LSE Investor Presentation Deck

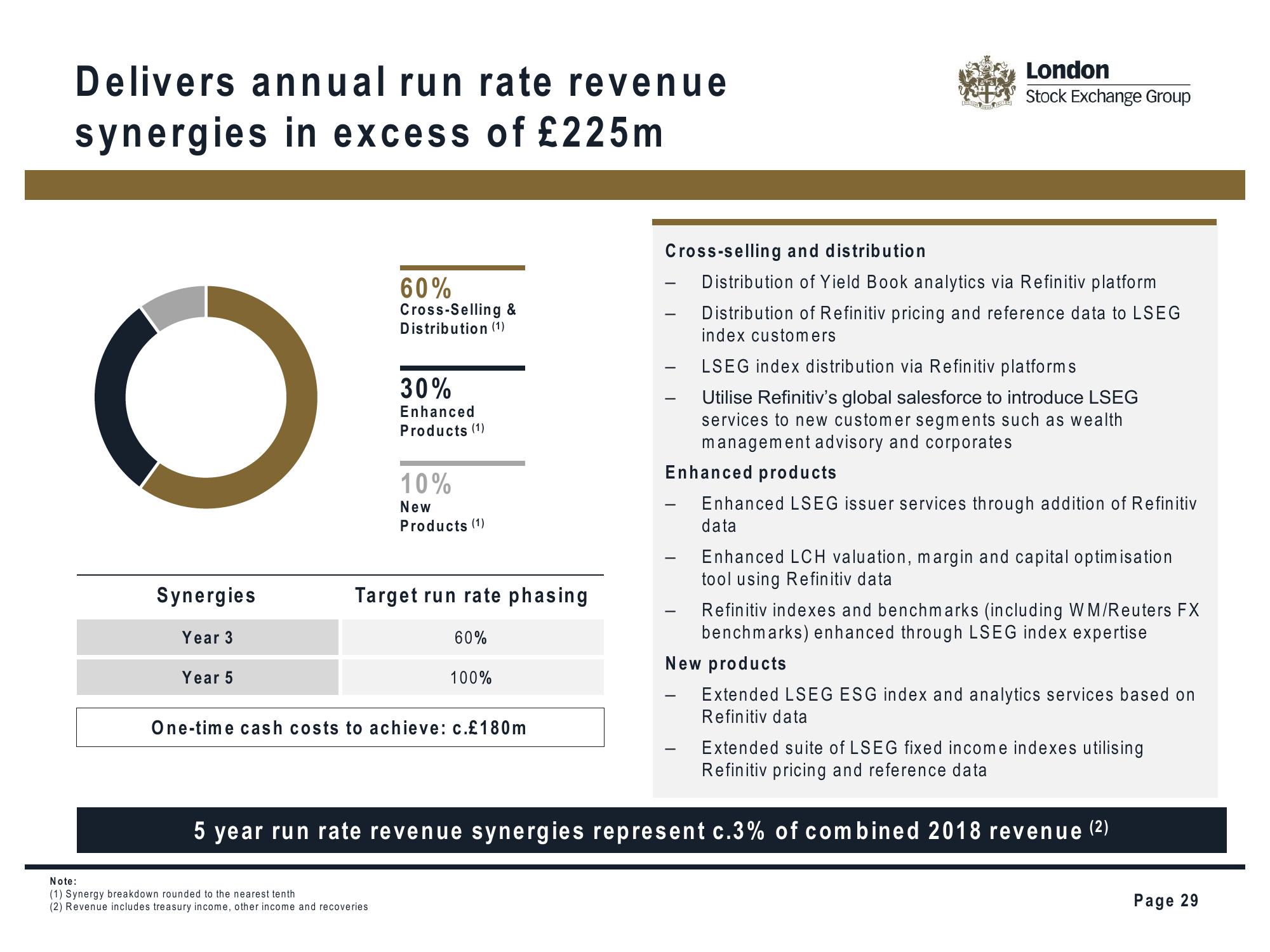

Delivers annual run rate revenue

synergies in excess of £225m

O

Synergies

Year 3

Year 5

60%

Cross-Selling &

Distribution (1)

30%

Enhanced

Products (1)

10%

New

Products (1)

Target run rate phasing

Note:

(1) Synergy breakdown rounded to the nearest tenth

(2) Revenue includes treasury income, other income and recoveries

60%

100%

One-time cash costs to achieve: c.£180m

London

Stock Exchange Group

Cross-selling and distribution

Distribution of Yield Book analytics via Refinitiv platform

Distribution of Refinitiv pricing and reference data to LSEG

index customers

LSEG index distribution via Refinitiv platforms

Utilise Refinitiv's global salesforce to introduce LSEG

services to new customer segments such as wealth

management advisory and corporates

Enhanced products

Enhanced LSEG issuer services through addition of Refinitiv

data

Enhanced LCH valuation, margin and capital optimisation

tool using Refinitiv data

Refinitiv indexes and benchmarks (including WM/Reuters FX

benchmarks) enhanced through LSEG index expertise

New products

Extended LSEG ESG index and analytics services based on

Refinitiv data

Extended suite of LSEG fixed income indexes utilising

Refinitiv pricing and reference data

5 year run rate revenue synergies represent c.3% of combined 2018 revenue (2)

Page 29View entire presentation