Barclays Global Financial Services Conference

Wholesale Banking restructure update

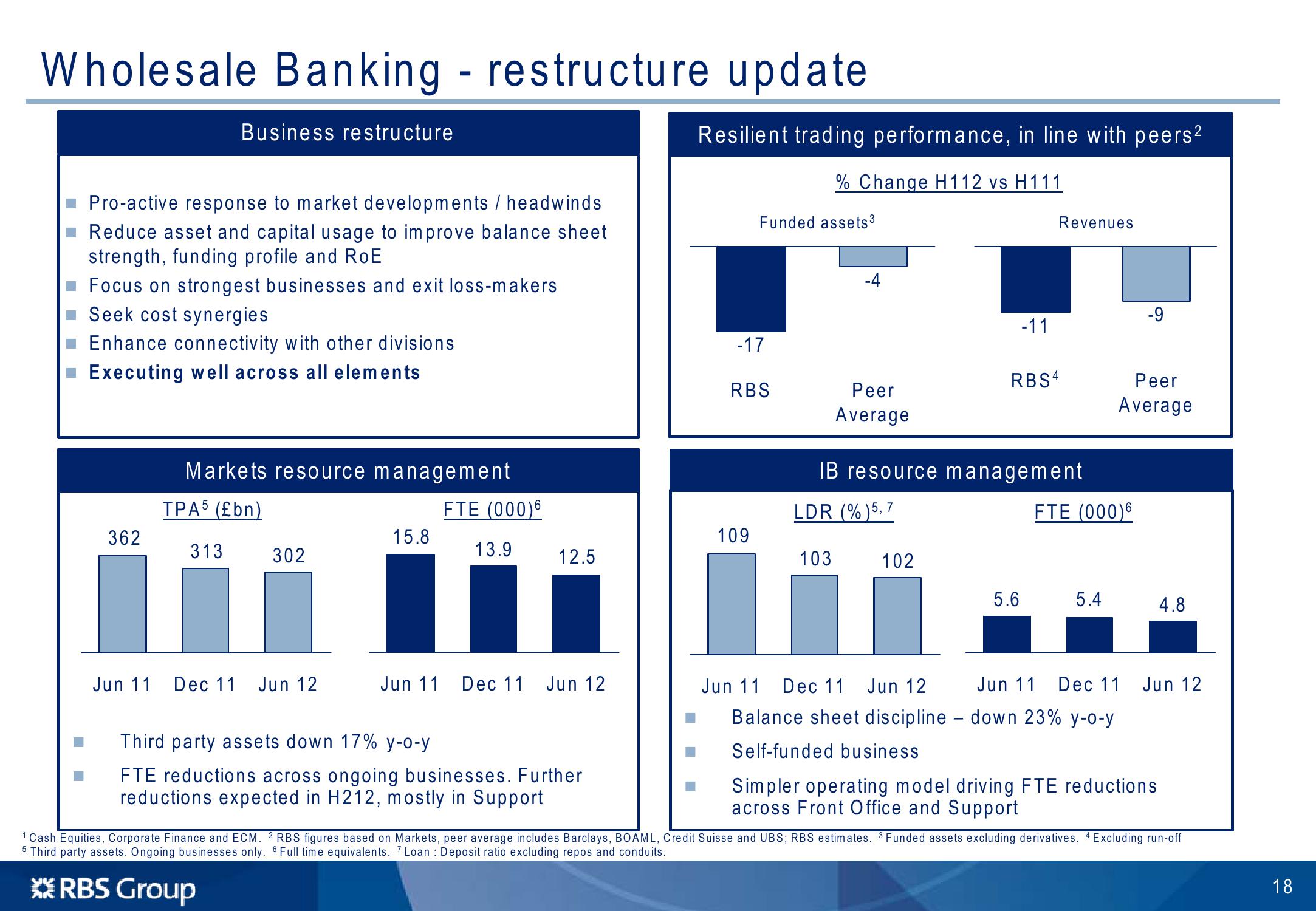

Business restructure

Pro-active response to market developments / headwinds

Reduce asset and capital usage to improve balance sheet

strength, funding profile and ROE

Focus on strongest businesses and exit loss-makers

Seek cost synergies

Enhance connectivity with other divisions

Executing well across all elements

Resilient trading performance, in line with peers²

% Change H112 vs H111

Funded assets³

Revenues

-4

-11

-17

RBS4

RBS

Peer

Average

Peer

Average

Markets resource management

IB resource management

TPA5 (£bn)

FTE (000)6

LDR (%) 5, 7

FTE (000)6

362

15.8

109

313

13.9

302

12.5

103

102

5.6

5.4

4.8

Jun 11

Dec 11 Jun 12

Jun 11 Dec 11 Jun 12

Jun 11 Dec 11 Jun 12

Jun 11 Dec 11 Jun 12

Third party assets down 17% y-o-y

FTE reductions across ongoing businesses. Further

reductions expected in H212, mostly in Support

Balance sheet discipline - down 23% y-o-y

Self-funded business

Simpler operating model driving FTE reductions

across Front Office and Support

1 Cash Equities, Corporate Finance and ECM. 2 RBS figures based on Markets, peer average includes Barclays, BOAML, Credit Suisse and UBS; RBS estimates. 3 Funded assets excluding derivatives. 4 Excluding run-off

5 Third party assets. Ongoing businesses only. 6 Full time equivalents. 7 Loan Deposit ratio excluding repos and conduits.

RBS Group

18View entire presentation