The Urgent Need for Change and The Superior Path Forward

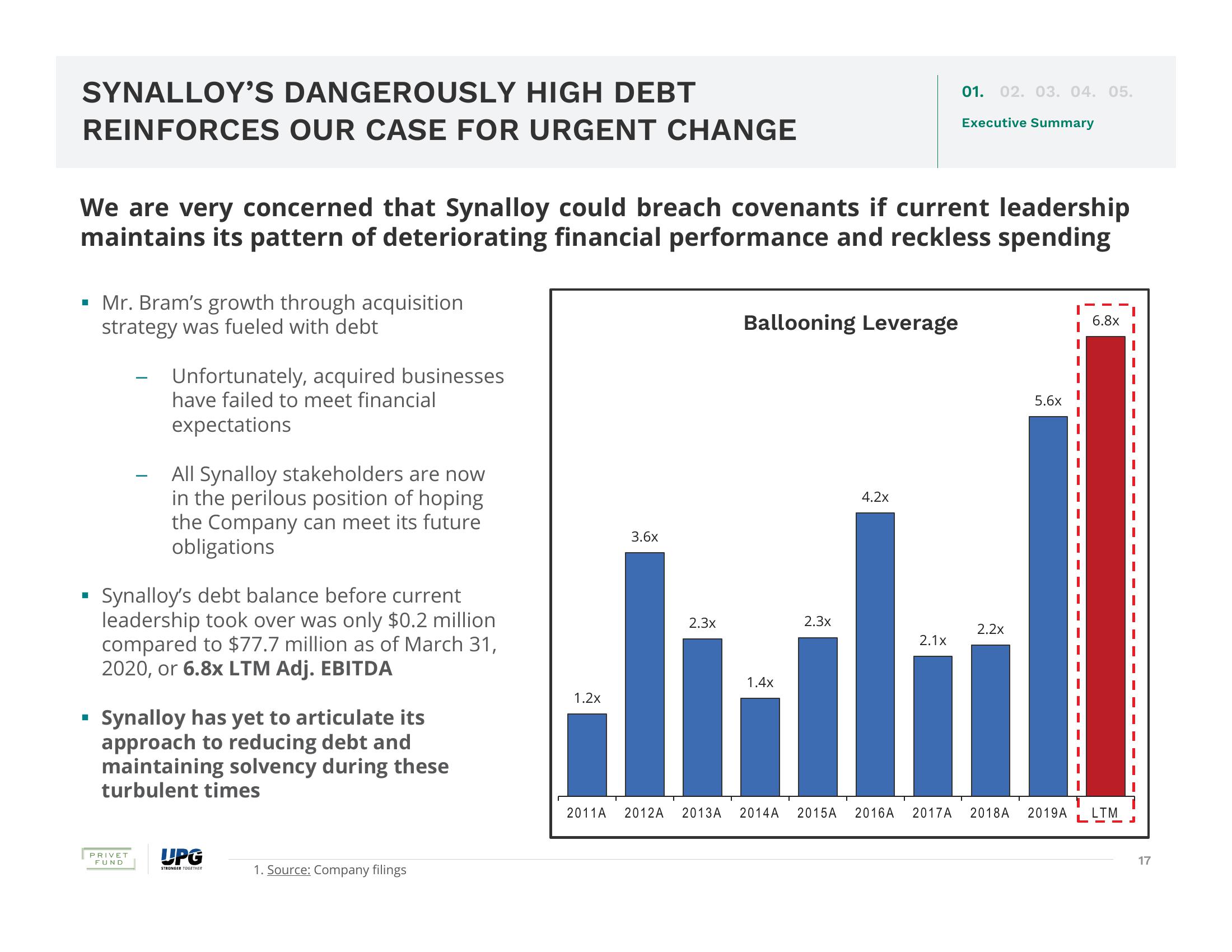

SYNALLOY'S DANGEROUSLY HIGH DEBT

REINFORCES OUR CASE FOR URGENT CHANGE

▪ Mr. Bram's growth through acquisition

strategy was fueled with debt

We are very concerned that Synalloy could breach covenants if current leadership

maintains its pattern of deteriorating financial performance and reckless spending

H

■

Unfortunately, acquired businesses

have failed to meet financial

expectations

All Synalloy stakeholders are now

in the perilous position of hoping

the Company can meet its future

obligations

Synalloy's debt balance before current

leadership took over was only $0.2 million

compared to $77.7 million as of March 31,

2020, or 6.8x LTM Adj. EBITDA

PRIVET

FUND

Synalloy has yet to articulate its

approach to reducing debt and

maintaining solvency during these

turbulent times

UPG

STRONGER TOGETHER

1. Source: Company filings

1.2x

3.6x

2.3x

2011A 2012A 2013A

Ballooning Leverage

2.3x

4.2x

01. 02. 03. 04. 05.

2.1x

Executive Summary

2.2x

5.6x

6.8x

1.4x

il

2014A 2015A 2016A 2017A 2018A 2019A LTM

17View entire presentation