SoftBank Results Presentation Deck

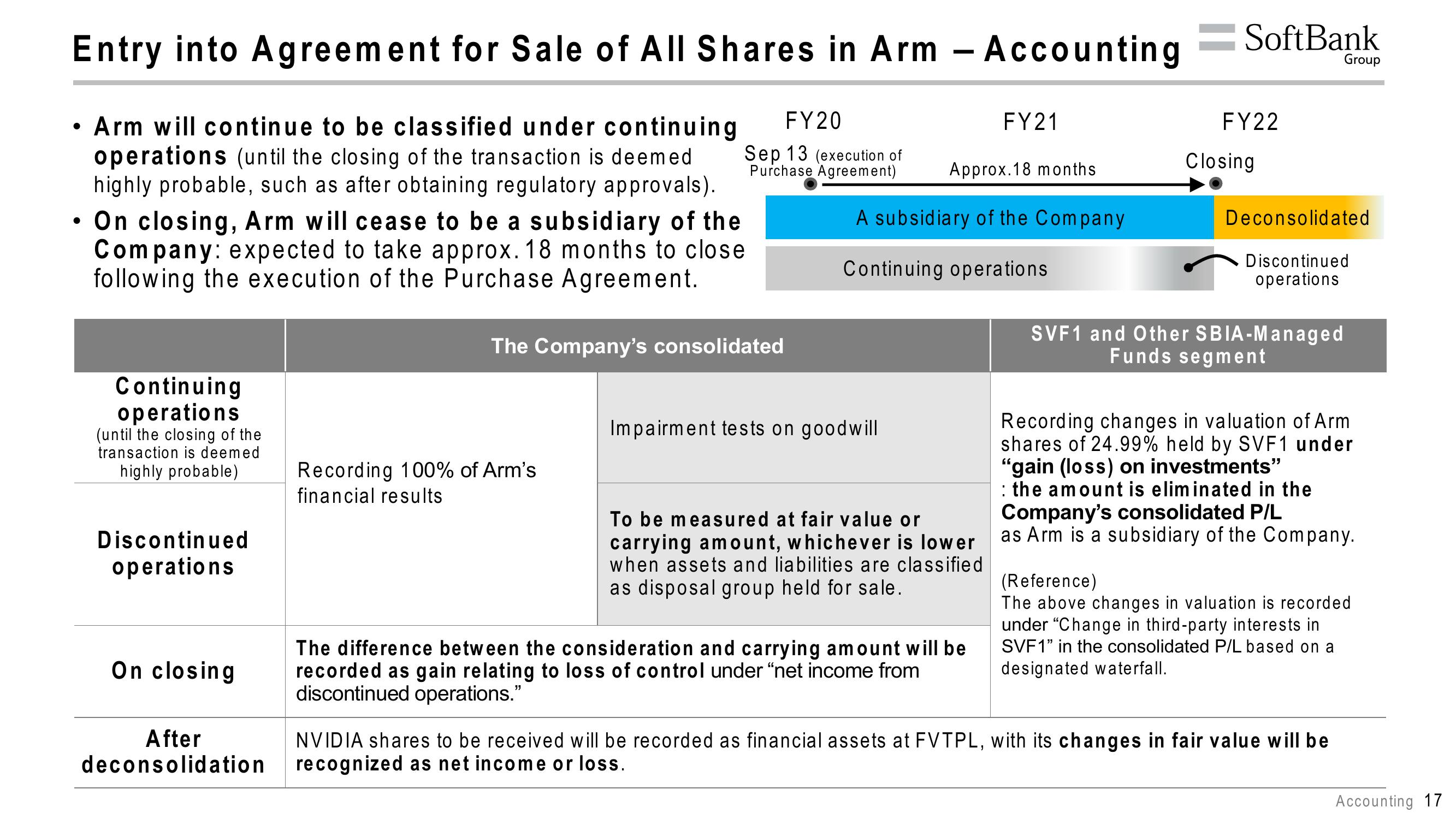

Entry into Agreement for Sale of All Shares in Arm - Accounting

●

• Arm will continue to be classified under continuing

operations (until the closing of the transaction is deemed.

highly probable, such as after obtaining regulatory approvals).

On closing, Arm will cease to be a subsidiary of the

Company: expected to take approx. 18 months to close

following the execution of the Purchase Agreement.

Continuing

operations

(until the closing of the

transaction is deemed

highly probable)

Discontinued

operations

On closing

After

deconsolidation

FY20

Sep 13 (execution of

Purchase Agreement)

The Company's consolidated

Recording 100% of Arm's

financial results

FY21

Approx. 18 months

A subsidiary of the Company

Continuing operations

Impairment tests on goodwill

To be measured at fair value or

carrying amount, whichever is lower

when assets and liabilities are classified

as disposal group held for sale.

The difference between the consideration and carrying amount will be

recorded as gain relating to loss of control under "net income from

discontinued operations."

SoftBank

FY22

Closing

Deconsolidated

Discontinued

operations

SVF1 and Other SBIA-Managed

Funds segment

Group

Recording changes in valuation of Arm

shares of 24.99% held by SVF1 under

"gain (loss) on investments"

: the amount is eliminated in the

Company's consolidated P/L

as Arm is a subsidiary of the Company.

(Reference)

The above changes in valuation is recorded

under "Change in third-party interests in

SVF1" in the consolidated P/L based on a

designated waterfall.

NVIDIA shares to be received will be recorded as financial assets at FVTPL, with its changes in fair value will be

recognized as net income or loss.

Accounting 17View entire presentation