Kore Investor Presentation Deck

Long-Term Organic Growth

KORE

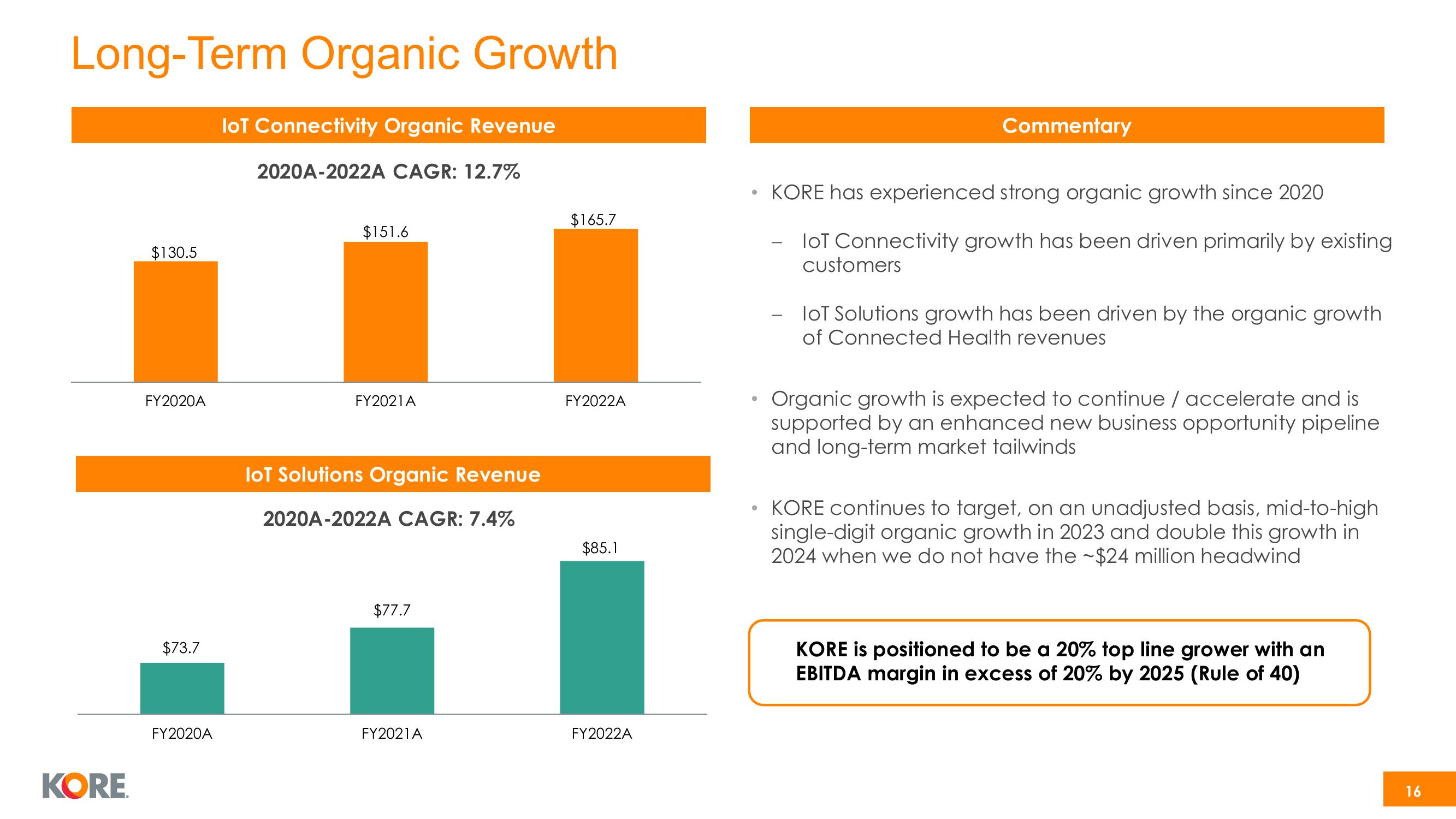

$130.5

FY2020A

$73.7

FY2020A

IoT Connectivity Organic Revenue

2020A-2022A CAGR: 12.7%

$151.6

FY2021A

IoT Solutions Organic Revenue

2020A-2022A CAGR: 7.4%

$77.7

FY2021A

$165.7

FY2022A

$85.1

FY2022A

●

Commentary

KORE has experienced strong organic growth since 2020

IoT Connectivity growth has been driven primarily by existing

customers

loT Solutions growth has been driven by the organic growth

of Connected Health revenues

Organic growth is expected to continue / accelerate and is

supported by an enhanced new business opportunity pipeline

and long-term market tailwinds

KORE continues to target, on an unadjusted basis, mid-to-high

single-digit organic growth in 2023 and double this growth in

2024 when we do not have the ~$24 million headwind

KORE is positioned to be a 20% top line grower with an

EBITDA margin in excess of 20% by 2025 (Rule of 40)

16View entire presentation