Invitation Homes Investor Presentation Deck

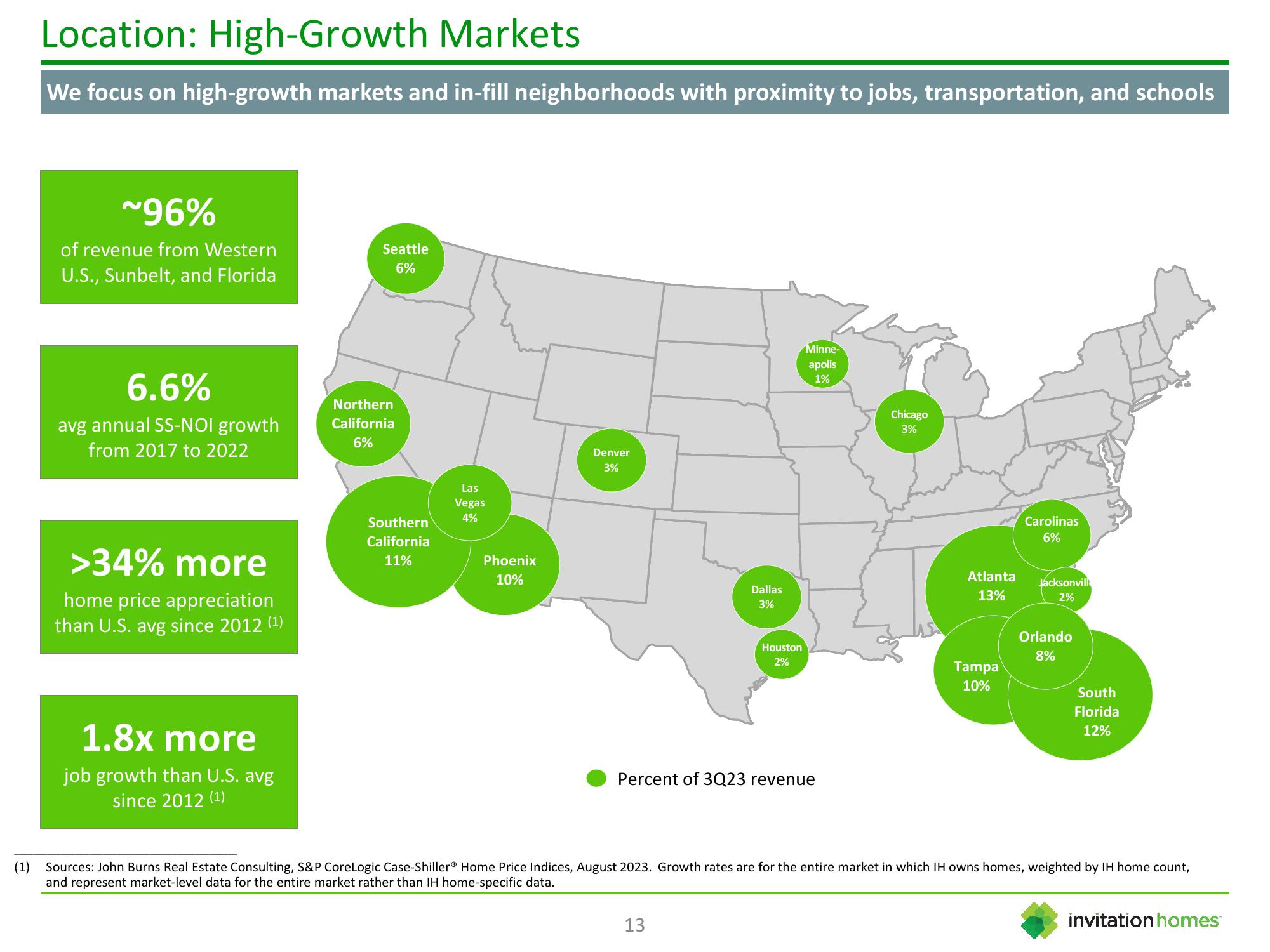

Location: High-Growth Markets

We focus on high-growth markets and in-fill neighborhoods with proximity to jobs, transportation, and schools

~96%

of revenue from Western

U.S., Sunbelt, and Florida

6.6%

avg annual SS-NOI growth

from 2017 to 2022

>34% more

home price appreciation

than U.S. avg since 2012 (¹)

1.8x more

job growth than U.S. avg

since 2012 (1)

Seattle

6%

Northern

California

6%

Southern

California

11%

Las

Vegas

4%

Phoenix

10%

Denver

3%

Dallas

3%

Houston

2%

13

Minne-

apolis

1%

Percent of 3Q23 revenue

Chicago

3%

Atlanta

13%

Tampa

10%

Carolinas

6%

Jacksonvill

2%

Orlando

8%

South

Florida

12%

(1) Sources: John Burns Real Estate Consulting, S&P CoreLogic Case-Shiller® Home Price Indices, August 2023. Growth rates are for the entire market in which IH owns homes, weighted by IH home count,

and represent market-level data for the entire market rather than IH home-specific data.

invitation homesView entire presentation