Melrose Investor Conference Presentation Deck

Melrose key financial numbers: GKN & Nortek both highly cash generative (continued)

Melrose

4. Strong cash generation since the GKN acquisition from all businesses (continued)

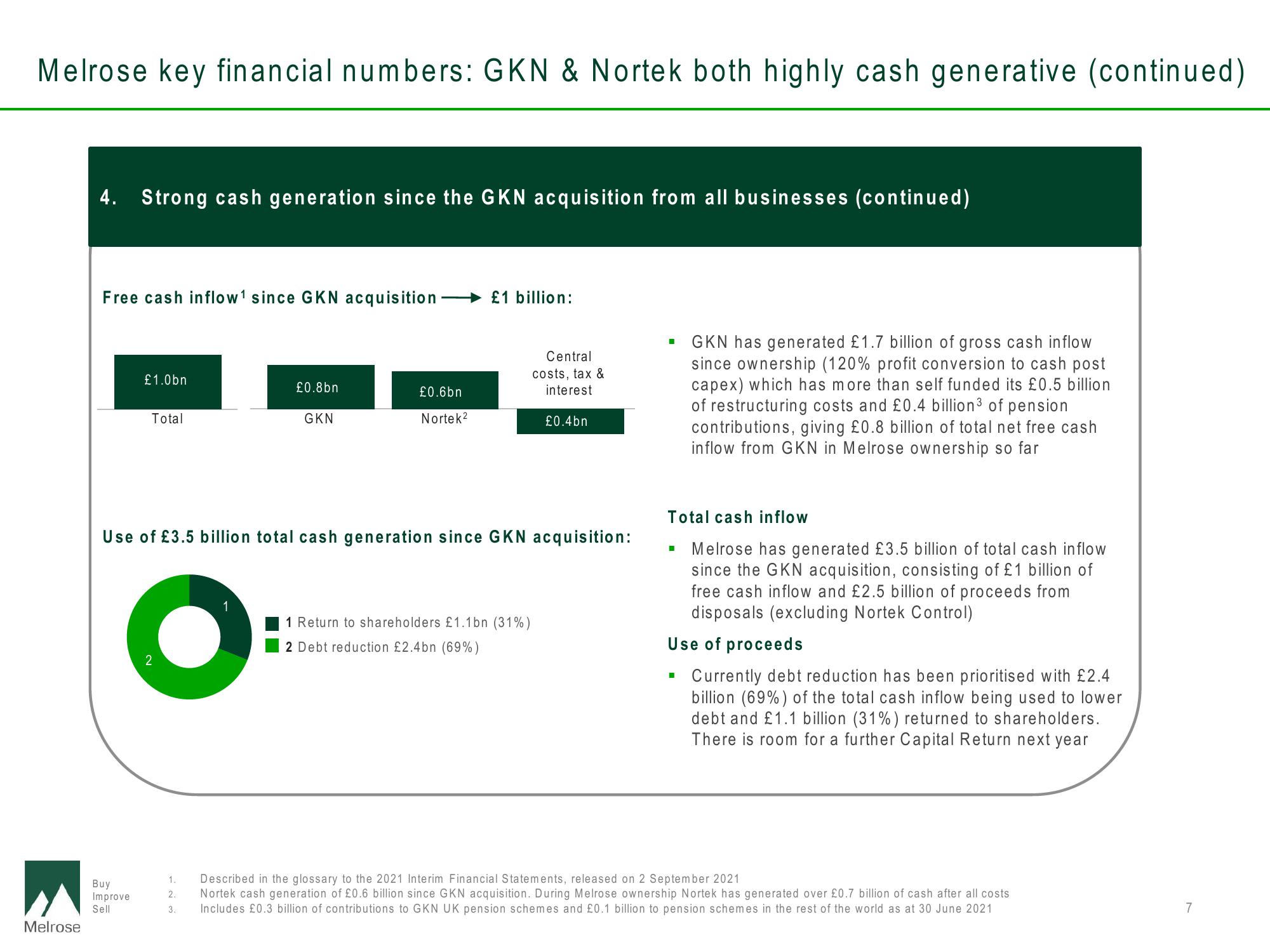

Free cash inflow¹ since GKN acquisition

£1.0bn

Buy

Improve

Sell

Total

1.

2.

3.

£0.8bn

1

GKN

£0.6bn

Nortek²

Use of £3.5 billion total cash generation since GKN acquisition:

£1 billion:

Central

costs, tax &

interest

£0.4bn

1 Return to shareholders £1.1bn (31%)

2 Debt reduction £2.4bn (69%)

GKN has generated £1.7 billion of gross cash inflow

since ownership (120% profit conversion to cash post

capex) which has more than self funded its £0.5 billion

of restructuring costs and £0.4 billion³ of pension

contributions, giving £0.8 billion of total net free cash

inflow from GKN in Melrose ownership so far

Total cash inflow

Melrose has generated £3.5 billion of total cash inflow

since the GKN acquisition, consisting of £1 billion of

free cash inflow and £2.5 billion of proceeds from

disposals (excluding Nortek Control)

Use of proceeds

■

Currently debt reduction has been prioritised with £2.4

billion (69%) of the total cash inflow being used to lower

debt and £1.1 billion (31%) returned to shareholders.

There is room for a further Capital Return next year

Described in the glossary to the 2021 Interim Financial Statements, released on 2 September 2021

Nortek cash generation of £0.6 billion since GKN acquisition. During Melrose ownership Nortek has generated over £0.7 billion of cash after all costs

Includes £0.3 billion of contributions to GKN UK pension schemes and £0.1 billion to pension schemes in the rest of the world as at 30 June 2021

7View entire presentation