OpenText Investor Presentation Deck

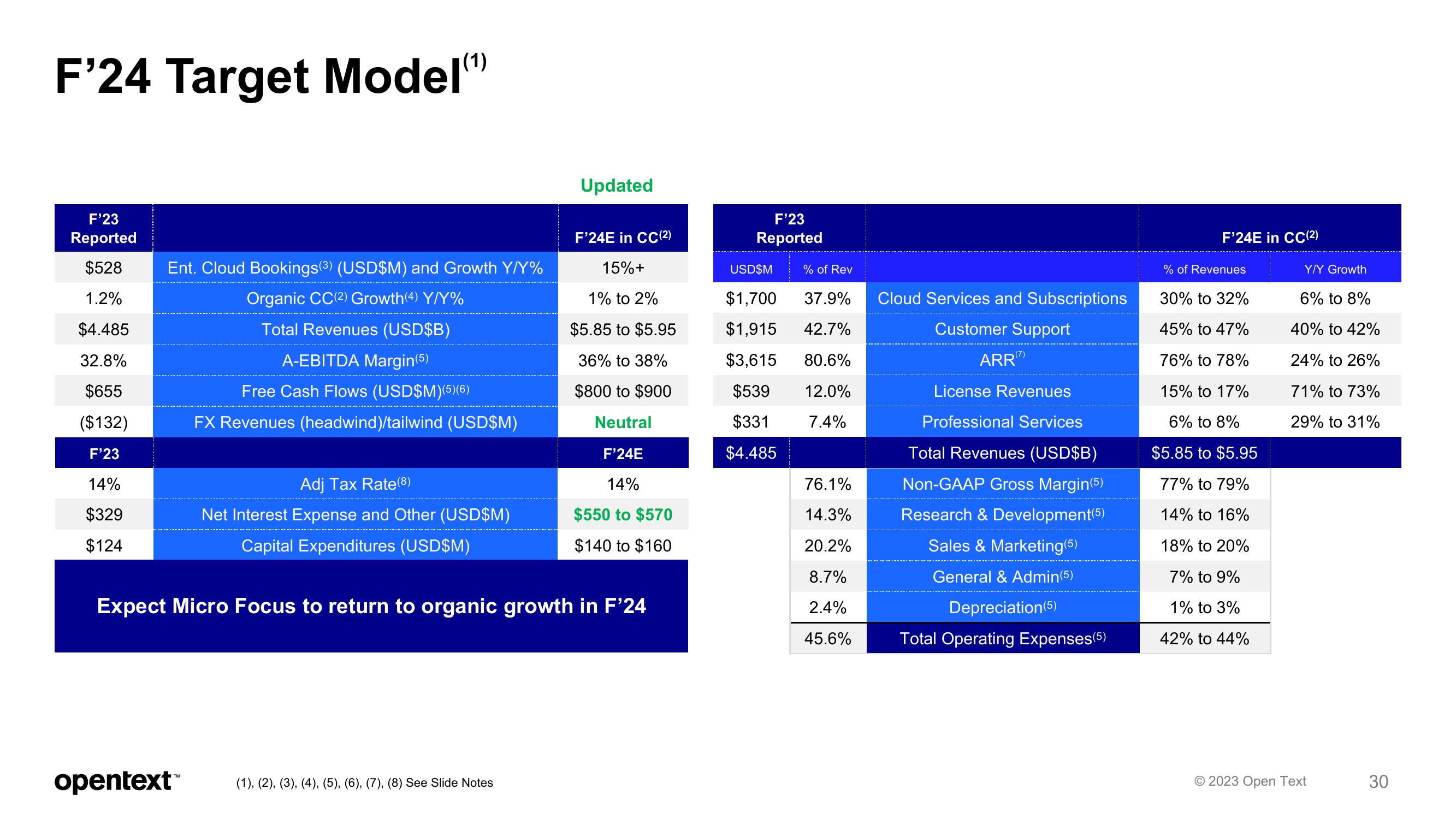

F'24 Target Model(¹)

F'23

Reported

$528

1.2%

$4.485

32.8%

$655

($132)

F'23

14%

$329

$124

Ent. Cloud Bookings (3) (USD$M) and Growth Y/Y%

Organic CC (2) Growth(4) Y/Y%

Total Revenues (USD$B)

A-EBITDA Margin(5)

Free Cash Flows (USD$M)(5)(6)

FX Revenues (headwind)/tailwind (USD$M)

Adj Tax Rate(8)

Net Interest Expense and Other (USD$M)

Capital Expenditures (USD$M)

Updated

opentext™ (1), (2), (3), (4), (5), (6), (7), (8) See Slide Notes

F'24E in CC (2)

15%+

1% to 2%

$5.85 to $5.95

36% to 38%

$800 to $900

Neutral

F'24E

14%

$550 to $570

$140 to $160

Expect Micro Focus to return to organic growth in F'24

F'23

Reported

USD$M

$1,700 37.9%

$1,915 42.7%

$3,615

$539

80.6%

12.0%

7.4%

$331

$4.485

% of Rev

76.1%

14.3%

20.2%

8.7%

2.4%

45.6%

Cloud Services and Subscriptions

Customer Support

ARR(7)

License Revenues

Professional Services

Total Revenues (USD$B)

Non-GAAP Gross Margin(5)

Research & Development (5)

Sales & Marketing (5)

General & Admin (5)

Depreciation (5)

Total Operating Expenses (5)

F'24E in CC (2)

% of Revenues

30% to 32%

45% to 47%

76% to 78%

15% to 17%

6% to 8%

$5.85 to $5.95

77% to 79%

14% to 16%

18% to 20%

7% to 9%

1% to 3%

42% to 44%

Y/Y Growth

6% to 8%

40% to 42%

24% to 26%

71% to 73%

29% to 31%

© 2023 Open Text

30View entire presentation