Investor Presentation

FINANCIALS

TECHNOLOGY

ENERGY EVOLUTION

NATURAL RESOURCES

INTRO

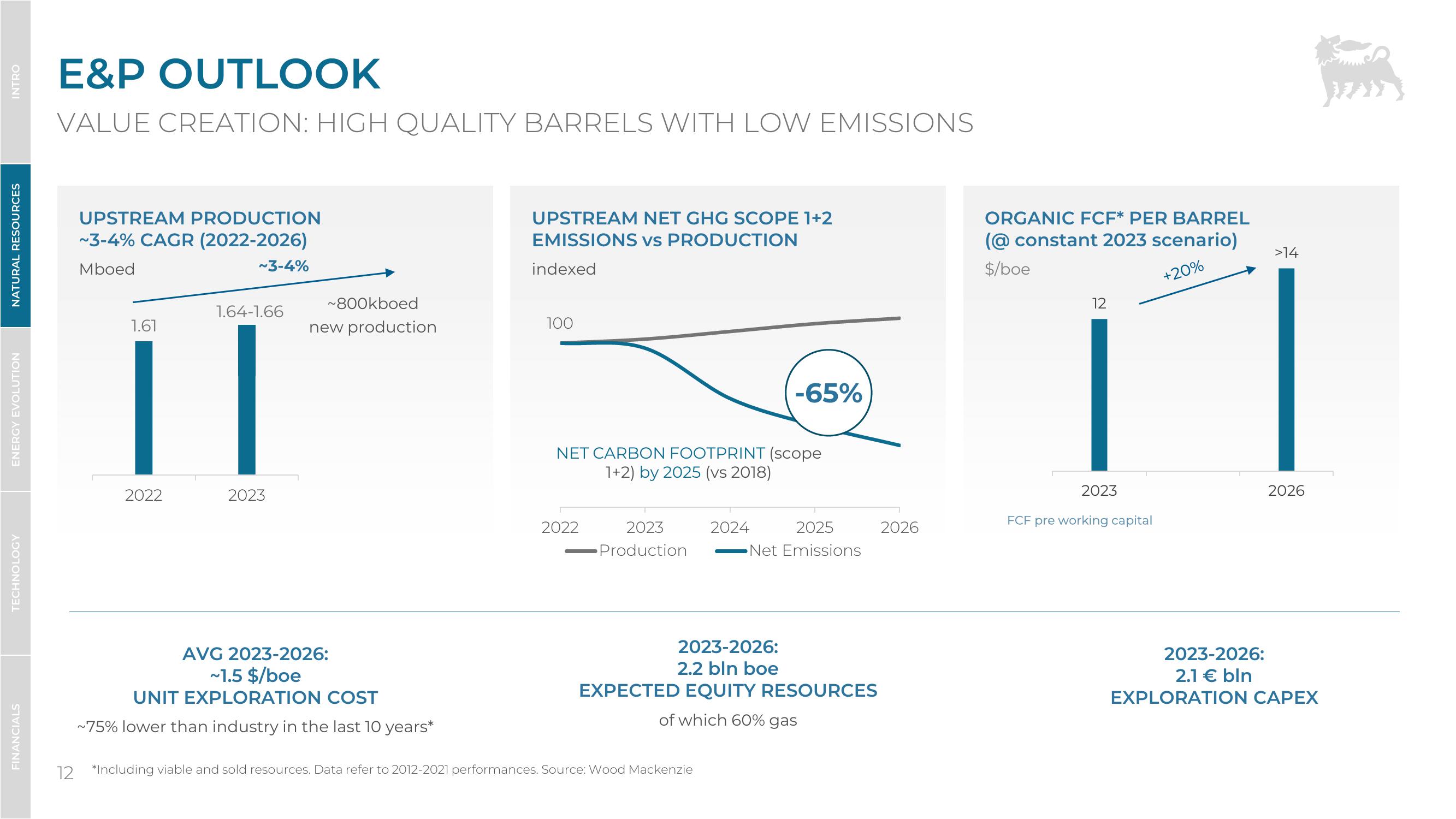

E&P OUTLOOK

VALUE CREATION: HIGH QUALITY BARRELS WITH LOW EMISSIONS

UPSTREAM PRODUCTION

~3-4% CAGR (2022-2026)

Mboed

~3-4%

UPSTREAM NET GHG SCOPE 1+2

EMISSIONS vs PRODUCTION

indexed

~800kboed

1.64-1.66

1.61

new production

100

-65%

NET CARBON FOOTPRINT (scope

1+2) by 2025 (vs 2018)

ORGANIC FCF* PER BARREL

(@constant 2023 scenario)

$/boe

12

+20%

2022

2023

2023

2026

2022

2023

Production

2024

2025

Net Emissions

2026

FCF pre working capital

AVG 2023-2026:

~1.5 $/boe

UNIT EXPLORATION COST

~75% lower than industry in the last 10 years*

2023-2026:

2.2 bln boe

EXPECTED EQUITY RESOURCES

of which 60% gas

12 *Including viable and sold resources. Data refer to 2012-2021 performances. Source: Wood Mackenzie

2023-2026:

2.1 € bln

EXPLORATION CAPEX

>14View entire presentation