Mondee Investor Presentation Deck

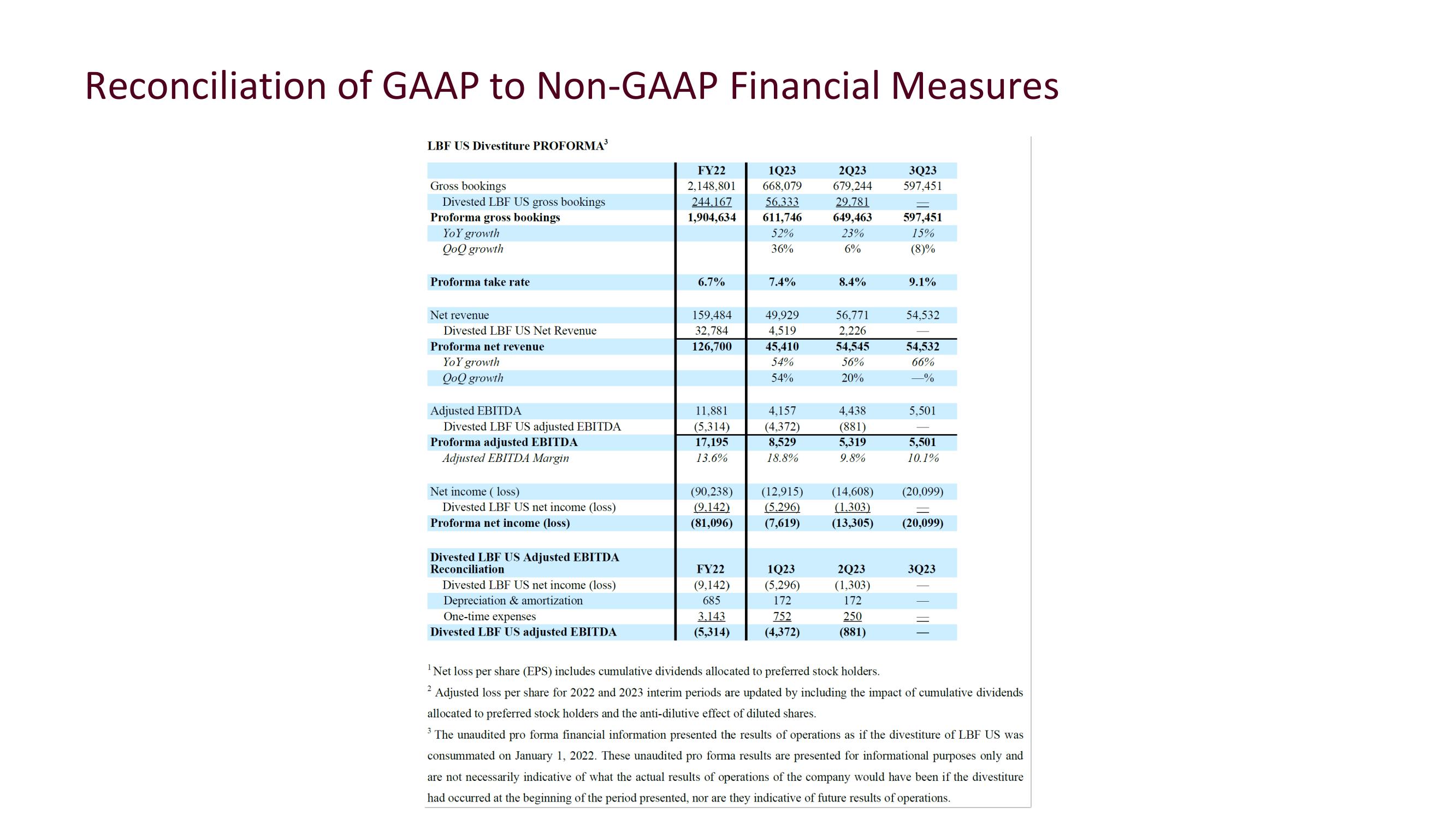

Reconciliation of GAAP to Non-GAAP Financial Measures

LBF US Divestiture PROFORMA³

Gross bookings

Divested LBF US gross bookings

Proforma gross bookings

YoY growth

QoQ growth

Proforma take rate

Net revenue

Divested LBF US Net Revenue

Proforma net revenue

YoY growth

QoQ growth

Adjusted EBITDA

Divested LBF US adjusted EBITDA

Proforma adjusted EBITDA

Adjusted EBITDA Margin

Net income ( loss)

Divested LBF US net income (loss)

Proforma net income (loss)

Divested LBF US Adjusted EBITDA

Reconciliation

Divested LBF US net income (loss)

Depreciation & amortization

One-time expenses

Divested LBF US adjusted EBITDA

FY22

2,148,801

244.167

1,904,634

2

6.7%

159,484

32,784

126,700

11,881

(5,314)

17,195

13.6%

1Q23

668,079

56.333

611,746

52%

36%

FY22

(9,142)

685

3.143

(5,314)

7.4%

49,929

4,519

45,410

54%

54%

4,157

(4,372)

8,529

18.8%

(90,238) (12,915)

(9,142)

(5.296)

(81,096)

(7,619)

1Q23

(5,296)

172

752

(4,372)

2Q23

679,244

29.781

649,463

23%

6%

8.4%

56,771

2,226

54,545

56%

20%

4,438

(881)

5,319

9.8%

(14,608)

(1,303)

(13,305)

2Q23

(1,303)

172

250

(881)

3Q23

597,451

=

597,451

15%

(8)%

9.1%

54,532

54,532

66%

-%

5,501

5,501

10.1%

(20,099)

=

(20,099)

3Q23

|||||

1

Net loss per share (EPS) includes cumulative dividends allocated to preferred stock holders.

Adjusted loss per share for 2022 and 2023 interim periods are updated by including the impact of cumulative dividends

allocated to preferred stock holders and the anti-dilutive effect of diluted shares.

3

The unaudited pro forma financial information presented the results of operations as if the divestiture of LBF US was

consummated on January 1, 2022. These unaudited pro forma results are presented for informational purposes only and

are not necessarily indicative of what the actual results of operations of the company would have been if the divestiture

had occurred at the beginning of the period presented, nor are they indicative of future results of operations.View entire presentation