SPAC Presentation

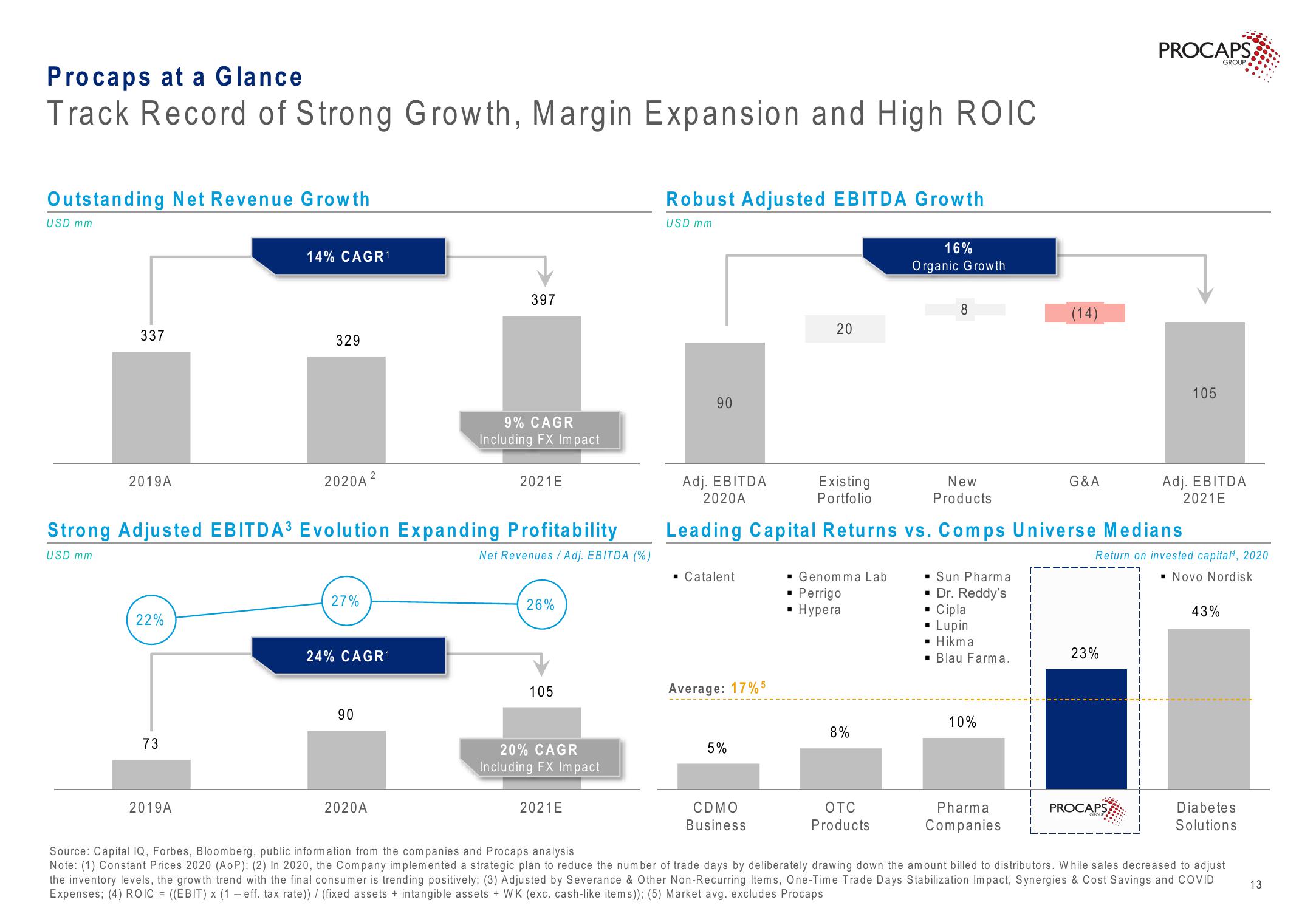

Procaps at a Glance

Track Record of Strong Growth, Margin Expansion and High ROIC

Outstanding Net Revenue Growth

USD mm

337

2019A

22%

73

14% CAGR¹

2019A

329

2020A

Strong Adjusted EBITDA³ Evolution Expanding Profitability

USD mm

Net Revenues / Adj. EBITDA (%)

27%

2

24% CAGR ¹

90

2020A

397

9% CAGR

Including FX Impact

2021E

26%

105

20% CAGR

Including FX Impact

2021E

Robust Adjusted EBITDA Growth

USD mm

90

Adj. EBITDA

2020A

▪ Catalent

Average: 17% 5

5%

CDMO

Business

I

20

■

Existing

Portfolio

Leading Capital Returns vs. Comps Universe Medians

Genomma Lab

Perrigo

Hypera

8%

16%

Organic Growth

OTC

Products

8

New

Products

▪ Sun Pharma

▪ Dr. Reddy's

I

■

Cipla

Lupin

▪ Hikma

Blau Farma.

10%

(14)

Pharma

Companies

G&A

PROCAPS

23%

PROCAPS,

105

Adj. EBITDA

2021E

GROUP

Return on invested capital, 2020

▪ Novo Nordisk

43%

Diabetes

Solutions

*

Source: Capital IQ, Forbes, Bloomberg, public information from the companies and Procaps analysis

Note: (1) Constant Prices 2020 (AOP); (2) In 2020, the Company implemented a strategic plan to reduce the number of trade days by deliberately drawing down the amount billed to distributors. While sales decreased to adjust

the inventory levels, the growth trend with the final consumer is trending positively; (3) Adjusted by Severance & Other Non-Recurring Items, One-Time Trade Days Stabilization Impact, Synergies & Cost Savings and COVID

Expenses; (4) ROIC = ((EBIT) x (1 - eff. tax rate)) / (fixed assets + intangible assets + WK (exc. cash-like items)); (5) Market avg. excludes Procaps

13View entire presentation