Snap Inc Results Presentation Deck

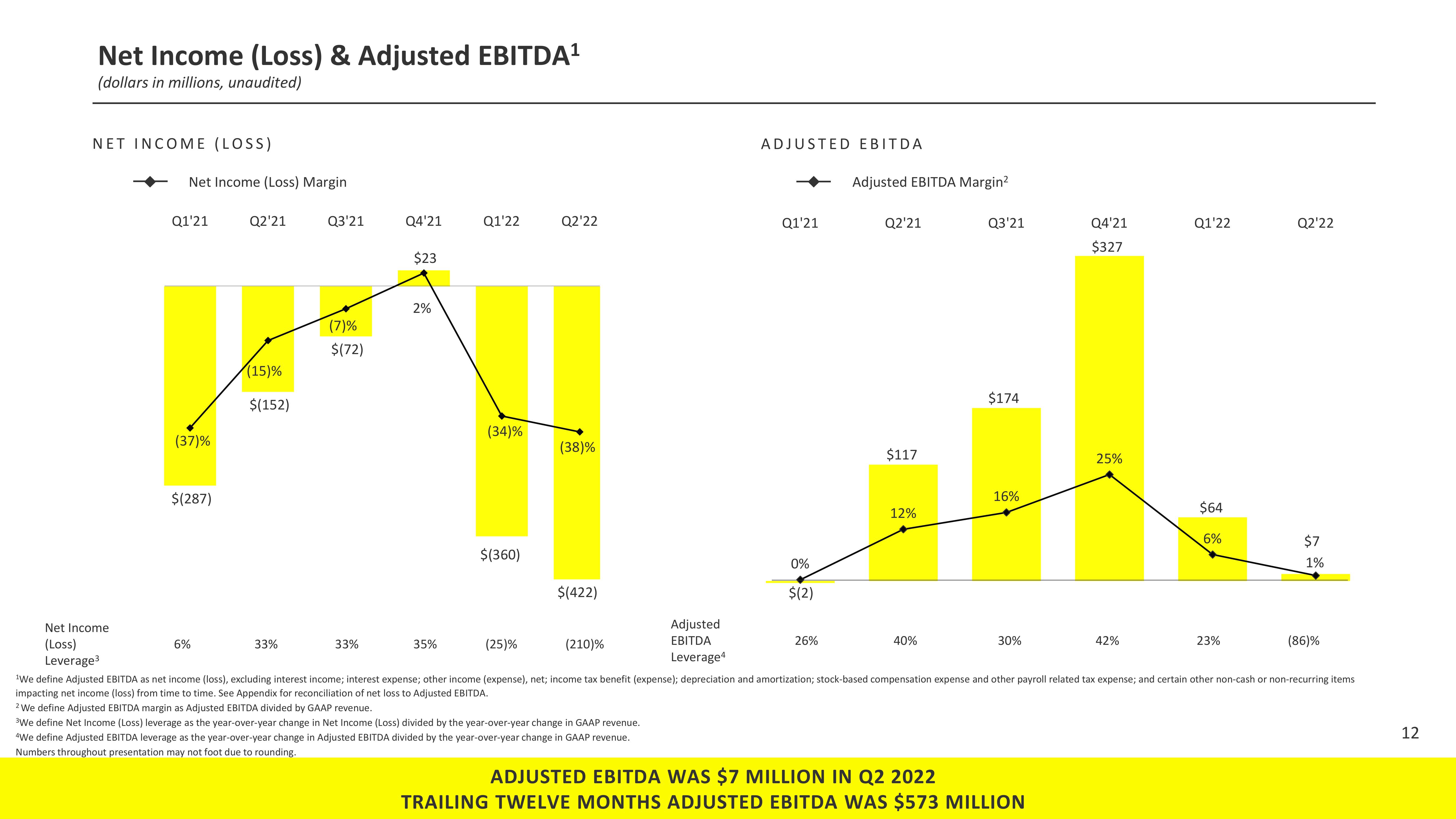

Net Income (Loss) & Adjusted EBITDA¹

(dollars in millions, unaudited)

NET INCOME (LOSS)

Net Income (Loss) Margin

Q1'21

(37)%

$(287)

Q2'21

6%

(15)%

$(152)

Q3'21

33%

(7)%

$(72)

Q4'21

33%

$23

2%

Q1'22

35%

(34)%

$(360)

Q2'22

(25)%

(38)%

$(422)

Adjusted

EBITDA

Leverage4

(210)%

ADJUSTED EBITDA

Q1'21

0%

$(2)

Adjusted EBITDA Margin²

26%

Q2'21

$117

12%

Q3'21

40%

$174

16%

Net Income

(Loss)

Leverage³

¹We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense and other payroll related tax expense; and certain other non-cash or non-recurring items

impacting net income (loss) from time to time. See Appendix for reconciliation of net loss to Adjusted EBITDA.

2 We define Adjusted EBITDA margin as Adjusted EBITDA divided by GAAP revenue.

³We define Net Income (Loss) leverage as the year-over-year change in Net Income (Loss) divided by the year-over-year change in GAAP revenue.

4We define Adjusted EBITDA leverage as the year-over-year change in Adjusted EBITDA divided by the year-over-year change in GAAP revenue.

Numbers throughout presentation may not foot due to rounding.

30%

Q4'21

$327

ADJUSTED EBITDA WAS $7 MILLION IN Q2 2022

TRAILING TWELVE MONTHS ADJUSTED EBITDA WAS $573 MILLION

25%

Q1'22

42%

$64

6%

Q2'22

23%

$7

1%

(86)%

12View entire presentation