Netstreit IPO Presentation Deck

4 Robust Pipeline of Quality Assets to Drive Growth

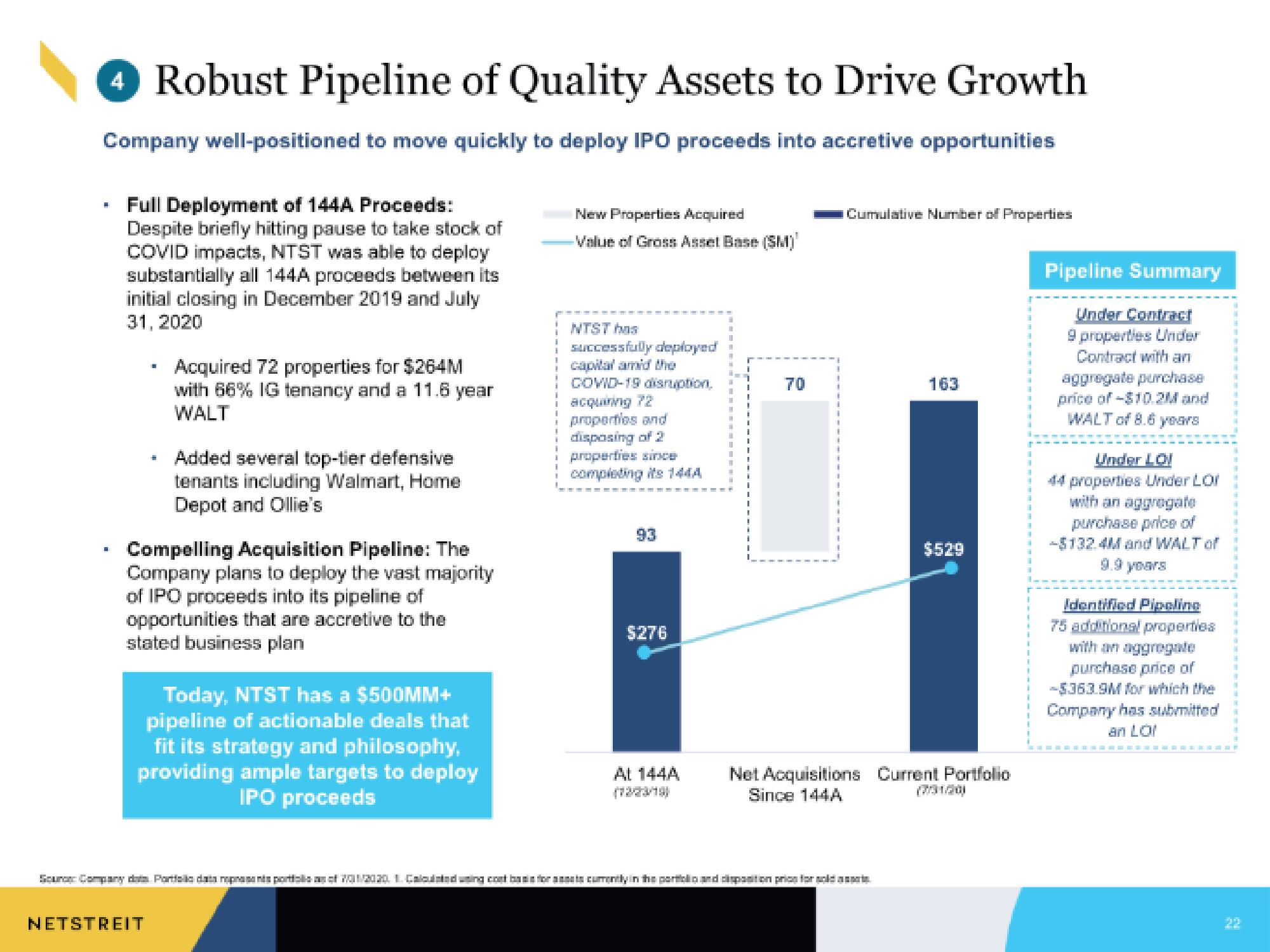

Company well-positioned to move quickly to deploy IPO proceeds into accretive opportunities

■

■

Full Deployment of 144A Proceeds:

Despite briefly hitting pause to take stock of

COVID impacts, NTST was able to deploy

substantially all 144A proceeds between its

initial closing in December 2019 and July

31, 2020

1

-

Acquired 72 properties for $264M

with 66% IG tenancy and a 11.6 year

WALT

NETSTREIT

Added several top-tier defensive

tenants including Walmart, Home

Depot and Ollie's

Compelling Acquisition Pipeline: The

Company plans to deploy the vast majority

of IPO proceeds into its pipeline of

opportunities that are accretive to the

stated business plan

Today, NTST has a $500MM+

pipeline of actionable deals that

fit its strategy and philosophy,

providing ample targets to deploy

IPO proceeds

New Properties Acquired

-Value of Gross Asset Base (SM)

NTST has

successfully deployed

capital amid the

COVID-19 disruption.

acquiring 72

properties and

disposing of 2

properties since

completing its 1444

$276

AL 144A

Soung Company data. Particiodata repasan portal of 20/2020. 1. Calculated using cost for is currently in the part and disposition price for old

Cumulative Number of Properties

163

$529

Net Acquisitions Current Portfolio

Since 144A

(7731/201

T

Pipeline Summary

Under Contract

9 properties Under

Contract with an

aggregate purchase

price of -$10.2M and

WALT of 8.6 years

Under LOI

44 properties Under LOI

with an aggregate

purchase price of

-$132.4M and WALT of

Identified Pipeline

75 additional properties

with an aggregate

purchase price of

-$363.9M for which the

Company has submitted

an LoiView entire presentation