AG Direct Lending SMA

ANGELO

AG GORDON

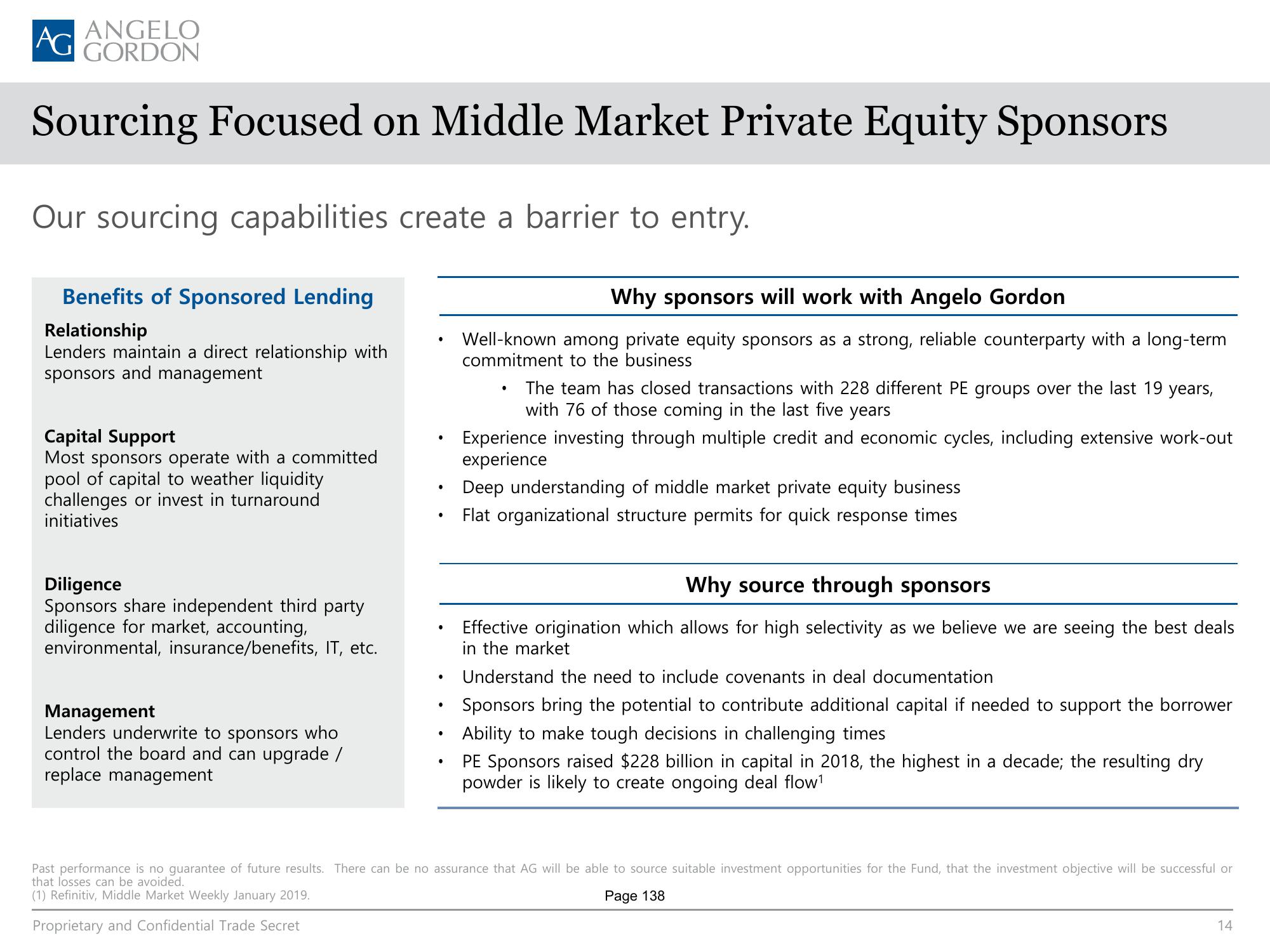

Sourcing Focused on Middle Market Private Equity Sponsors

Our sourcing capabilities create a barrier to entry.

Benefits of Sponsored Lending

Relationship

Lenders maintain a direct relationship with

sponsors and management

Capital Support

Most sponsors operate with a committed

pool of capital to weather liquidity

challenges or invest in turnaround

initiatives

Diligence

Sponsors share independent third party

diligence for market, accounting,

environmental, insurance/benefits, IT, etc.

Management

Lenders underwrite to sponsors who

control the board and can upgrade /

replace management

●

●

●

●

●

●

Why sponsors will work with Angelo Gordon

Well-known among private equity sponsors as a strong, reliable counterparty with a long-term

commitment to the business

The team has closed transactions with 228 different PE groups over the last 19 years,

with 76 of those coming in the last five years

Experience investing through multiple credit and economic cycles, including extensive work-out

experience

Deep understanding of middle market private equity business

Flat organizational structure permits for quick response times

Why source through sponsors

Effective origination which allows for high selectivity as we believe we are seeing the best deals

in the market

Understand the need to include covenants in deal documentation

Sponsors bring the potential to contribute additional capital if needed to support the borrower

Ability to make tough decisions in challenging times

PE Sponsors raised $228 billion in capital in 2018, the highest in a decade; the resulting dry

powder is likely to create ongoing deal flow1¹

Past performance is no guarantee of future results. There can be no assurance that AG will be able to source suitable investment opportunities for the Fund, that the investment objective will be successful or

that losses can be avoided.

(1) Refinitiv, Middle Market Weekly January 2019.

Page 138

Proprietary and Confidential Trade Secret

14View entire presentation