TPG Results Presentation Deck

AUM Subject to Fee Earning Growth

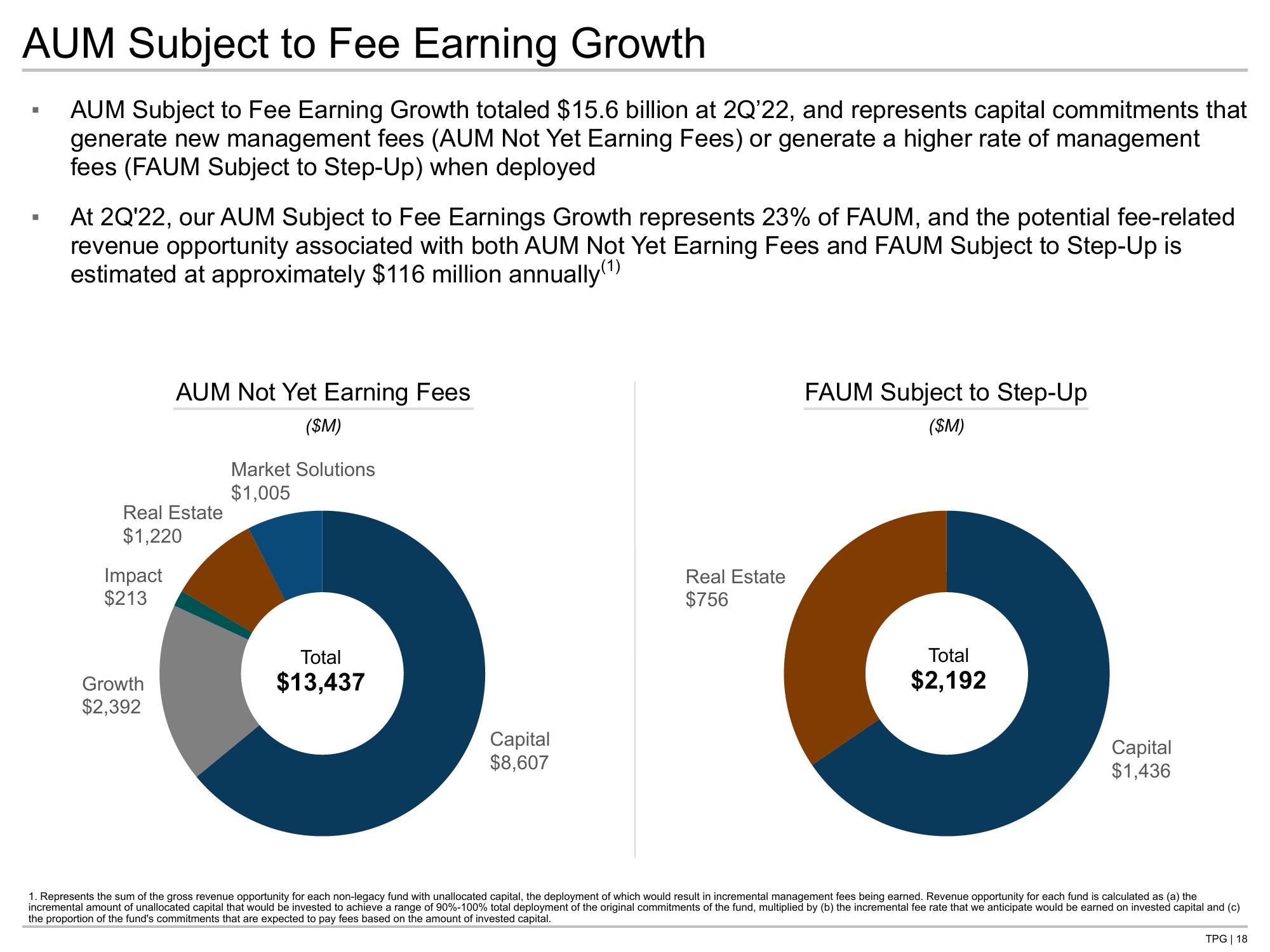

AUM Subject to Fee Earning Growth totaled $15.6 billion at 2Q'22, and represents capital commitments that

generate new management fees (AUM Not Yet Earning Fees) or generate a higher rate of management

fees (FAUM Subject to Step-Up) when deployed

H

■

At 2Q'22, our AUM Subject to Fee Earnings Growth represents 23% of FAUM, and the potential fee-related

revenue opportunity associated with both AUM Not Yet Earning Fees and FAUM Subject to Step-Up is

estimated at approximately $116 million annually(¹)

Real Estate

$1,220

Impact

$213

AUM Not Yet Earning Fees

($M)

Growth

$2,392

Market Solutions

$1,005

Total

$13,437

Capital

$8,607

Real Estate

$756

FAUM Subject to Step-Up

($M)

Total

$2,192

Capital

$1,436

1. Represents the sum of the gross revenue opportunity for each non-legacy fund with unallocated capital, the deployment of which would result in incremental management fees being earned. Revenue opportunity for each fund is calculated as (a) the

incremental amount of unallocated capital that would be invested to achieve a range of 90%-100% total deployment of the original commitments of the fund, multiplied by (b) the incremental fee rate that we anticipate would be earned on invested capital and (c)

the proportion of the fund's commitments that are expected to pay fees based on the amount of invested capital.

TPG | 18View entire presentation