Bed Bath & Beyond Results Presentation Deck

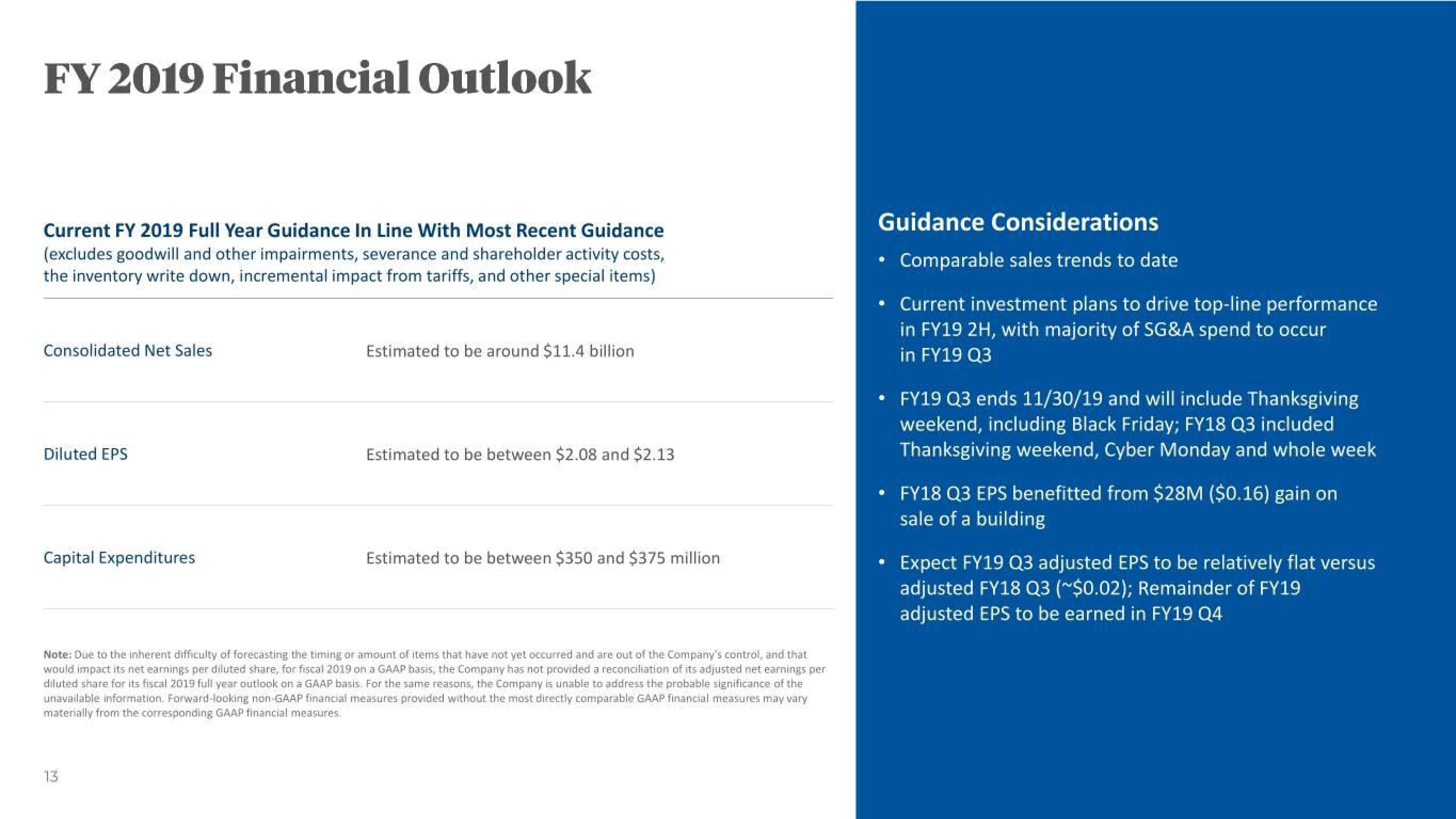

FY 2019 Financial Outlook

Current FY 2019 Full Year Guidance In Line With Most Recent Guidance

(excludes goodwill and other impairments, severance and shareholder activity costs,

the inventory write down, incremental impact from tariffs, and other special items)

Consolidated Net Sales

Diluted EPS

Capital Expenditures

Estimated to be around $11.4 billion

13

Estimated to be between $2.08 and $2.13

Estimated to be between $350 and $375 million

Note: Due to the inherent difficulty of forecasting the timing or amount of items that have not yet occurred and are out of the Company's control, and that

would impact its net earnings per diluted share, for fiscal 2019 on a GAAP basis, the Company has not provided a reconciliation of its adjusted net earnings per

diluted share for its fiscal 2019 full year outlook on a GAAP basis. For the same reasons, the Company is unable to address the probable significance of the

unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary

materially from the corresponding GAAP financial measures.

Guidance Considerations

• Comparable sales trends to date

• Current investment plans to drive top-line performance

in FY19 2H, with majority of SG&A spend to occur

in FY19 Q3

• FY19 Q3 ends 11/30/19 and will include Thanksgiving

weekend, including Black Friday; FY18 Q3 included

Thanksgiving weekend, Cyber Monday and whole week

FY18 Q3 EPS benefitted from $28M ($0.16) gain on

sale of a building

• Expect FY19 Q3 adjusted EPS to be relatively flat versus

adjusted FY18 Q3 (~$0.02); Remainder of FY19

adjusted EPS to be earned in FY19 Q4View entire presentation