Commercial Metals Company Results Presentation Deck

Well-Positioned to Benefit From Near-Term and Structural Trends

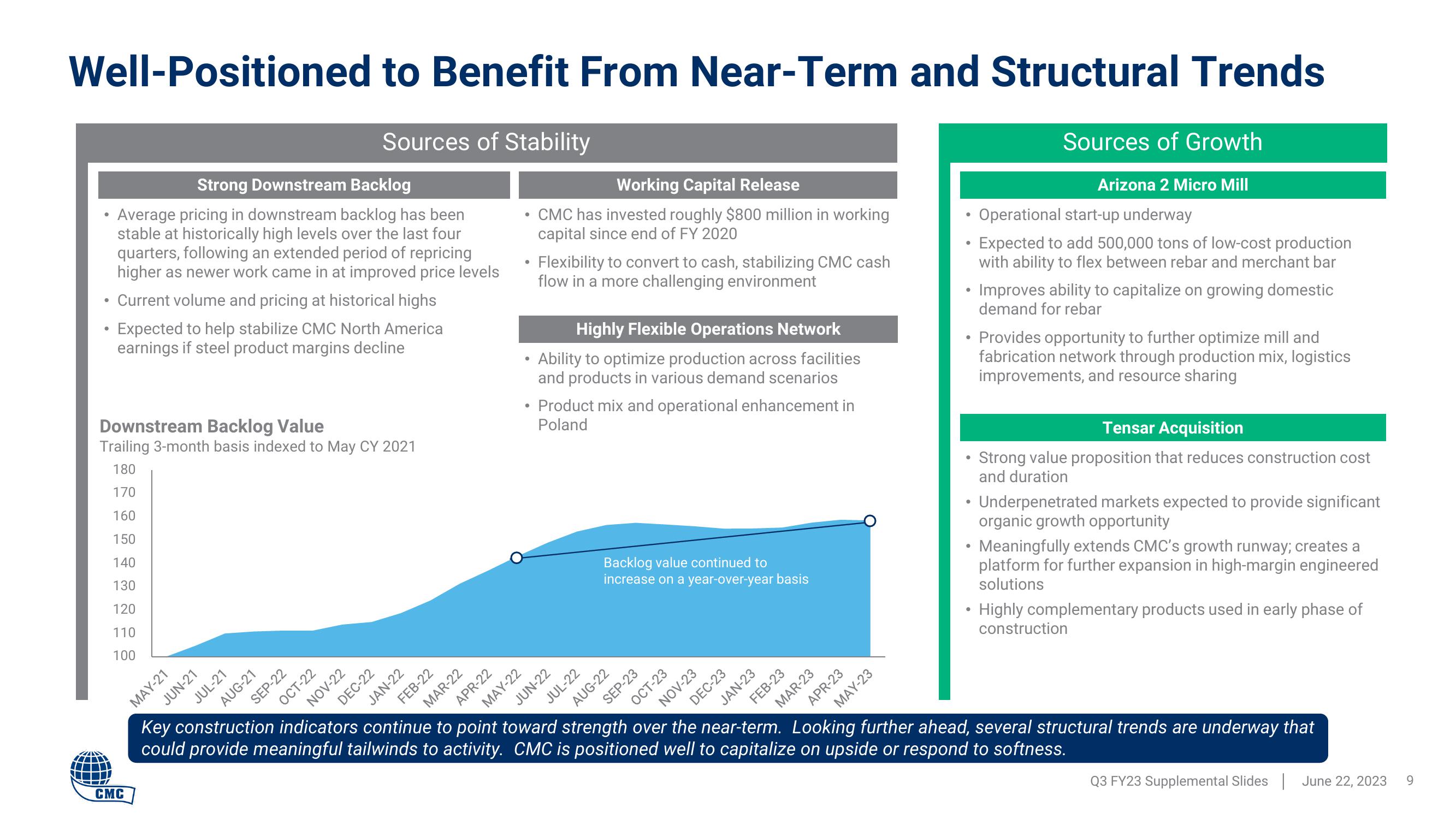

Sources of Stability

●

●

Strong Downstream Backlog

Average pricing in downstream backlog has been

stable at historically high levels over the last four

quarters, following an extended period of repricing

higher as newer work came in at improved price levels

Current volume and pricing at historical highs

Expected to help stabilize CMC North America

earnings if steel product margins decline

Downstream Backlog Value

Trailing 3-month basis indexed to May CY 2021

180

170

160

150

140

130

120

110

100

CMC

MAY-21

JUN-21

JUL-21

AUG-21

SEP-22

OCT-22

DEC-22

NOV-22

JAN-22

FEB-22

APR-22

MAR-22

●

●

• Flexibility to convert to cash, stabilizing CMC cash

flow in a more challenging environment

●

Working Capital Release

CMC has invested roughly $800 million in working

capital since end of FY 2020

●

Highly Flexible Operations Network

Ability to optimize production across facilities

and products in various demand scenarios

Product mix and operational enhancement in

Poland

MAY-22

JUN-22

JUL-22

Backlog value continued to

increase on a year-over-year basis

AUG-22

SEP-23

OCT-23

NOV-23

DEC-23

JAN-23

FEB-23

MAR-23

APR-23

MAY-23

●

●

●

●

●

Sources of Growth

Arizona 2 Micro Mill

Operational start-up underway

Expected to add 500,000 tons of low-cost production

with ability to flex between rebar and merchant bar

Improves ability to capitalize on growing domestic

demand for rebar

Provides opportunity to further optimize mill and

fabrication network through production mix, logistics

improvements, and resource sharing

Tensar Acquisition

Strong value proposition that reduces construction cost

and duration

Underpenetrated markets expected to provide significant

organic growth opportunity

Meaningfully extends CMC's growth runway; creates a

platform for further expansion in high-margin engineered

solutions

• Highly complementary products used in early phase of

construction

Key construction indicators continue to point toward strength over the near-term. Looking further ahead, several structural trends are underway that

could provide meaningful tailwinds to activity. CMC is positioned well to capitalize on upside or respond to softness.

Q3 FY23 Supplemental Slides June 22, 2023

9View entire presentation