First Foundation Investor Presentation Deck

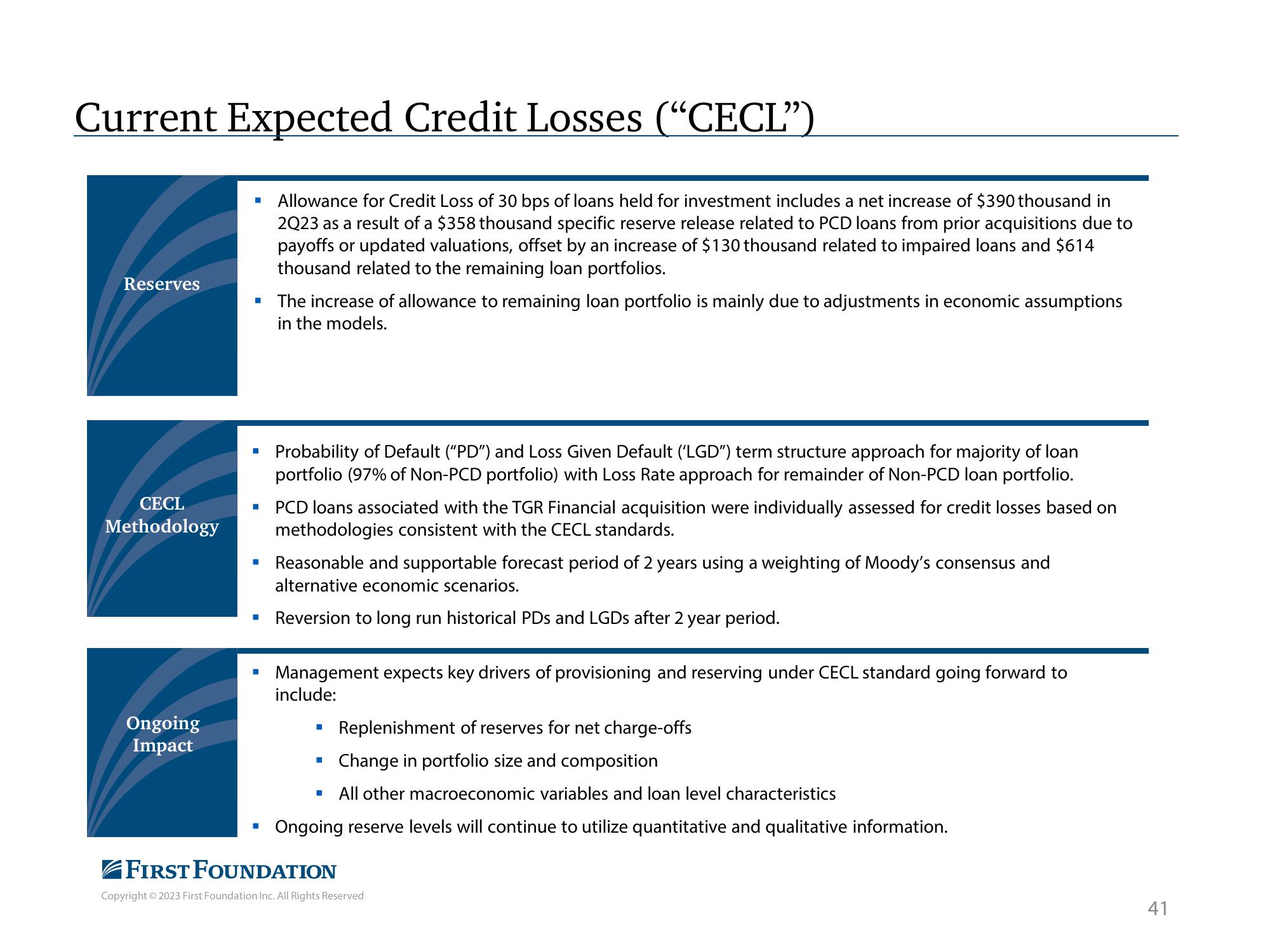

Current Expected Credit Losses (“CECL”)

Reserves

CECL

Methodology

Ongoing

Impact

■

▪ The increase of allowance to remaining loan portfolio is mainly due to adjustments in economic assumptions

in the models.

H

-

H

I

M

Allowance for Credit Loss of 30 bps of loans held for investment includes a net increase of $390 thousand in

2Q23 as a result of a $358 thousand specific reserve release related to PCD loans from prior acquisitions due to

payoffs or updated valuations, offset by an increase of $130 thousand related to impaired loans and $614

thousand related to the remaining loan portfolios.

H

Probability of Default ("PD") and Loss Given Default ('LGD") term structure approach for majority of loan

portfolio (97% of Non-PCD portfolio) with Loss Rate approach for remainder of Non-PCD loan portfolio.

PCD loans associated with the TGR Financial acquisition were individually assessed for credit losses based on

methodologies consistent with the CECL standards.

Reasonable and supportable forecast period of 2 years using a weighting of Moody's consensus and

alternative economic scenarios.

Reversion to long run historical PDs and LGDs after 2 year period.

Management expects key drivers of provisioning and reserving under CECL standard going forward to

include:

Replenishment of reserves for net charge-offs

Change in portfolio size and composition

All other macroeconomic variables and loan level characteristics

Ongoing reserve levels will continue to utilize quantitative and qualitative information.

■

■

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

41View entire presentation