Inovalon Results Presentation Deck

Covenant-Lite Debt Leverage

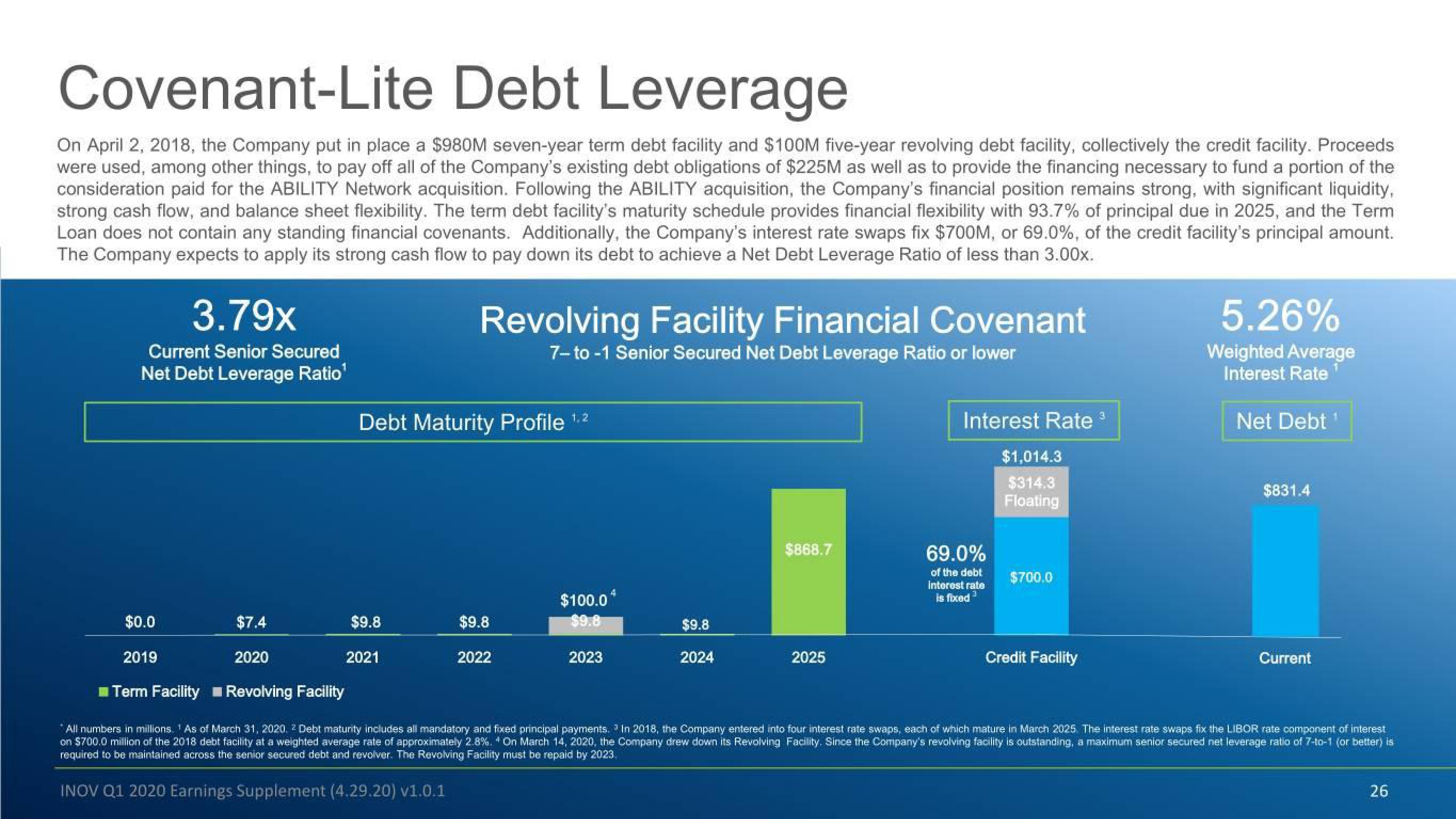

On April 2, 2018, the Company put in place a $980M seven-year term debt facility and $100M five-year revolving debt facility, collectively the credit facility. Proceeds

were used, among other things, to pay off all of the Company's existing debt obligations of $225M as well as to provide the financing necessary to fund a portion of the

consideration paid for the ABILITY Network acquisition. Following the ABILITY acquisition, the Company's financial position remains strong, with significant liquidity,

strong cash flow, and balance sheet flexibility. The term debt facility's maturity schedule provides financial flexibility with 93.7% of principal due in 2025, and the Term

Loan does not contain any standing financial covenants. Additionally, the Company's interest rate swaps fix $700M, or 69.0%, of the credit facility's principal amount.

The Company expects to apply its strong cash flow to pay down its debt to achieve a Net Debt Leverage Ratio of less than 3.00x.

3.79x

Current Senior Secured

Net Debt Leverage Ratio¹

$0.0

2019

Revolving Facility Financial Covenant

7-to-1 Senior Secured Net Debt Leverage Ratio or lower

Debt Maturity Profile ¹.²

$9.8

2021

$9.8

$100.0

2022

2023

$9.8

$868.7

2024

$7.4

2020

Revolving Facility

Term Facility

3

*All numbers in millions. As of March 31, 2020, ² Debt maturity includes all mandatory and fixed principal payments. In 2018, the Company entered into four interest rate swaps, each of which mature in March 2025. The interest rate swaps fix the LIBOR rate component of interest

on $700.0 million of the 2018 debt facility at a weighted average rate of approximately 2.8%. * On March 14, 2020, the Company drew down its Revolving Facility. Since the Company's revolving facility is outstanding, a maximum senior secured net leverage ratio of 7-to-1 (or better) is

required to be maintained across the senior secured debt and revolver. The Revolving Facility must be repaid by 2023

INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1

Interest Rate ³

2025

69.0%

of the debt

Interest rate

is fixed ³

$1,014.3

$314.3

Floating

$700.0

5.26%

Weighted Average

Interest Rate

Credit Facility

Net Debt

$831.4

Current

26View entire presentation