Lordstown Motors Investor Presentation Deck

Financial Overview

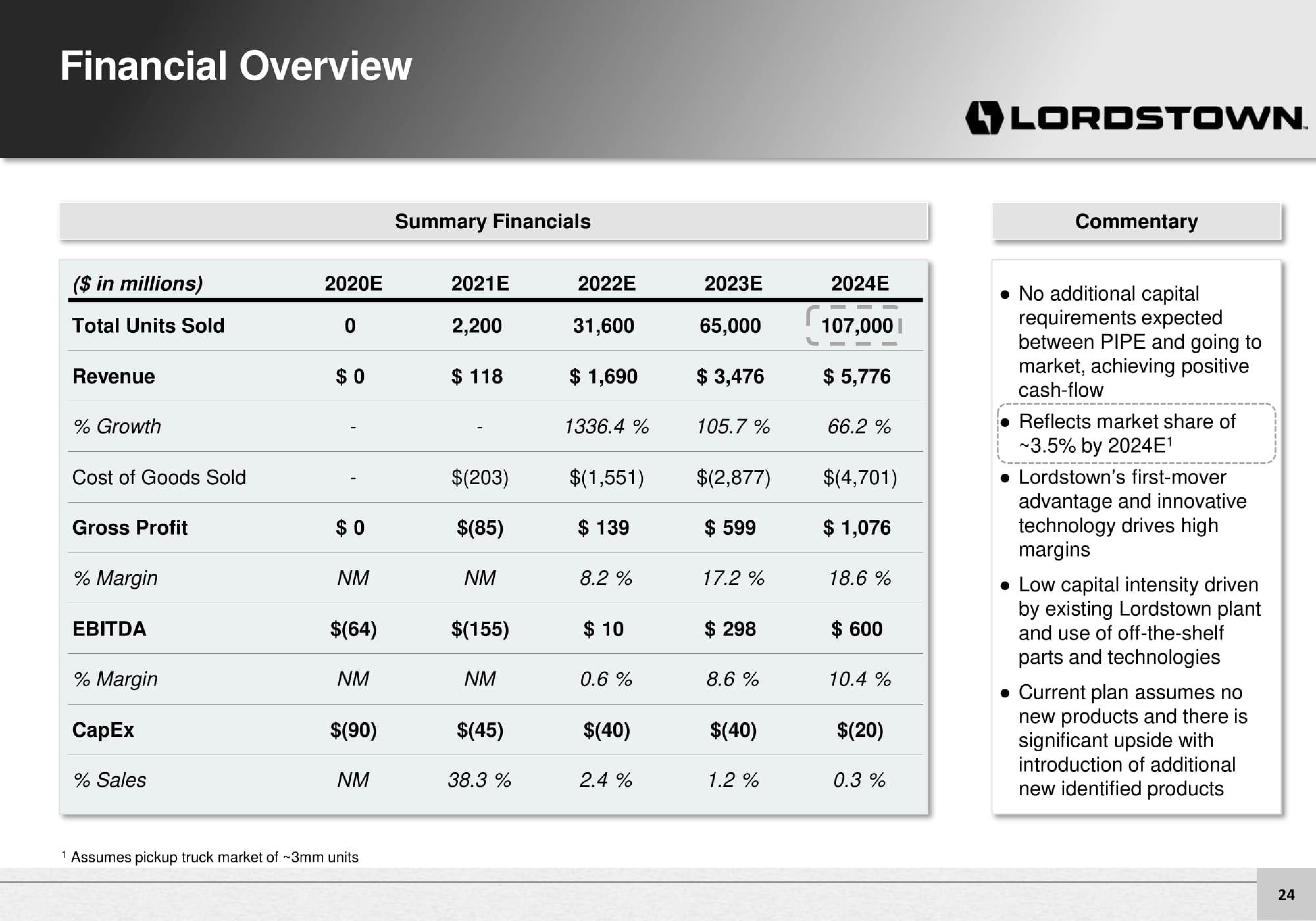

($ in millions)

Total Units Sold

Revenue

% Growth

Cost of Goods Sold

Gross Profit

% Margin

EBITDA

% Margin

CapEx

% Sales

2020E

0

$0

$0

NM

$(64)

NM

$(90)

NM

1 Assumes pickup truck market of ~3mm units

Summary Financials

2021E

2,200

$ 118

$(203)

$(85)

NM

$(155)

NM

$(45)

38.3 %

2022E

31,600

$ 1,690

1336.4 %

$(1,551)

$ 139

8.2 %

$ 10

0.6 %

$(40)

2.4%

2023E

65,000

$ 3,476

105.7 %

$(2,877)

$ 599

17.2 %

$ 298

8.6 %

$(40)

1.2 %

2024E

107,000

$ 5,776

66.2 %

$(4,701)

$ 1,076

18.6 %

$ 600

10.4 %

$(20)

0.3 %

LORDSTOWN.

Commentary

• No additional capital

requirements expected

between PIPE and going to

market, achieving positive

cash-flow

Reflects market share of

~3.5% by 2024E¹

Lordstown's first-mover

advantage and innovative

technology drives high

margins

• Low capital intensity driven

by existing Lordstown plant

and use of off-the-shelf

parts and technologies

. Current plan assumes no

new products and there is

significant upside with

introduction of additional

new identified products

24View entire presentation