Credit Suisse Investor Event Presentation Deck

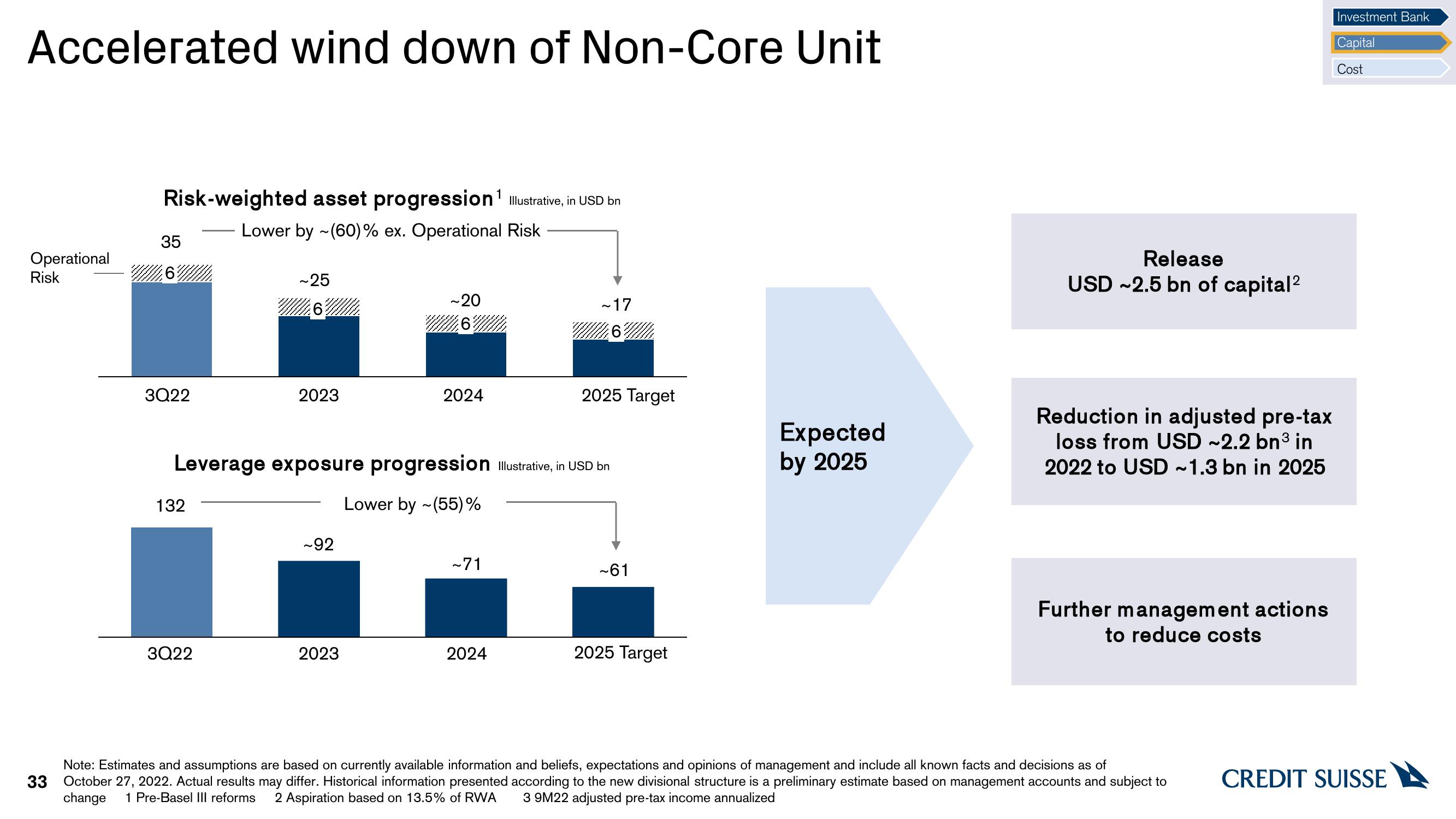

Accelerated wind down of Non-Core Unit

Operational

Risk

Risk-weighted asset progression ¹ Illustrative, in USD bn

1

Lower by ~(60)% ex. Operational Risk

35

6

3Q22

132

~25

6

3Q22

2023

~92

~20

6

Leverage exposure progression Illustrative, in USD bn

Lower by ~(55) %

2023

2024

~71

~17

2024

2025 Target

~61

2025 Target

Expected

by 2025

Release

USD ~2.5 bn of capital²

Reduction in adjusted pre-tax

loss from USD ~2.2 bn³ in

2022 to USD ~1.3 bn in 2025

Further management actions

to reduce costs

Note: Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of management and include all known facts and decisions as of

33 October 27, 2022. Actual results may differ. Historical information presented according to the new divisional structure is a preliminary estimate based on management accounts and subject to

change 1 Pre-Basel III reforms 2 Aspiration based on 13.5% of RWA 3 9M22 adjusted pre-tax income annualized

Investment Bank

Capital

Cost

CREDIT SUISSEView entire presentation