Kinnevik Results Presentation Deck

UNDER CERTAIN CIRCUMSTANCES WE REFLECT PRIVATE MARKET INERTIA RELATIVE

TO PUBLIC MARKETS BY MUTING UPWARDS AND DOWNWARDS PEER MOVEMENTS

■

H

■

I

We seek to reflect the development of public markets, all the while

being mindful of the fact that investors take different approaches to

valuing more established publicly listed businesses relative to high-

growth private businesses

■

■

Peer Sets

Premiums & Discounts

■

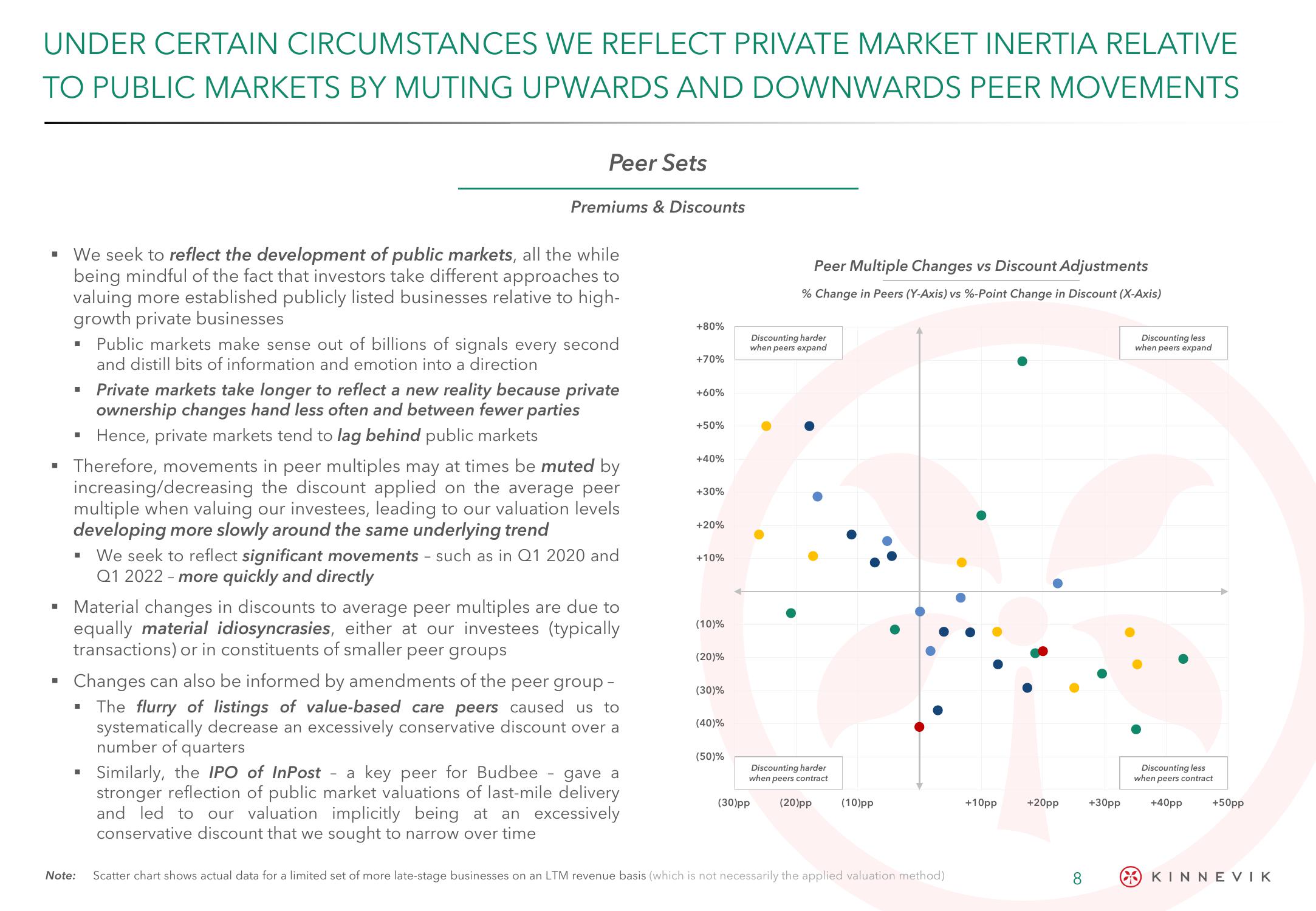

Therefore, movements in peer multiples may at times be muted by

increasing/decreasing the discount applied on the average peer

multiple when valuing our investees, leading to our valuation levels

developing more slowly around the underlying trend

■

Public markets make sense out of billions of signals every second

and distill bits of information and emotion into a direction

Note:

Private markets take longer to reflect a new reality because private

ownership changes hand less often and between fewer parties

Hence, private markets tend to lag behind public markets

Material changes in discounts to average peer multiples are due to

equally material idiosyncrasies, either at our investees (typically

transactions) or in constituents of smaller peer groups

Changes can also be informed by amendments of the peer group -

The flurry of listings of value-based care peers caused us to

systematically decrease an excessively conservative discount over a

number of quarters

We seek to reflect significant movements such as in Q1 2020 and

Q1 2022 - more quickly and directly

Similarly, the IPO of InPost a key peer for Budbee gave a

stronger reflection of public market valuations of last-mile delivery

and led to our valuation implicitly being at an excessively

conservative discount that we sought to narrow over time

+80%

+70%

+60%

+50%

+40%

+30%

+20%

+10%

(10)%

(20)%

(30)%

(40)%

(50)%

Peer Multiple Changes vs Discount Adjustments

% Change in Peers (Y-Axis) vs %-Point Change in Discount (X-Axis)

Discounting harder

when peers expand

Discounting harder

when peers contract

(30)pp

(20)pp (10)pp

Scatter chart shows actual data for a limited set of more late-stage businesses on an LTM revenue basis (which is not necessarily the applied valuation method)

+10pp

+20pp

8

+30pp

Discounting less

when peers expand

Discounting less

when peers contract

+40pp

+50pp

KINNEVIKView entire presentation