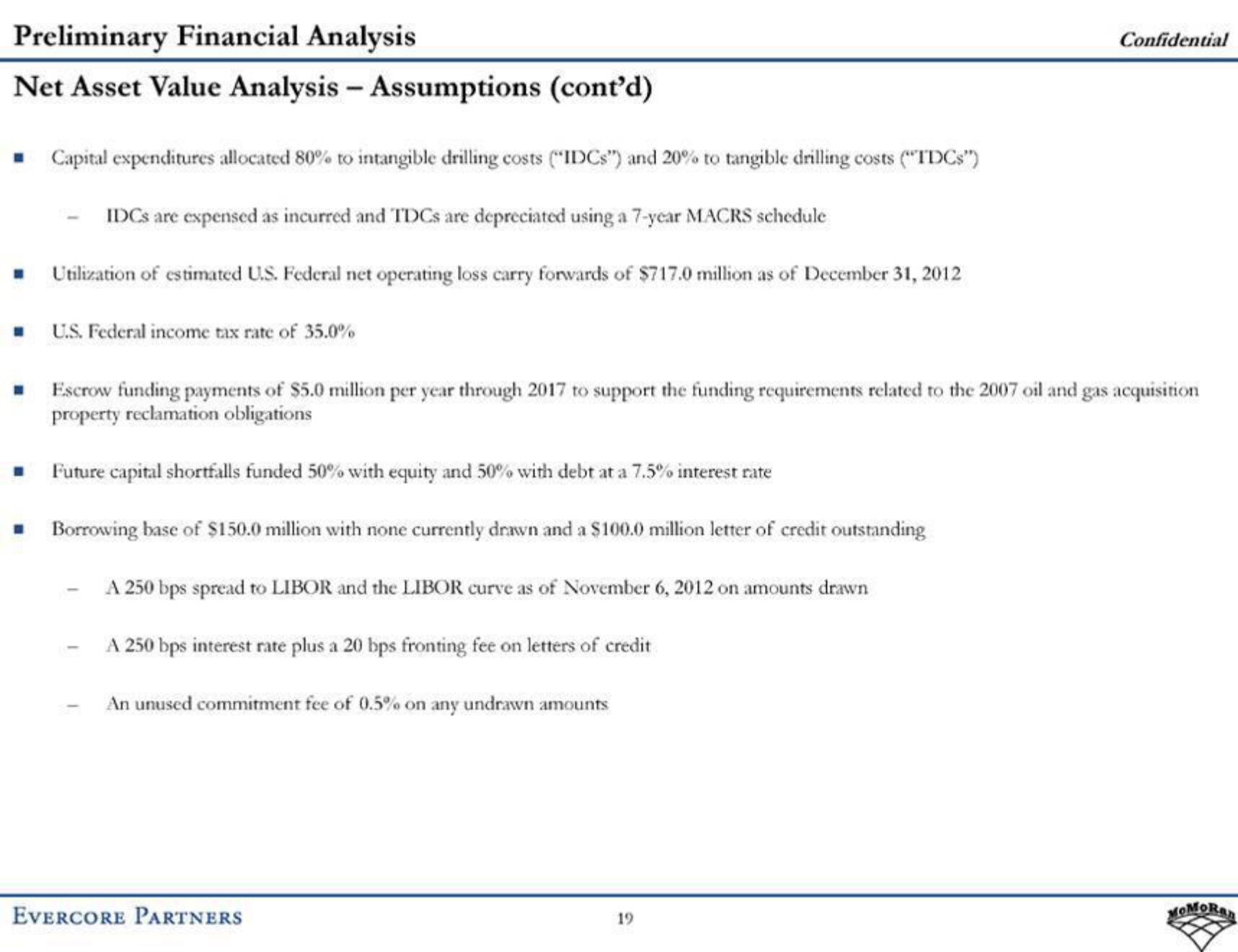

Net Asset Value Analysis - Assumptions (cont'd)

■ Capital expenditures allocated 80% to intangible drilling costs ("IDCs") and 20% to tangible drilling costs ("TDCs")

IDCs are expensed as incurred and TDCs are depreciated using a 7-year MACRS schedule

- Utilization of estimated U.S. Federal net operating loss carry forwards of $717.0 million as of December 31, 2012

H

U.S. Federal income tax rate of 35.0%

Escrow funding payments of $5.0 million per year through 2017 to support the funding requirements related to the 2007 oil and gas acquisition

property reclamation obligations

Future capital shortfalls funded 50% with equity and 50% with debt at a 7.5% interest rate

■ Borrowing base of $150.0 million with none currently drawn and a $100.0 million letter of credit outstanding

A 250 bps spread to LIBOR and the LIBOR curve as of November 6, 2012 on amounts drawn

A 250 bps interest rate plus a 20 bps fronting fee on letters of credit

An unused commitment fee of 0.5% on any undrawn amounts

EVERCORE PARTNERS

Confidential

19

MOMORANView entire presentation