Ares US Real Estate Opportunity Fund III

Ground Lease Aggregation Strategy, Various - In-Closing

Creation of a national platform to originate and aggregate a diversified ground lease portfolio

100

90

80

70

60

50

40

30

20

10

0

Anticipated Investment

Date:

Location:

Gross Capitalization:(¹)

Anticipated Equity

Committed:(3)

Investment Theme:

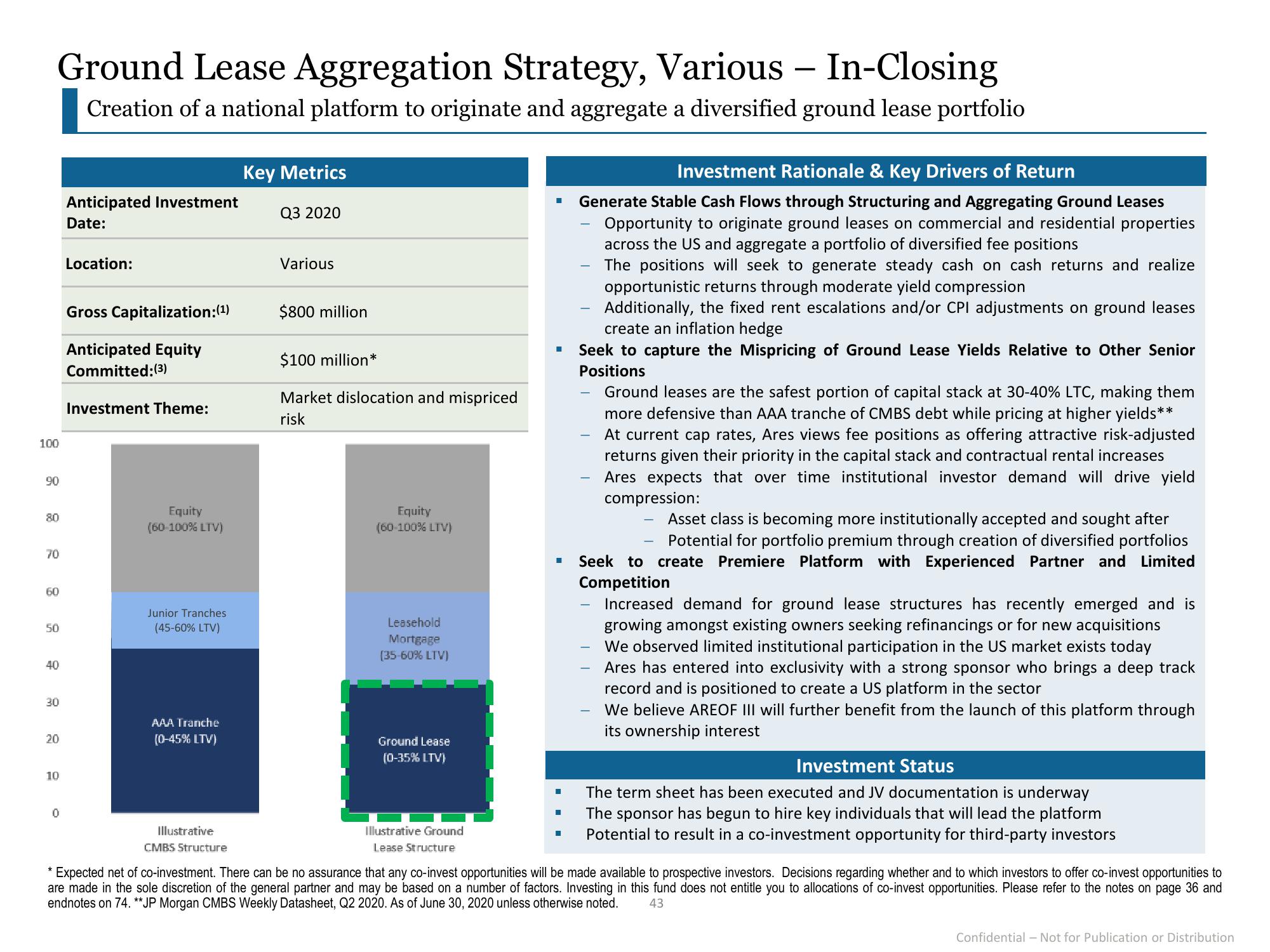

Equity

(60-100% LTV)

Junior Tranches

(45-60% LTV)

AAA Tranche

(0-45% LTV)

Illustrative

CMBS Structure

Key Metrics

Q3 2020

Various

$800 million

$100 million*

Market dislocation and mispriced

risk

Equity

(60-100% LTV)

Leasehold

Mortgage

(35-60% LTV)

Ground Lease

(0-35% LTV)

Illustrative Ground

Lease Structure

I

I

I

M

■

■

Investment Rationale & Key Drivers of Return

Generate Stable Cash Flows through Structuring and Aggregating Ground Leases

Opportunity to originate ground leases on commercial and residential properties

across the US and aggregate a portfolio of diversified fee positions

The positions will seek to generate steady cash on cash returns and realize

opportunistic returns through moderate yield compression

Additionally, the fixed rent escalations and/or CPI adjustments on ground leases

create an inflation hedge

Seek to capture the Mispricing of Ground Lease Yields Relative to Other Senior

Positions

-

-

Ground leases are the safest portion of capital stack at 30-40% LTC, making them

more defensive than AAA tranche of CMBS debt while pricing at higher yields**

At current cap rates, Ares views fee positions as offering attractive risk-adjusted

returns given their priority in the capital stack and contractual rental increases

Ares expects that over time institutional investor demand will drive yield

compression:

Asset class is becoming more institutionally accepted and sought after

Potential for portfolio premium through creation of diversified portfolios

Seek to create Premiere Platform with Experienced Partner and Limited

Competition

Increased demand for ground lease structures has recently emerged and is

growing amongst existing owners seeking refinancings or for new acquisitions

We observed limited institutional participation in the US market exists today

Ares has entered into exclusivity with a strong sponsor who brings a deep track

record and is positioned to create a US platform in the sector

We believe AREOF III will further benefit from the launch of this platform through

its ownership interest

Investment Status

The term sheet has been executed and JV documentation is underway

The sponsor has begun to hire key individuals that will lead the platform

Potential to result in a co-investment opportunity for third-party investors

Expected net of co-investment. There can be no assurance that any co-invest opportunities will be made available to prospective investors. Decisions regarding whether and to which investors to offer co-invest opportunities to

are made in the sole discretion of the general partner and may be based on a number of factors. Investing in this fund does not entitle you to allocations of co-invest opportunities. Please refer to the notes on page 36 and

endnotes on 74. **JP Morgan CMBS Weekly Datasheet, Q2 2020. As of June 30, 2020 unless otherwise noted.

43

Confidential - Not for Publication or DistributionView entire presentation