Endeavour Mining Results Presentation Deck

★

SABODALA-MASSAWA,

SENEGAL

Lowest AISC achieved since acquiring the mine

Q1-2022 vs Q4-2021 INSIGHTS

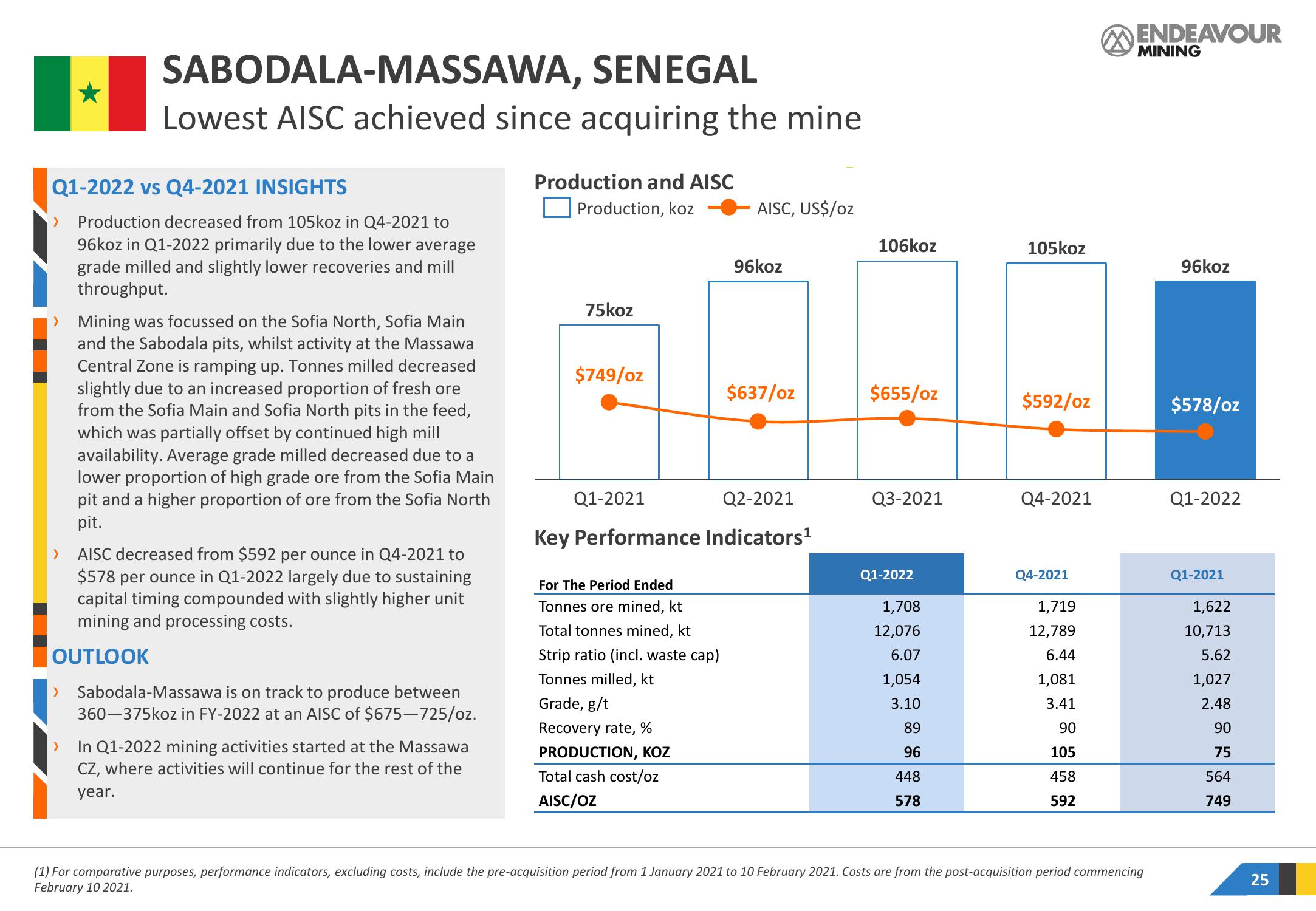

> Production decreased from 105koz in Q4-2021 to

96koz in Q1-2022 primarily due to the lower average

grade milled and slightly lower recoveries and mill

throughput.

> Mining was focussed on the Sofia North, Sofia Main

and the Sabodala pits, whilst activity at the Massawa

Central Zone is ramping up. Tonnes milled decreased

slightly due to an increased proportion of fresh ore

from the Sofia Main and Sofia North pits in the feed,

which was partially offset by continued high mill

availability. Average grade milled decreased due to a

lower proportion of high grade ore from the Sofia Main

pit and a higher proportion of ore from the Sofia North

pit.

> AISC decreased from $592 per ounce in Q4-2021 to

$578 per ounce in Q1-2022 largely due to sustaining

capital timing compounded with slightly higher unit

mining and processing costs.

OUTLOOK

>

> Sabodala-Massawa is on track to produce between

360-375koz in FY-2022 at an AISC of $675-725/oz.

In Q1-2022 mining activities started at the Massawa

CZ, where activities will continue for the rest of the

year.

Production and AISC

Production, koz

75koz

$749/oz

Q1-2021

AISC, US$/oz

For The Period Ended

Tonnes ore mined, kt

Total tonnes mined, kt

Strip ratio (incl. waste cap)

Tonnes milled, kt

Grade, g/t

Recovery rate, %

PRODUCTION, KOZ

Total cash cost/oz

AISC/OZ

96koz

$637/oz

Q2-2021

Key Performance Indicators¹

106koz

$655/oz

Q3-2021

Q1-2022

1,708

12,076

6.07

1,054

3.10

89

96

448

578

105koz

$592/oz

Q4-2021

Q4-2021

1,719

12,789

6.44

1,081

3.41

90

105

458

592

ENDEAVOUR

MINING

(1) For comparative purposes, performance indicators, excluding costs, include the pre-acquisition period from 1 January 2021 to 10 February 2021. Costs are from the post-acquisition period commencing

February 10 2021.

96koz

$578/oz

Q1-2022

Q1-2021

1,622

10,713

5.62

1,027

2.48

90

75

564

749

25View entire presentation