AstraZeneca Results Presentation Deck

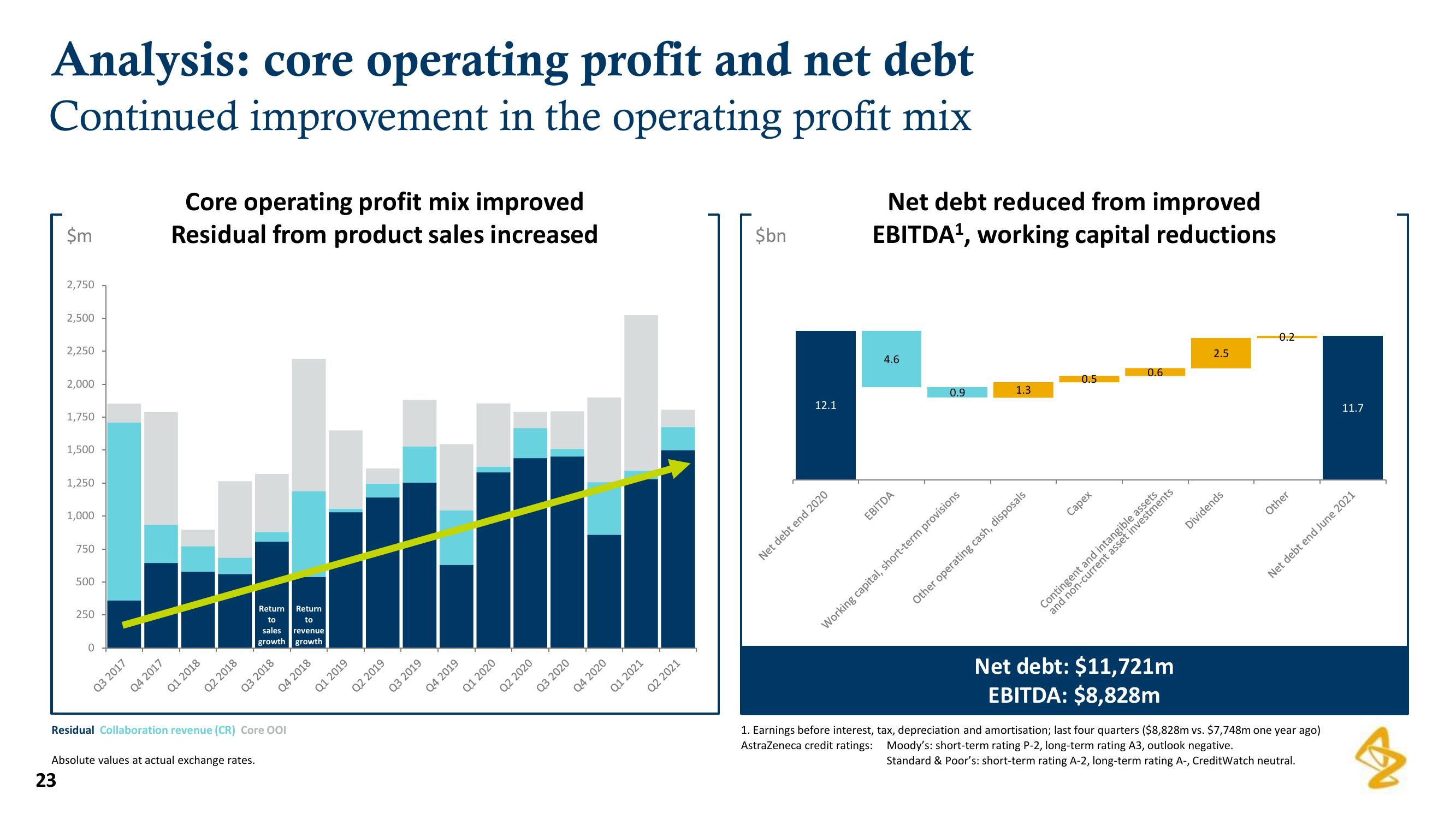

Analysis: core operating profit and net debt

Continued improvement in the operating profit mix

$m

2,750

23

2,500

2,250

2,000

1,750

1,500

1,250

1,000

750

500

250

0

Q3 2017

Q4 2017

Core operating profit mix improved

Residual from product sales increased

Q1 2018

Q2 2018

Absolute values at actual exchange rates.

Return Return

to

to

sales

revenue

growth growth

Residual Collaboration revenue (CR) Core OOI

Q3 2018

Q4 2018

Q1 2019

Q2 2019

Q3 2019

Q4 2019

Q1 2020

Q2 2020

Q3 2020

Q4 2020

Q1 2021

Q2 2021

$bn

12.1

Net debt end 2020

Net debt reduced from improved

EBITDA¹, working capital reductions

4.6

EBITDA

0.9

Working capital, short-term provisions

1.3

Other operating cash, disposals

0.5

Capex

0.6

and non-current asset investments

Contingent and intangible assets

Net debt: $11,721m

EBITDA: $8,828m

2.5

Dividends

0.2

Other

11.7

Net debt end June 2021

1. Earnings before interest, tax, depreciation and amortisation; last four quarters ($8,828m vs. $7,748m one year ago)

Moody's: short-term rating P-2, long-term rating A3, outlook negative.

AstraZeneca credit ratings:

Standard & Poor's: short-term rating A-2, long-term rating A-, CreditWatch neutral.

3View entire presentation