Oatly Results Presentation Deck

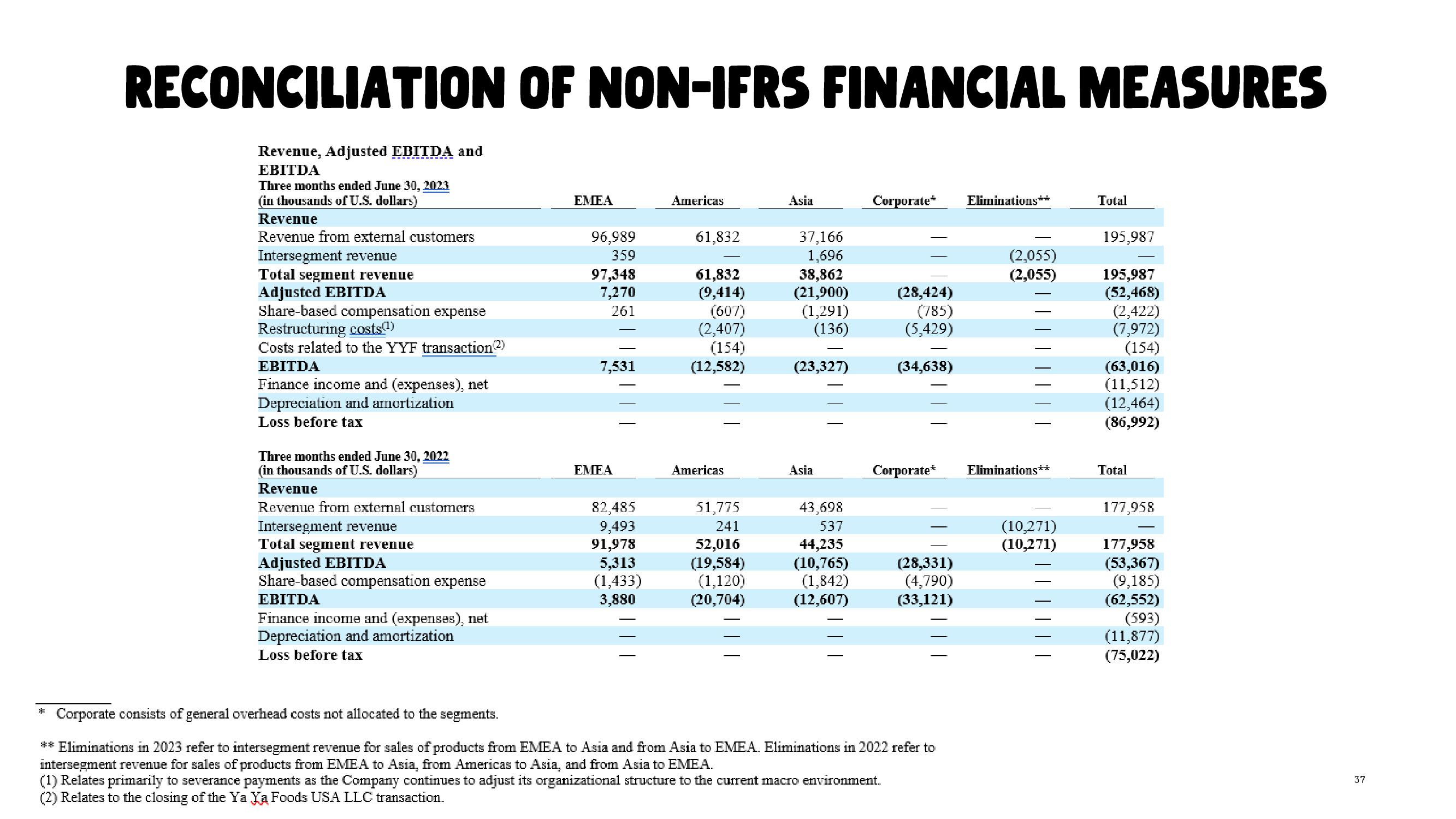

RECONCILIATION OF NON-IFRS FINANCIAL MEASURES

Revenue, Adjusted EBITDA and

EBITDA

Three months ended June 30, 2023

(in thousands of U.S. dollars)

Revenue

Revenue from external customers

Intersegment revenue

Total segment revenue

Adjusted EBITDA

Share-based compensation expense

Restructuring costs(1)

Costs related to the YYF transaction(?)

EBITDA

Finance income and (expenses), net

Depreciation and amortization

Loss before tax

Three months ended June 30, 2022

(in thousands of U.S. dollars)

Revenue

Revenue from external customers

Intersegment revenue

Total segment revenue

Adjusted EBITDA

Share-based compensation expense

EBITDA

Finance income and (expenses), net

Depreciation and amortization

Loss before tax

EMEA

96,989

359

97,348

7,270

261

7,531

EMEA

82,485

9,493

91,978

5,313

(1,433)

3,880

Americas

61,832

61,832

(9,414)

(607)

(2,407)

(154)

(12,582)

Americas

51,775

241

52,016

(19,584)

(1,120)

(20,704)

Asia

37,166

1,696

38,862

(21,900)

(1,291)

(136)

—

(23,327)

Asia

43,698

537

44,235

(10,765)

(1,842)

(12,607)

Corporate* Eliminations**

(28,424)

(785)

(5,429)

(34,638)

Corporate*

(28,331)

(4,790)

(33,121)

* Corporate consists of general overhead costs not allocated to the segments.

** Eliminations in 2023 refer to intersegment revenue for sales of products from EMEA to Asia and from Asia to EMEA. Eliminations in 2022 refer to

intersegment revenue for sales of products from EMEA to Asia, from Americas to Asia, and from Asia to EMEA.

(1) Relates primarily to severance payments as the Company continues to adjust its organizational structure to the current macro environment.

(2) Relates to the closing of the Ya Ya Foods USA LLC transaction.

(2,055)

(2,055)

Eliminations**

(10,271)

(10,271)

Total

195,987

195,987

(52,468)

(2,422)

(7,972)

(154)

(63,016)

(11,512)

(12,464)

(86,992)

Total

177,958

177,958

(53,367)

(9,185)

(62,552)

(593)

(11,877)

(75,022)

37View entire presentation