Hydrofarm IPO Presentation Deck

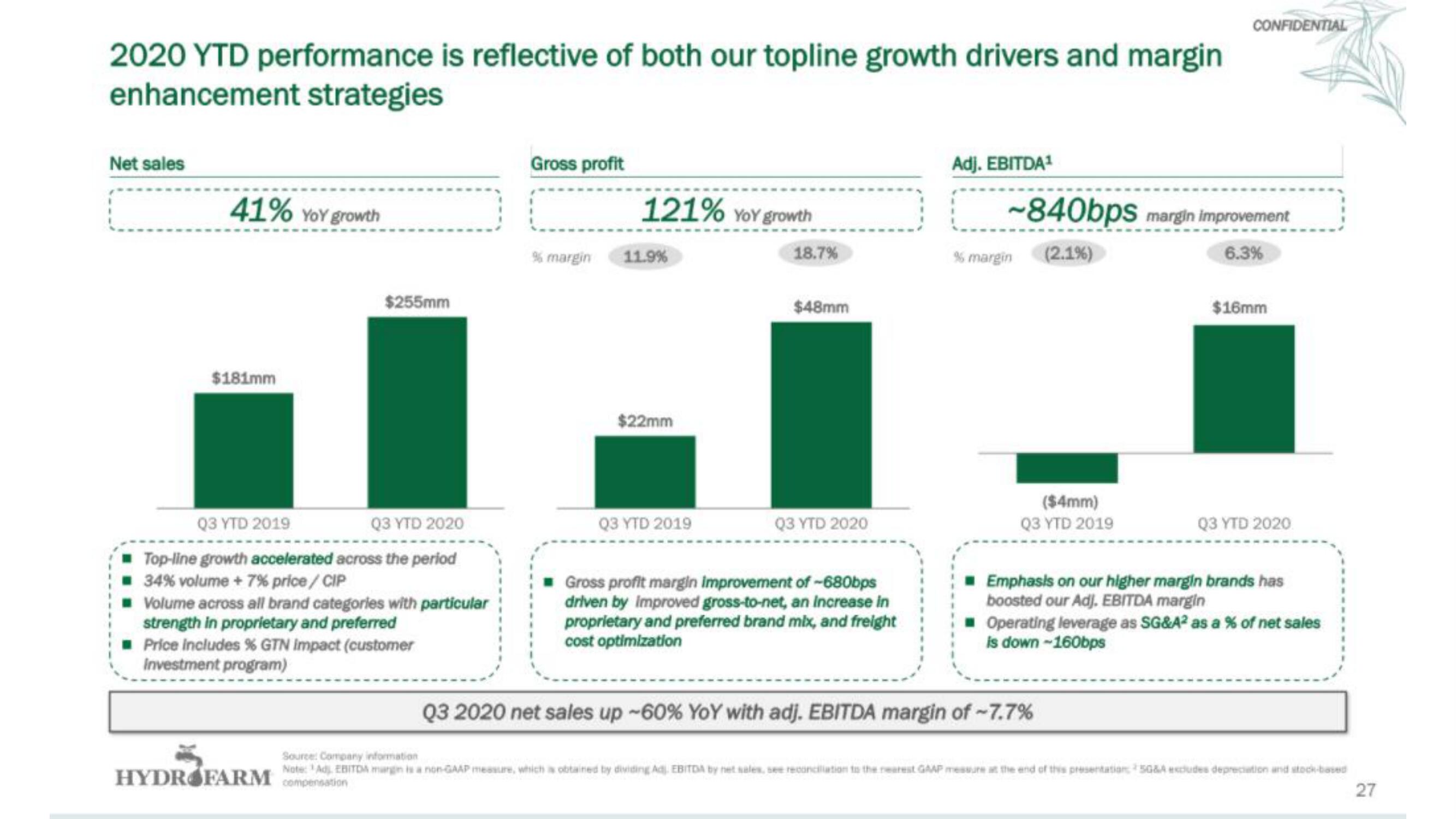

2020 YTD performance is reflective of both our topline growth drivers and margin

enhancement strategies

Net sales

41% YoY growth

$181mm

$255mm

Q3 YTD 2019

Q3 YTD 2020

Top-line growth accelerated across the period

34% volume + 7% price/CIP

Volume across all brand categories with particular

strength in proprietary and preferred

Price includes % GTN Impact (customer

Investment program)

HYDROFARM compensation

Gross profit

% margin

121% YoY growth

11.9%

$22mm

Q3 YTD 2019

18.7%

$48mm

Q3 YTD 2020

Gross profit margin improvement of -680bps

driven by improved gross-to-net, an increase in

proprietary and preferred brand mix, and freight

cost optimization

Adj. EBITDA¹

~840bps margin improvement

(2.1%)

6.3%

% margin

($4mm)

Q3 YTD 2019

CONFIDENTIAL

Q3 2020 net sales up -60% YoY with adj. EBITDA margin of -7.7%

$16mm

Q3 YTD 2020

Emphasis on our higher margin brands has

boosted our Adj. EBITDA margin

Operating leverage as SG&A² as a % of net sales

is down-160bps

Source: Company information

Note: Adj. EBITDA margin is a non-GAAP messure, which is obtained by dividing Adj. EBITDA by net sales, see reconciliation to the rearest GAAP messure at the end of this presentation: 50&A excludes depreciation and stock-based

27View entire presentation