Credit Suisse Investor Event Presentation Deck

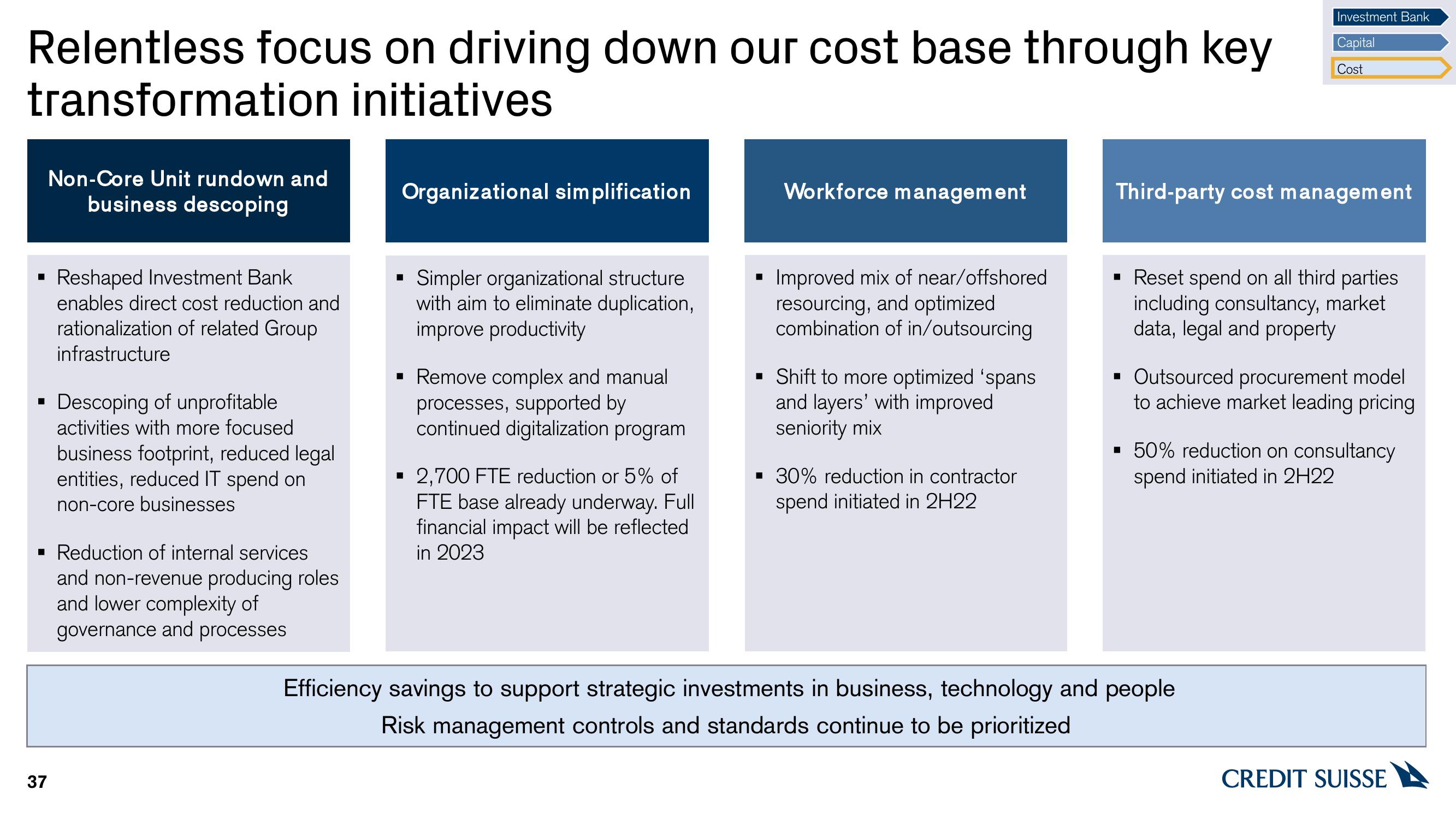

Relentless focus on driving down our cost base through key

transformation initiatives

■

■

Non-Core Unit rundown and

business descoping

Reshaped Investment Bank

enables direct cost reduction and

rationalization of related Group

infrastructure

37

Descoping of unprofitable

activities with more focused

business footprint, reduced legal

entities, reduced IT spend on

non-core businesses

▪ Reduction of internal services

and non-revenue producing roles

and lower complexity of

governance and processes

Organizational simplification

■

Simpler organizational structure

with aim to eliminate duplication,

improve productivity

Remove complex and manual

processes, supported by

continued digitalization program

2,700 FTE reduction or 5% of

FTE base already underway. Full

financial impact will be reflected

in 2023

■

Workforce management

Improved mix of near/offshored

resourcing, and optimized

combination of in/outsourcing

▪ Shift to more optimized 'spans

and layers' with improved

seniority mix

▪ 30% reduction in contractor

spend initiated in 2H22

Third-party cost management

■

■

Investment Bank

Capital

Cost

Reset spend on all third parties

including consultancy, market

data, legal and property

Outsourced procurement model

to achieve market leading pricing

▪ 50% reduction on consultancy

spend initiated in 2H22

Efficiency savings to support strategic investments in business, technology and people

Risk management controls and standards continue to be prioritized

CREDIT SUISSEView entire presentation