Disney Investor Presentation Deck

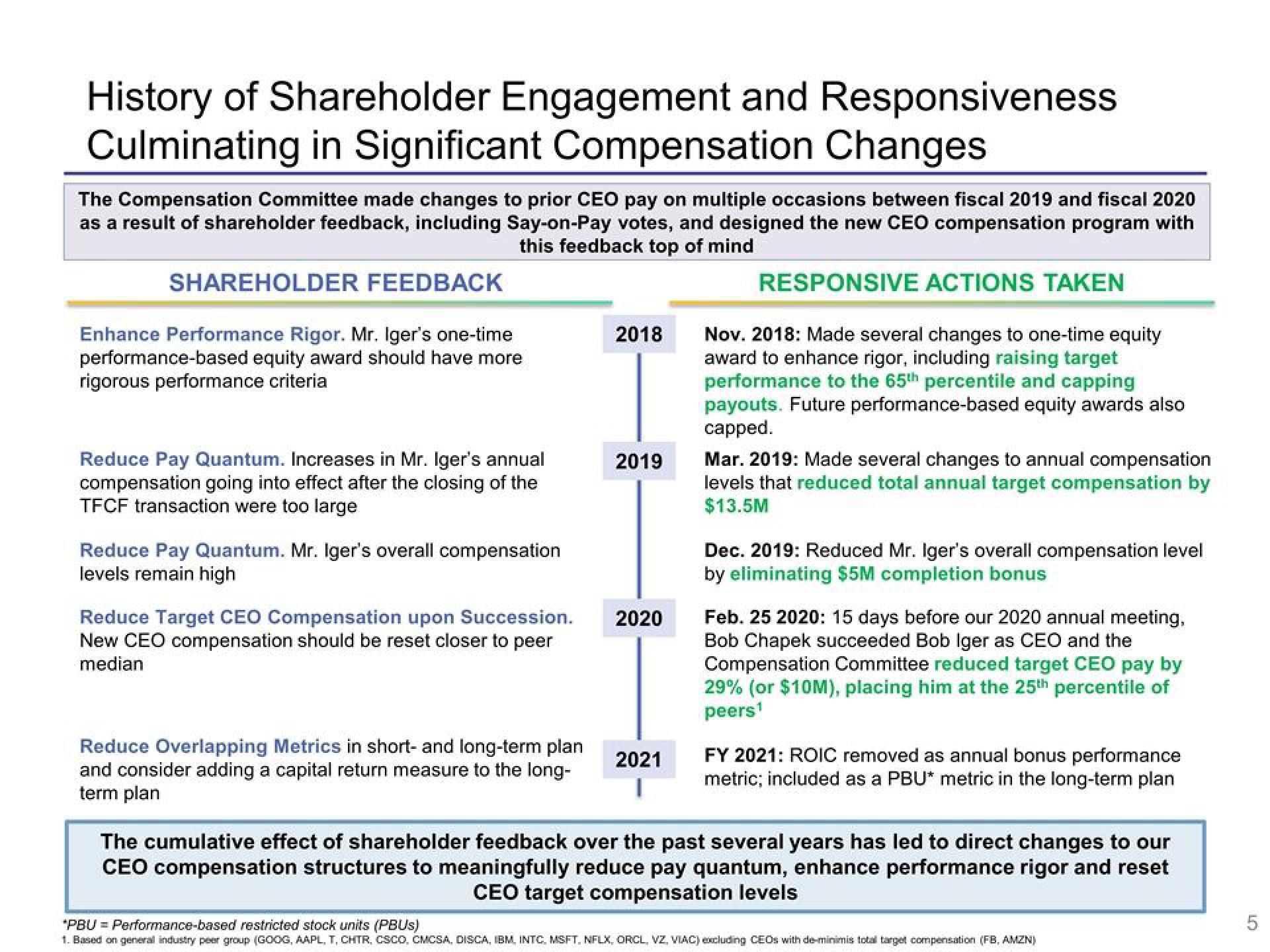

History of Shareholder Engagement and Responsiveness

Culminating in Significant Compensation Changes

The Compensation Committee made changes to prior CEO pay on multiple occasions between fiscal 2019 and fiscal 2020

as a result of shareholder feedback, including Say-on-Pay votes, and designed the new CEO compensation program with

this feedback top of mind

SHAREHOLDER FEEDBACK

Enhance Performance Rigor. Mr. Iger's one-time

performance-based equity award should have more

rigorous performance criteria

Reduce Pay Quantum. Increases in Mr. Iger's annual

compensation going into effect after the closing of the

TFCF transaction were too large

Reduce Pay Quantum. Mr. Iger's overall compensation

levels remain high

Reduce Target CEO Compensation upon Succession.

New CEO compensation should be reset closer to peer

median

Reduce Overlapping Metrics in short- and long-term plan

and consider adding a capital return measure to the long-

term plan

2018

2019

2020

2021

1

RESPONSIVE ACTIONS TAKEN

Nov. 2018: Made several changes to one-time equity

award to enhance rigor, including raising target

performance to the 65th percentile and capping

payouts. Future performance-based equity awards also

capped.

Mar. 2019: Made several changes to annual compensation

levels that reduced total annual target compensation by

$13.5M

Dec. 2019: Reduced Mr. Iger's overall compensation level

by eliminating $5M completion bonus

Feb. 25 2020: 15 days before our 2020 annual meeting,

Bob Chapek succeeded Bob Iger as CEO and the

Compensation Committee reduced target CEO pay by

29% (or $10M), placing him at the 25th percentile of

peers¹

FY 2021: ROIC removed as annual bonus performance

metric; included as a PBU* metric in the long-term plan

The cumulative effect of shareholder feedback over the past several years has led to direct changes to our

CEO compensation structures to meaningfully reduce pay quantum, enhance performance rigor and reset

CEO target compensation levels

*PBU = Performance-based restricted stock units (PBUS)

1. Based on general industry peer group (GOOG, AAPL, T, CHTR, CSCO, CMCSA, DISCA, IBM, INTC, MSFT, NFLX, ORCL, VZ, VIAC) excluding CEOs with de-minimis total target compensation (FB, AMZN)

LO

5View entire presentation