Fort Capital Investment Banking Pitch Book

Forecast Financial Performance

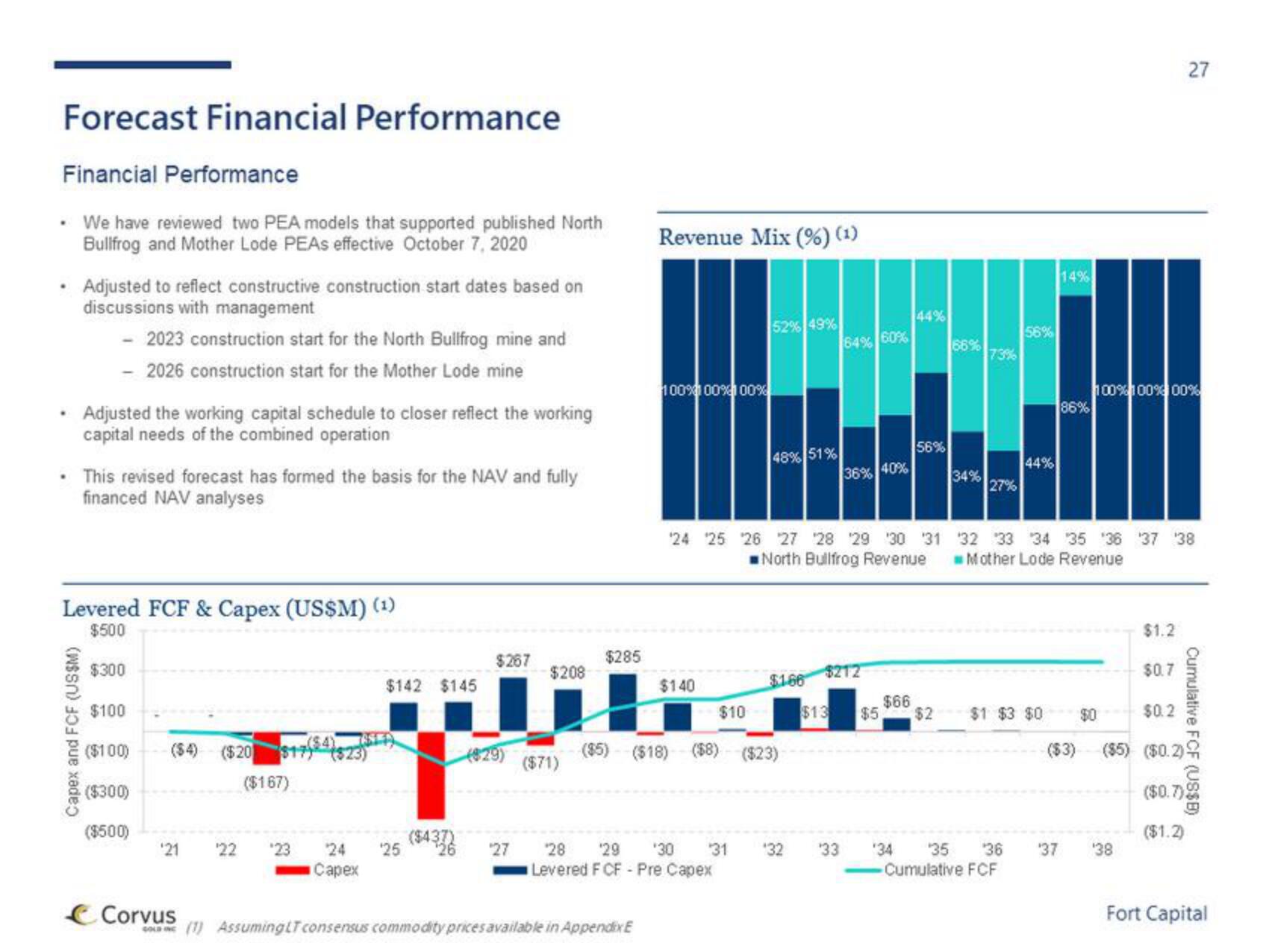

Financial Performance

. We have reviewed two PEA models that supported published North

Bullfrog and Mother Lode PEAS effective October 7, 2020

.

.

.

Adjusted to reflect constructive construction start dates based on

discussions with management

Capex and FCF (US$M)

2023 construction start for the North Bullfrog mine and

- 2026 construction start for the Mother Lode mine

Adjusted the working capital schedule to closer reflect the working

capital needs of the combined operation

This revised forecast has formed the basis for the NAV and fully

financed NAV analyses

Levered FCF & Capex (US$M) (¹)

$500

$300

$100

($100)

($300)

($500)

*

'21

($20 $17(4)(523)

($167)

'22 *23

24

Capex

$142 $145

25 ($437

$285

27

$267

$208

4bb

(829)

($71)

Revenue Mix (%) (1)

100%100 %100%

Corvus

COLN (1) Assuming LT consensus commodity prices available in Appendix E

$140

52% 49%

$10

48% 51%

24 25 26 27 28 29 30 31

North Bullfrog Revenue

$1.66

(85) ($18) ($8) ($23)

64% 60%

36% 40%

*28 '29 *30 31 132 '33

Levered FCF - Pre Capex

$212

44%

56%

$66

$13 $5 $2

*34

66%

34%

27%

56%

44%

$1 $3 $0

14%

35 36 '37

Cumulative FCF

86%

32 33 34 35 36 37 38

Mother Lode Revenue

($3)

100% 100% 100%

$0

$1.2

'38

27

$0.7

$0.2

($5) ($0.2)

Cumulative FCF (US$B)

($0.7)

($1.2)

Fort CapitalView entire presentation