Frontier IPO Presentation Deck

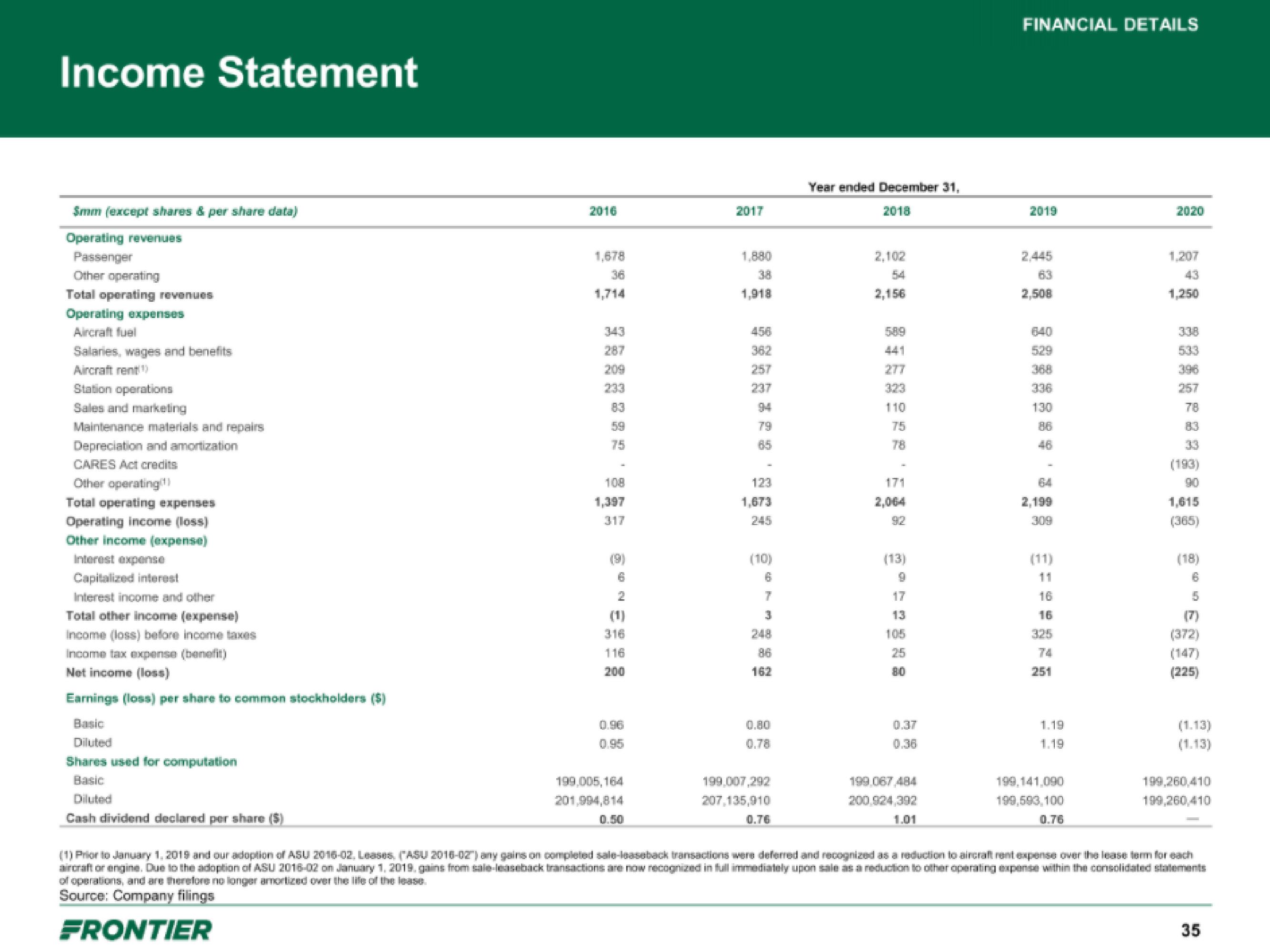

Income Statement

Smm (except shares & per share data)

Operating revenues

Passenger

Other operating

Total operating revenues

Operating expenses

Aircraft fuel

Salaries, wages and benefits

Aircraft rent! ¹

Station operations

Sales and marketing

Maintenance materials and repairs

Depreciation and amortization

CARES Act credits

Other operating¹

Total operating expenses

Operating income (loss)

Other income (expense)

Interest expense

Capitalized interest

Interest income and other

Total other income (expense)

Income (loss) before income taxes

Income tax expense (benefit)

Net income (loss)

Earnings (loss) per share to common stockholders ($)

Basic

Diluted

Shares used for computation

Basic

Diluted

Cash dividend declared per share

2016

1,714

287

209

5:9

75

1,397

317

2

316

116

200

0.96

199,005,164

201,994,814

1,880

3.8

1,918

257

237

85

123

1,673

(10)

6

7

162

0.80

199,007,292

207,135,910

0.76

Year ended December 31,

2018

2,102

54

2,156

441

110

75

78

171

2,064

(13)

9

105

80

0.37

199,067,484

200,924,392

1.01

FINANCIAL DETAILS

2019

2,508

5:29

130

46

(11)

16

16

251

1.19

1.19

199,141,090

199,593,100

0.76

2020

1,250

257

(193)

1,615

(365)

(18)

16

5

(372)

(1.13)

(1.13)

199,260,410

199,260,410

(1) Prior to January 1, 2019 and our adoption of ASU 2016-02, Leases, (ASU 2016-02") any gains on completed sale-leaseback transactions were deferred and recognized as a reduction to aircraft rent expense over the lease term for each

aircraft or engine. Due to the adoption of ASU 2016-02 on January 1, 2019. gains from sale-leaseback transactions are now recognized in full immediately upon sale as a reduction to other operating expense within the consolidated statements

of operations, and are therefore no longer amortized over the life of the lease.

Source: Company filings

FRONTIER

35View entire presentation