Q2 2018 Fixed Income Investor Conference Call

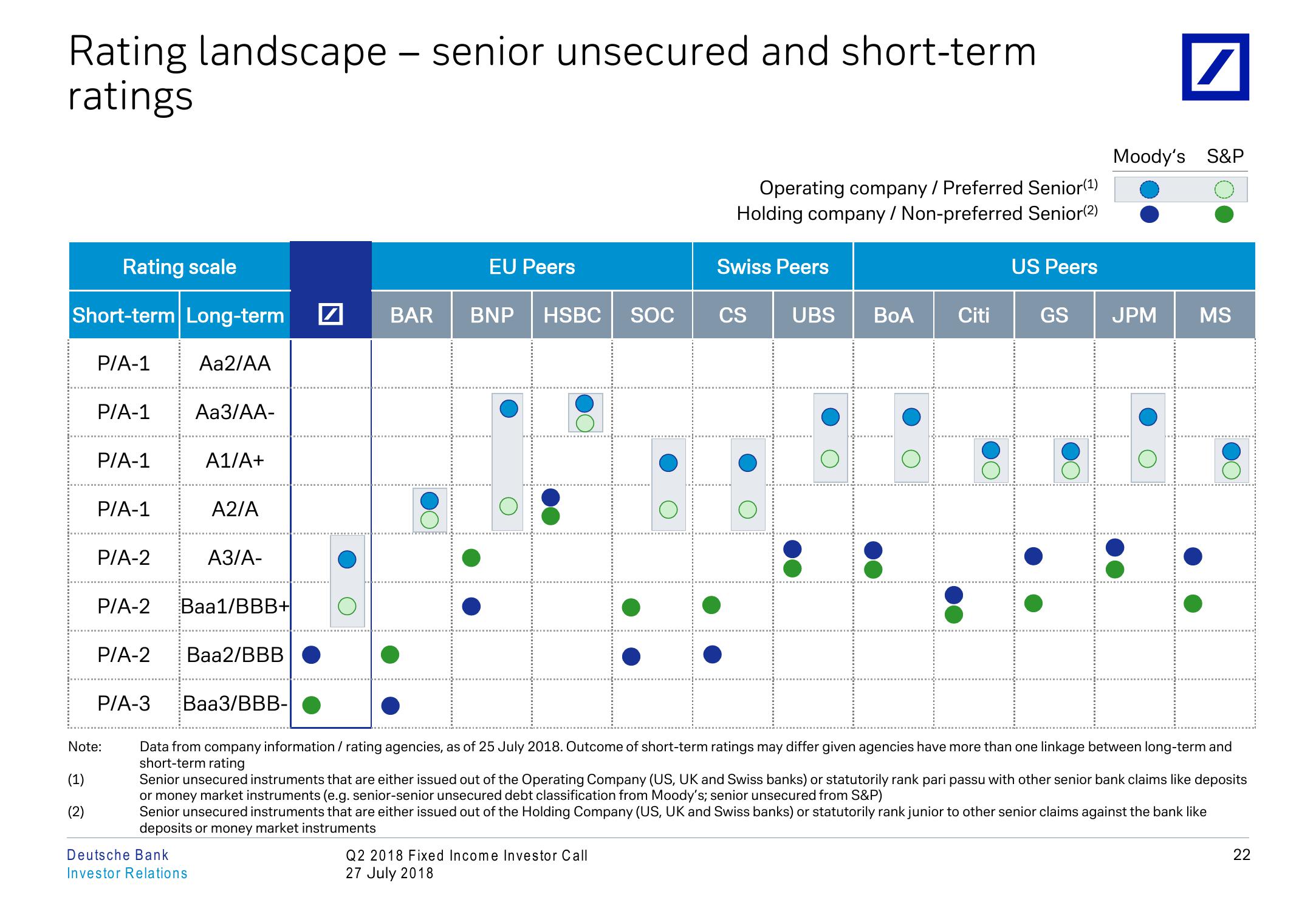

Rating landscape - senior unsecured and short-term

ratings

☑

Operating company / Preferred Senior (1)

Holding company / Non-preferred Senior(2)

Moody's S&P

Rating scale

EU Peers

Swiss Peers

US Peers

Short-term Long-term

BAR BNP HSBC SOC

CS

UBS

BoA

Citi

GS

JPM

MS

P/A-1

Aa2/AA

P/A-1

Aa3/AA-

P/A-1

A1/A+

O

P/A-1

A2/A

O

O

P/A-2

A3/A-

P/A-2

Baa1/BBB+

P/A-2

Baa2/BBB

P/A-3

Note:

(1)

(2)

Baa3/BBB-

Data from company information / rating agencies, as of 25 July 2018. Outcome of short-term ratings may differ given agencies have more than one linkage between long-term and

short-term rating

Senior unsecured instruments that are either issued out of the Operating Company (US, UK and Swiss banks) or statutorily rank pari passu with other senior bank claims like deposits

or money market instruments (e.g. senior-senior unsecured debt classification from Moody's; senior unsecured from S&P)

Senior unsecured instruments that are either issued out of the Holding Company (US, UK and Swiss banks) or statutorily rank junior to other senior claims against the bank like

deposits or money market instruments

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

22

22View entire presentation