Aptiv Overview

Offering Summary

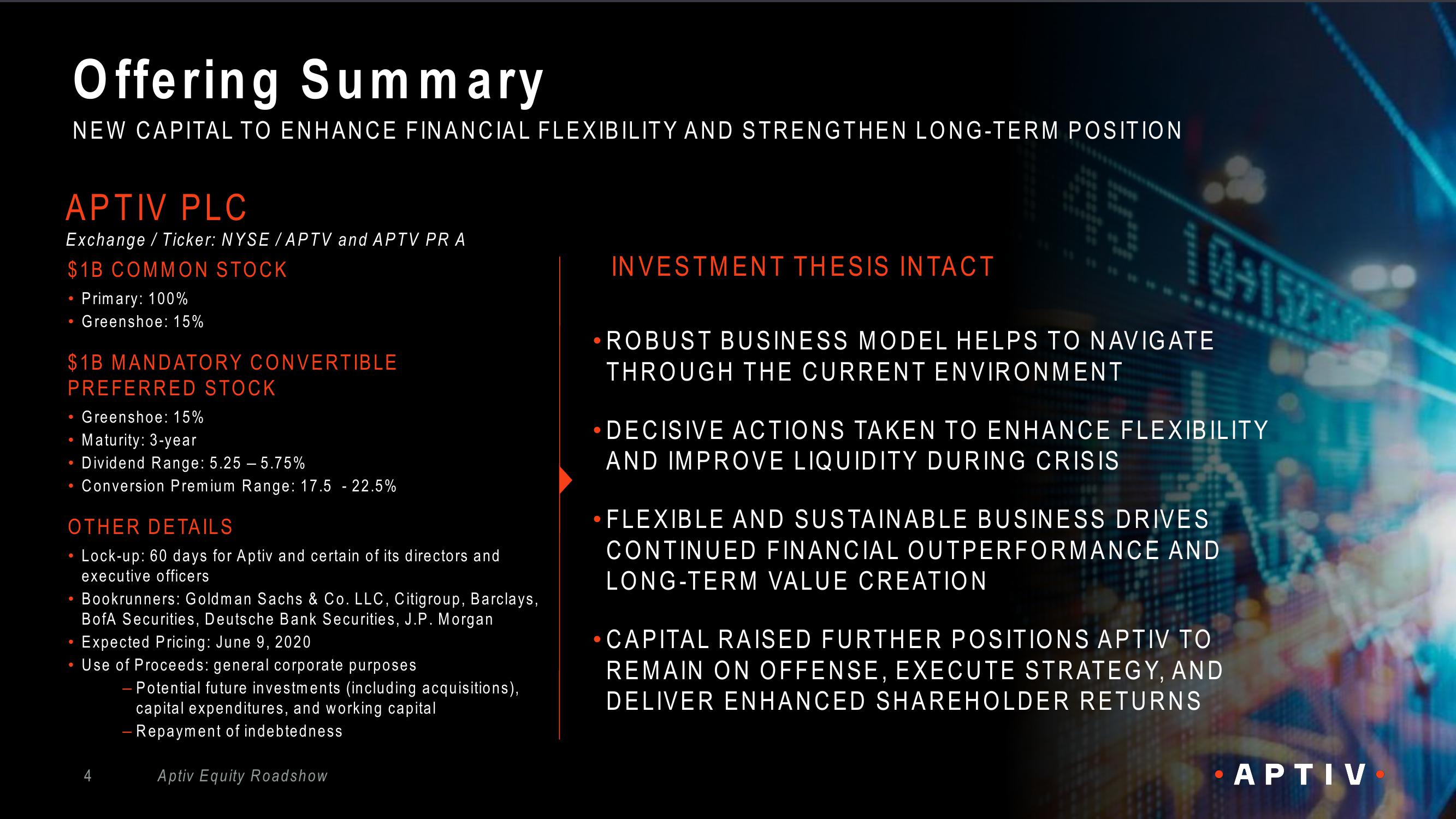

NEW CAPITAL TO ENHANCE FINANCIAL FLEXIBILITY AND STRENGTHEN LONG-TERM POSITION

APTIV PLC

Exchange / Ticker: NYSE / APTV and APTV PRA

$1B COMMON STOCK

Primary: 100%

Greenshoe: 15%

$1B MANDATORY CONVERTIBLE

PREFERRED STOCK

Greenshoe: 15%

Maturity: 3-year

• Dividend Range: 5.25 -5.75%

• Conversion Premium Range: 17.5 - 22.5%

OTHER DETAILS

Lock-up: 60 days for Aptiv and certain of its directors and

executive officers

• Bookrunners: Goldman Sachs & Co. LLC, Citigroup, Barclays,

BofA Securities, Deutsche Bank Securities, J.P. Morgan

Expected Pricing: June 9, 2020

Use of Proceeds: general corporate purposes

4

- Potential future investments (including acquisitions),

capital expenditures, and working capital

- Repayment of indebtedness

Aptiv Equity Roadshow

●

●

INVESTMENT THESIS INTACT

ROBUST BUSINESS MODEL HELPS TO NAVIGATE

THROUGH THE CURRENT ENVIRONMENT

DECISIVE ACTIONS TAKEN TO ENHANCE FLEXIBILITY

AND IMPROVE LIQUIDITY DURING CRISIS

FLEXIBLE AND SUSTAINABLE BUSINESS DRIVES

CONTINUED FINANCIAL OUTPERFORMANCE AND

LONG-TERM VALUE CREATION

CAPITAL RAISED FURTHER POSITIONS APTIV TO

REMAIN ON OFFENSE, EXECUTE STRATEGY, AND

DELIVER ENHANCED SHAREHOLDER RETURNS

APTIVView entire presentation