Evercore Investment Banking Pitch Book

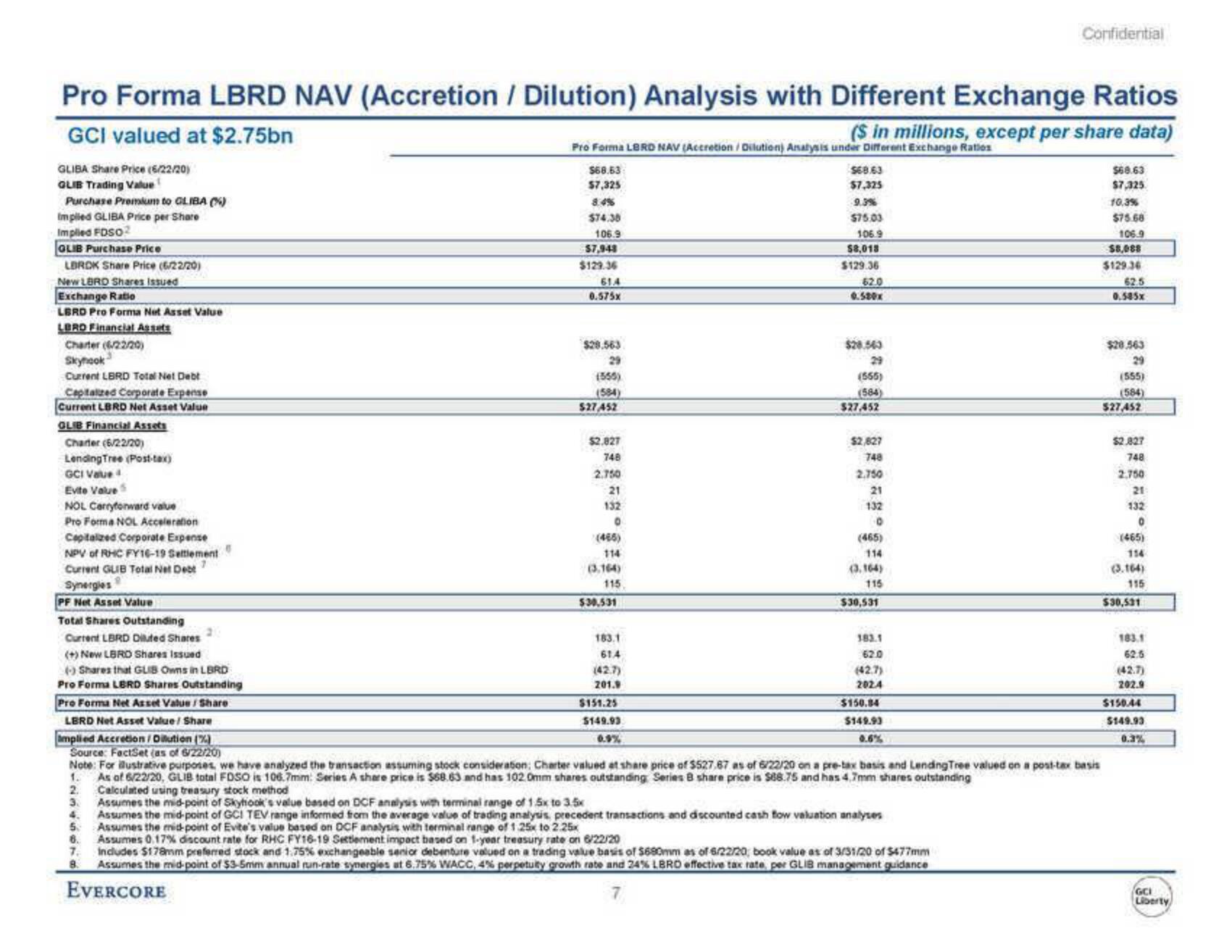

Pro Forma LBRD NAV (Accretion / Dilution) Analysis with Different Exchange Ratios

GCI valued at $2.75bn

($ in millions, except per share data)

GLIBA Share Price (6/22/20)

GLIB Trading Value

Purchase Premium to GLIBA (%)

Implied GLIBA Price per Share

Implied FDSO2

GLIB Purchase Price

LBROK Share Price (6/22/20)

New LBRD Shares issued

Exchange Ratio

LBRD Pro Forma Net Asset Value

LBRD Financial Assets

Charter (6/22/20)

Skyhook

Current LBRD Total Net Debt

Capitalized Corporate Expense

Current LBRD Net Asset Value

GLIB Financial Assets

Charter (6/22/20)

Lending Tree (Post-tax)

GCI Value

Evite Value

NOL Carryforward value

Pro Forma NOL Acceleration

Capitalized Corporate Expense

NPV of RHC FY16-19 Settlement

Current GLIB Total Net Debt

Synergies

PF Net Asset Value

6

4.

5

Pro Forma LBRD NAV (Accretion/Dilution) Analysis under Different Exchange Ratios

6.

7.

8.

$68.63

$7,325

8.4%

$74.38

106.9

$7,949

$129.36

614

0.575x

$28.563

29

(555)

(584)

$27,452

$2.827

748

2.750

21

132

0

114

(3,164)

115

$30,531

183.1

614

(42.7)

201.9

$68.63

$7,325

9.3%

$75.03

106.9

$8,013

$151.25

$149.93

0.9%

$129.36

62.0

0.500x

$28.543

(555)

(584)

$27,452

Total Shares Outstanding

Current LBRD Diluted Shares

(+) New LBRD Shares Issued

(-) Shares that GLIB Owns in LBRD

Pro Forma LBRD Shares Outstanding

Pro Forma Net Asset Value /Share

LERD Net Asset Value / Share

amplied Accretion/Dilution (%)

Source: FactSet (as of 6/22/20)

Note: For illustrative purposes, we have analyzed the transaction assuming stock consideration; Charter valued at share price of $527.67 as of 6/22/20 on a pre-tax basis and Lending Tree valued on a post-tax basis

1. As of 6/22/20, GLIB total FDSO is 106.7mm: Series A share price is $68.63 and has 102. 0mm shares outstanding Series 8 share price is $88.75 and has 4,7mm shares outstanding

2 Calculated using treasury stock method

$2,827

748

2.750

21

132

O

(465)

114

(3,164)

115

$30,531

183.1

62.0

(42.7)

202.4

3. Assumes the mid-point of Skyhook's value based on DCF analysis with terminal range of 1.5x to 3.5x

Assumes the mid-point of GCI TEV range informed from the average value of trading analysis, precedent transactions and discounted cash flow valuation analyses

Assumes the mid-point of Evite's value based on DCF analysis with terminal range of 1.25x to 2.25x

Assumes 0.17% discount rate for RHC FY16-19 Settlement impact based on 1-year treasury rate on 6/22/20

Includes $178mm preferred stock and 1.75% exchangeable senior debenture valued on a trading value basis of $680mm as of 6/22/20, book value as of 3/31/20 of $477mm

Assumes the mid-point of $3-5mm annual run-rate synergies at 6.75% WACC, 4% perpetulty growth rate and 24% LBRD effective tax rate, per GLIB management guidance

EVERCORE

Confidential

$150.84

$149.93

$68.63

$7,325

10.3%

$75.68

106.9

$8,088

$129.36

62.5

0.585x

$28.563

29

(555)

(584)

$27,452

$2.827

748

2.750

21

132

0

(465)

114

(3.164)

115

$30,531

183.1

62.5

(42.7)

202.9

$150.44

$149.93

0.3%

GCI

LibertyView entire presentation