Melrose Results Presentation Deck

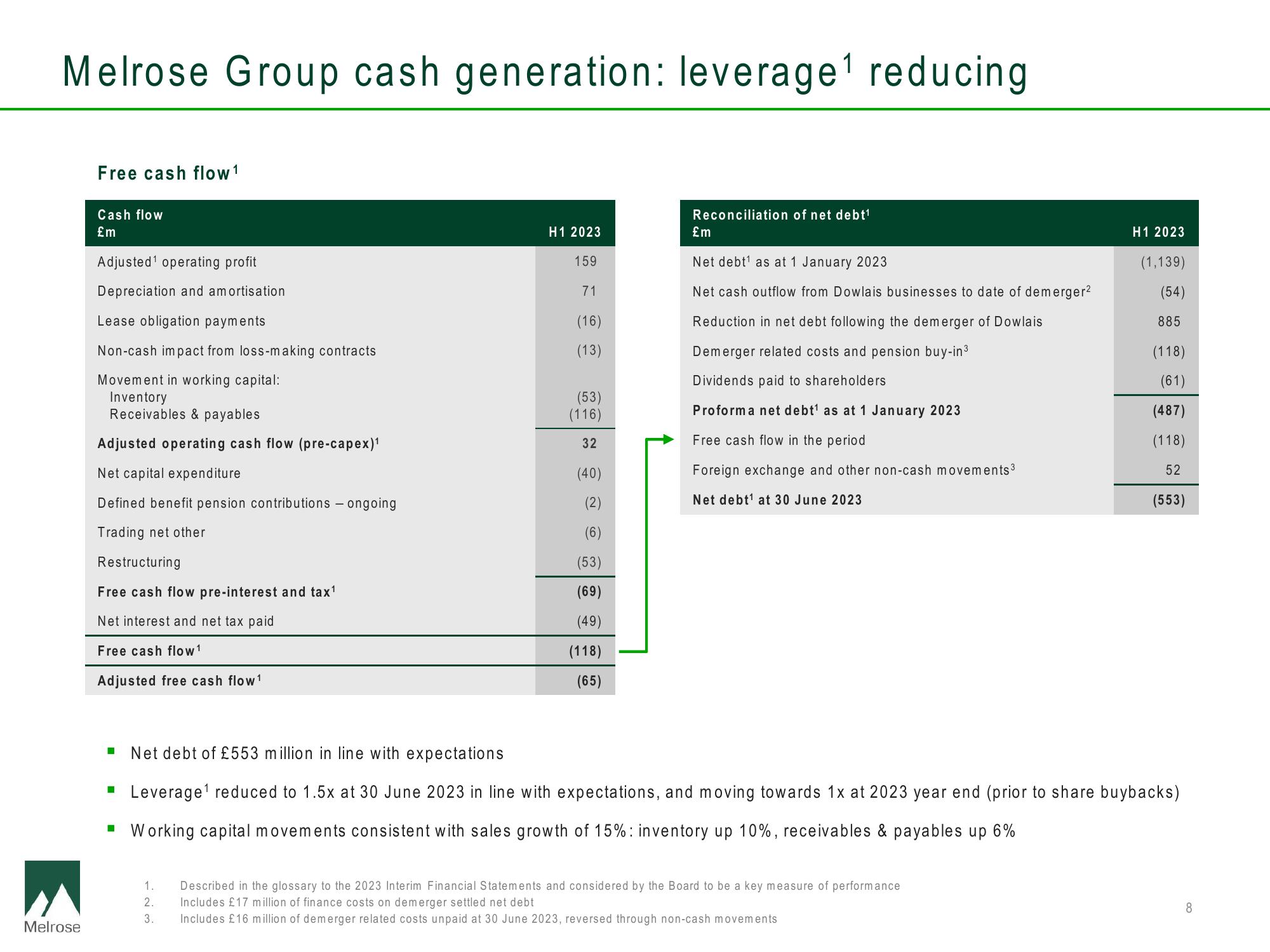

Melrose Group cash generation: leverage¹ reducing

Melrose

Free cash flow 1

Cash flow

£m

Adjusted¹ operating profit

Depreciation and amortisation

Lease obligation payments

Non-cash impact from loss-making contracts

Movement in working capital:

Inventory

Receivables & payables

Adjusted operating cash flow (pre-capex)¹

Net capital expenditure

Defined benefit pension contributions - ongoing

Trading net other

Restructuring

Free cash flow pre-interest and tax¹

Net interest and net tax paid

Free cash flow ¹

Adjusted free cash flow ¹

H1 2023

159

■

71

(16)

(13)

(53)

(116)

32

(40)

(2)

(53)

(69)

(49)

(118)

(65)

Reconciliation of net debt¹

£m

Net debt¹ as at 1 January 2023

Net cash outflow from Dowlais businesses to date of demerger²

Reduction in net debt following the demerger of Dowlais

Demerger related costs and pension buy-in³

Dividends paid to shareholders

Proforma net debt¹ as at 1 January 2023

Free cash flow in the period

Foreign exchange and other non-cash movements ³

Net debt¹ at 30 June 2023

H1 2023

(1,139)

(54)

1.

Described in the glossary to the 2023 Interim Financial Statements and considered by the Board to be a key measure of performance

Includes £17 million of finance costs on demerger settled net debt

2.

3. Includes £16 million of demerger related costs unpaid at 30 June 2023, reversed through non-cash movements

885

(118)

(61)

(487)

(118)

52

■ Net debt of £553 million in line with expectations

▪ Leverage¹ reduced to 1.5x at 30 June 2023 in line with expectations, and moving towards 1x at 2023 year end (prior to share buybacks)

Working capital movements consistent with sales growth of 15%: inventory up 10%, receivables & payables up 6%

(553)

8View entire presentation