Altus Power SPAC Presentation Deck

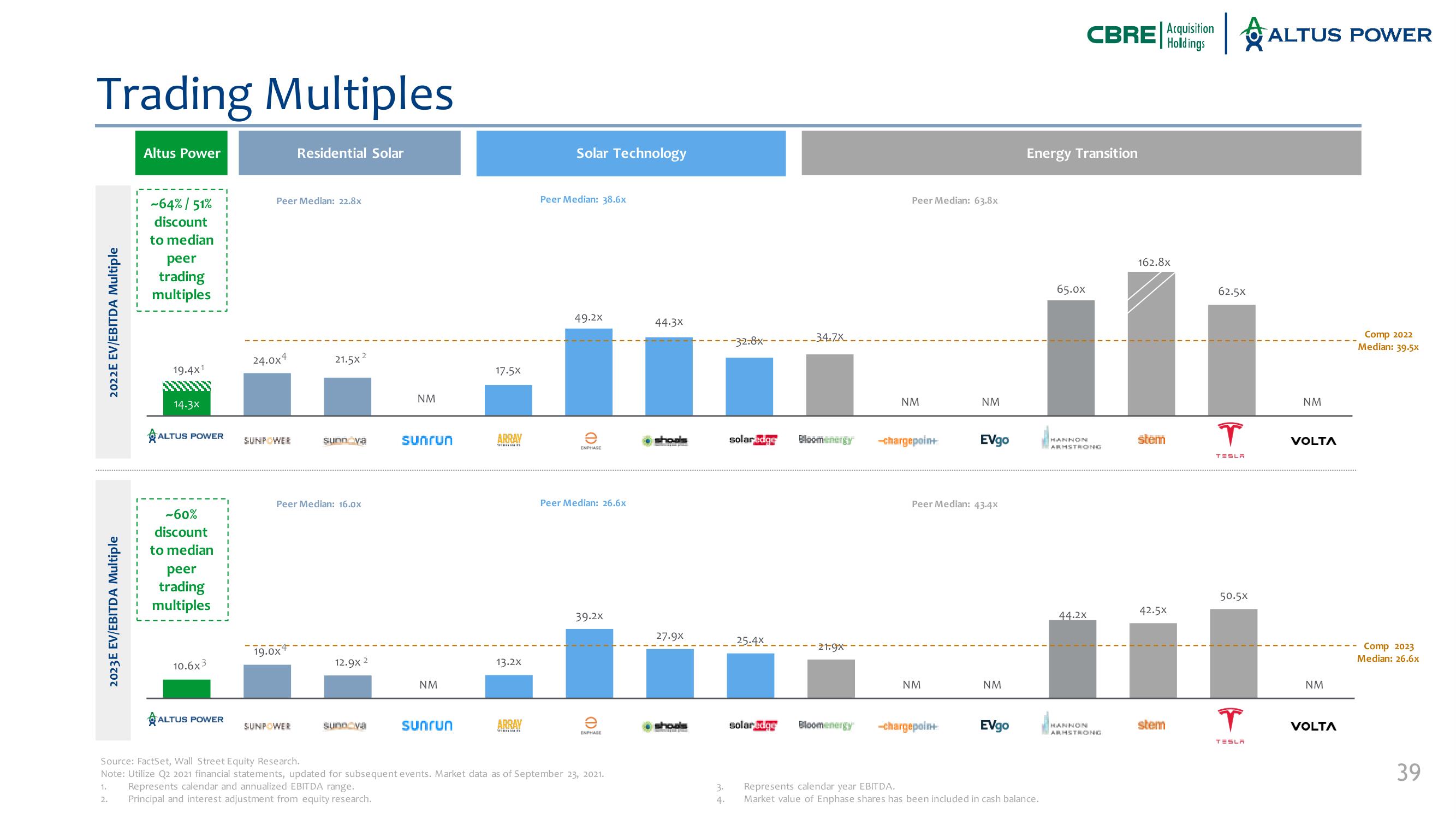

Trading Multiples

2022E EV/EBITDA Multiple

2023E EV/EBITDA Multiple

Altus Power

1.

2.

-64% / 51%

discount

to median

peer

trading

multiples

19.4x1

14.3x

ALTUS POWER

-60%

discount

to median

peer

trading

multiples

10.6x3

ALTUS POWER

Peer Median: 22.8x

24.0x4

SUNPOWER

Residential Solar

19.0x

SUNPOWER

21.5x2

Peer Median: 16.0x

sunn va

12.9x 2

sunn va

NM

sunrun

NM

sunrun

17.5X

ARRAY

13.2x

ARRAY

Solar Technology

Peer Median: 38.6x

49.2x

ENPHASE

Peer Median: 26.6x

39.2x

ENPHASE

Source: FactSet, Wall Street Equity Research.

Note: Utilize Q2 2021 financial statements, updated for subsequent events. Market data as of September 23, 2021.

Represents calendar and annualized EBITDA range.

Principal and interest adjustment from equity research.

44.3x

27.9X

shouls

3.

4.

-32.8x-

-34.7x

solaredge Bloomenergy

25.4x

21:9x

solaredge Bloomenergy

Peer Median: 63.8x

NM

-chargepoint

NM

NM

Peer Median: 43.4x

-chargepoin+

EVgo

NM

EVgo

Energy Transition

Represents calendar year EBITDA.

Market value of Enphase shares has been included in cash balance.

CBRE Acquisition

Holdings

65.0x

HANNON

ARMSTRONG

44.2x

HANNON

ARHSTRONG

162.8x

stem

42.5X

stem

62.5×

T

TESLA

50.5×

T

TESLA

A

ALTUS POWER

NM

VOLTA

NM

VOLTA

Comp 2022

Median: 39.5x

Comp 2023

Median: 26.6x

39View entire presentation