Enact IPO Presentation Deck

Enact | Investor Presentation

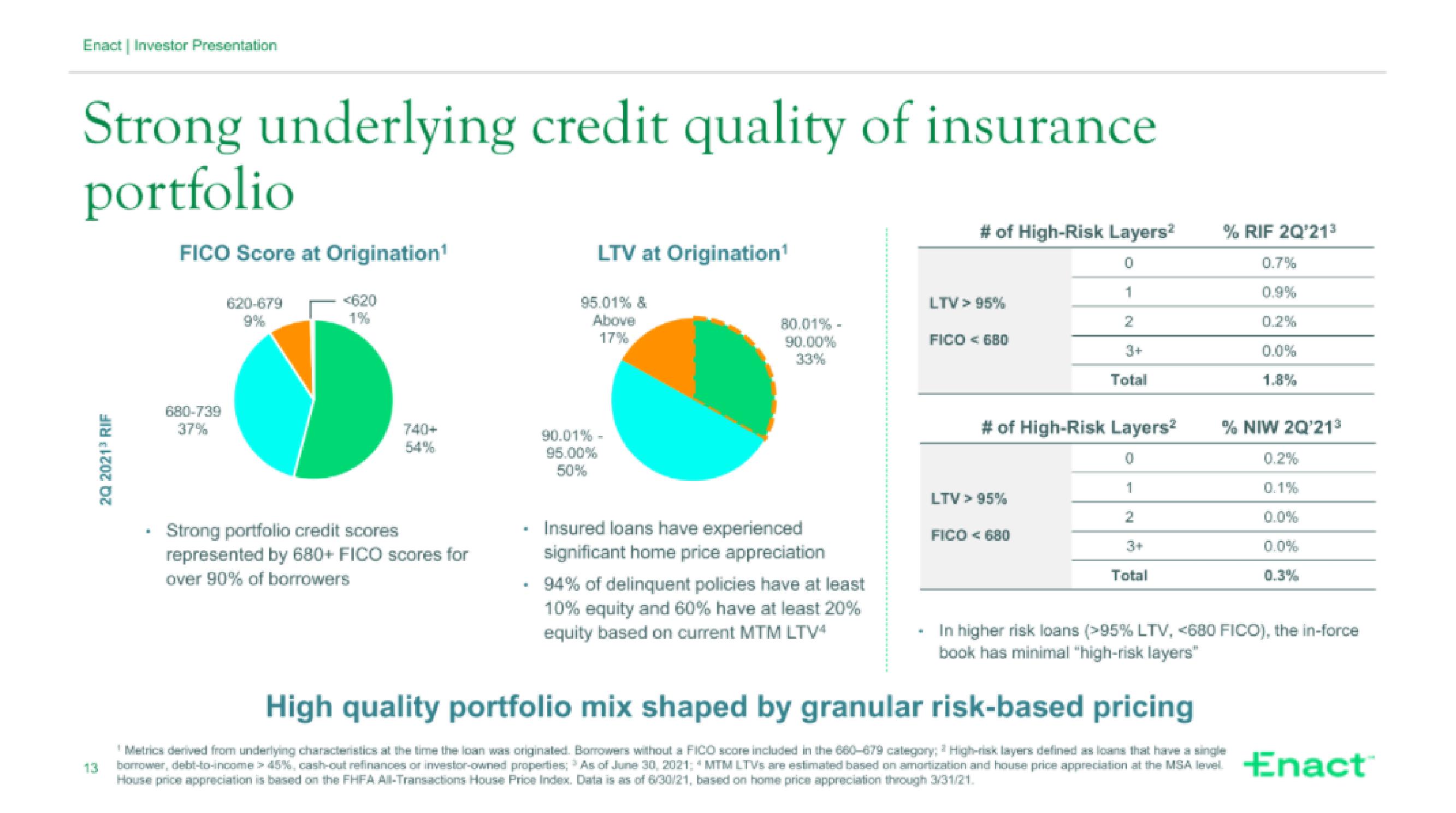

Strong underlying credit quality of insurance

portfolio

13

20 2021³ RIF

■

FICO Score at Origination¹

680-739

37%

620-679

<620

1%

740+

54%

Strong portfolio credit scores

represented by 680+ FICO scores for

over 90% of borrowers

LTV at Origination¹

95.01% &

Above

17%

90.01% -

95.00%

50%

80.01% -

90.00%

Insured loans have experienced

significant home price appreciation

94% of delinquent policies have at least

10% equity and 60% have at least 20%

equity based on current MTM LTV4

# of High-Risk Layers²

LTV > 95%

FICO < 680

LTV > 95%

1

# of High-Risk Layers²

0

1

FICO < 680

3+

Total

3+

Total

% RIF 2Q'21³

0.7%

0.9%

0.2%

0.0%

1.8%

% NIW 2Q'21³

0.1%

0.0%

0.0%

0.3%

In higher risk loans (>95% LTV, <680 FICO), the in-force

book has minimal "high-risk layers"

High quality portfolio mix shaped by granular risk-based pricing

Metrics derived from underlying characteristics at the time the loan was originated. Borrowers without a FICO score included in the 660-679 category: High-risk layers defined as loans that have a single

borrower, debt-to-Income> 45%, cash-out refinances or investor-owned properties; As of June 30, 2021; * MTM LTV's are estimated based on amortization and house price appreciation at the MSA level. Enact™

House price appreciation is based on the FHFA All-Transactions House Price Index. Data is as of 6/30/21, based on home price appreciation through 3/31/21.View entire presentation