Getty SPAC Presentation Deck

Summary Financial Overview (Cont'd)

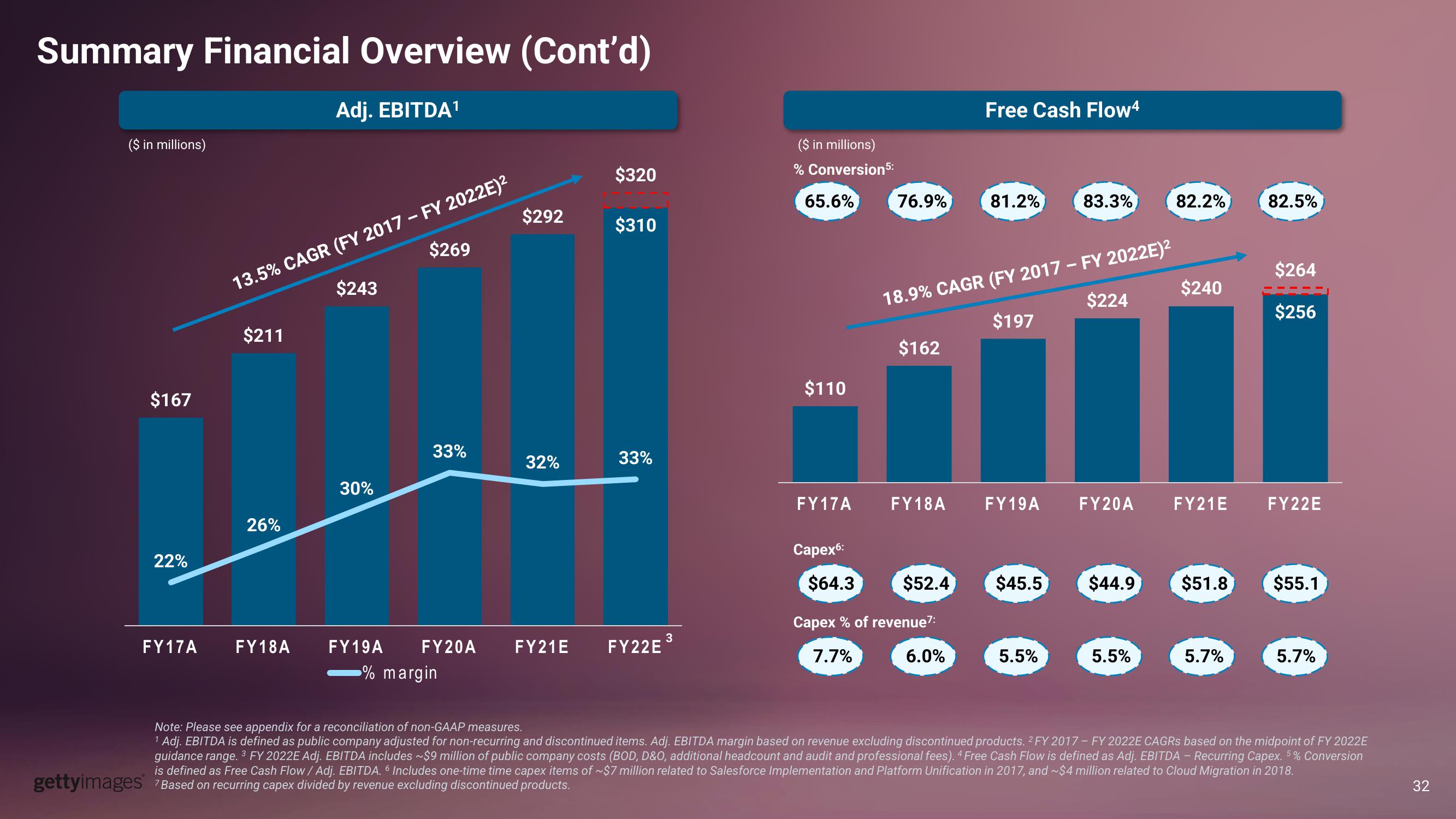

Adj. EBITDA¹

($ in millions)

$167

22%

13.5% CAGR (FY 2017 - FY 2022E)²

$269

$243

$211

26%

FY17A FY18A

30%

33%

$292

32%

FY19A FY20A FY21E

% margin

$320

$310

33%

FY22E

3

($ in millions)

% Conversion 5:

65.6%

$110

FY17A

Capex6:

76.9%

$64.3

$162

FY18A

$52.4

Capex % of revenue7:

7.7%

18.9% CAGR (FY 2017 - FY 2022E)²

$224

$197

Free Cash Flow4

6.0%

81.2%

FY19A

$45.5

83.3%

5.5%

FY20 A

$44.9

5.5%

82.2%

$240

FY21E

$51.8

5.7%

82.5%

$264

$256

FY22E

$55.1

5.7%

Note: Please see appendix for a reconciliation of non-GAAP measures.

Adj. EBITDA is defined as public company adjusted for non-recurring and discontinued items. Adj. EBITDA margin based on revenue excluding discontinued products. 2 FY 2017 - FY 2022E CAGRS based on the midpoint of FY 2022E

guidance range. 3 FY 2022E Adj. EBITDA includes ~$9 million of public company costs (BOD, D&O, additional headcount and audit and professional fees). 4 Free Cash Flow is defined as Adj. EBITDA - Recurring Capex. 5% Conversion

is defined as Free Cash Flow / Adj. EBITDA. Includes one-time time capex items of ~$7 million related to Salesforce Implementation and Platform Unification in 2017, and ~$4 million related to Cloud Migration in 2018.

gettyimages Based on recurring capex divided by revenue excluding discontinued products.

7

32View entire presentation